Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer? 1.a) What type of risk can be reduced or eliminated by holding a larger portfolio? Why? b) Jet Airlines has a beta of 1.50.

Answer?

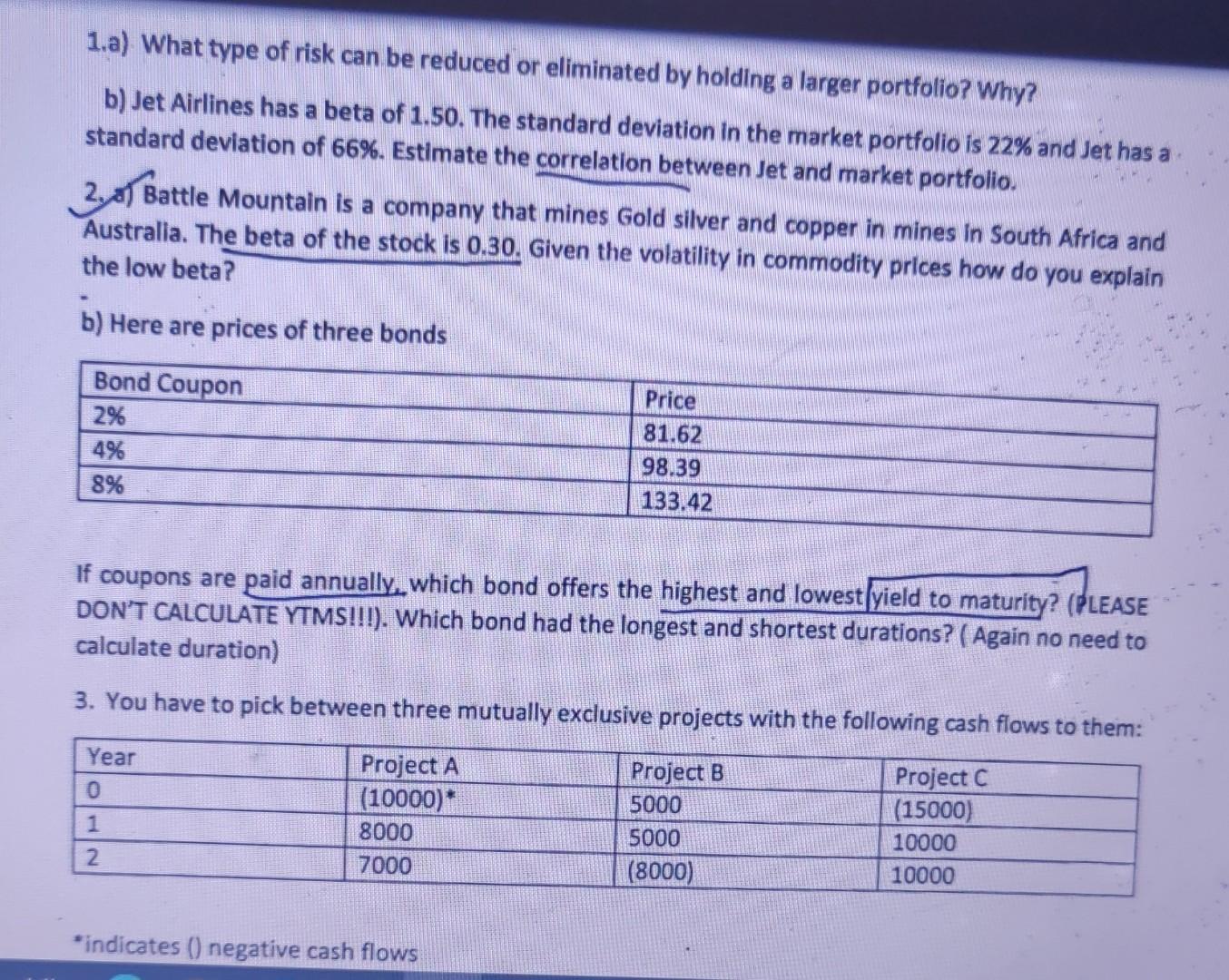

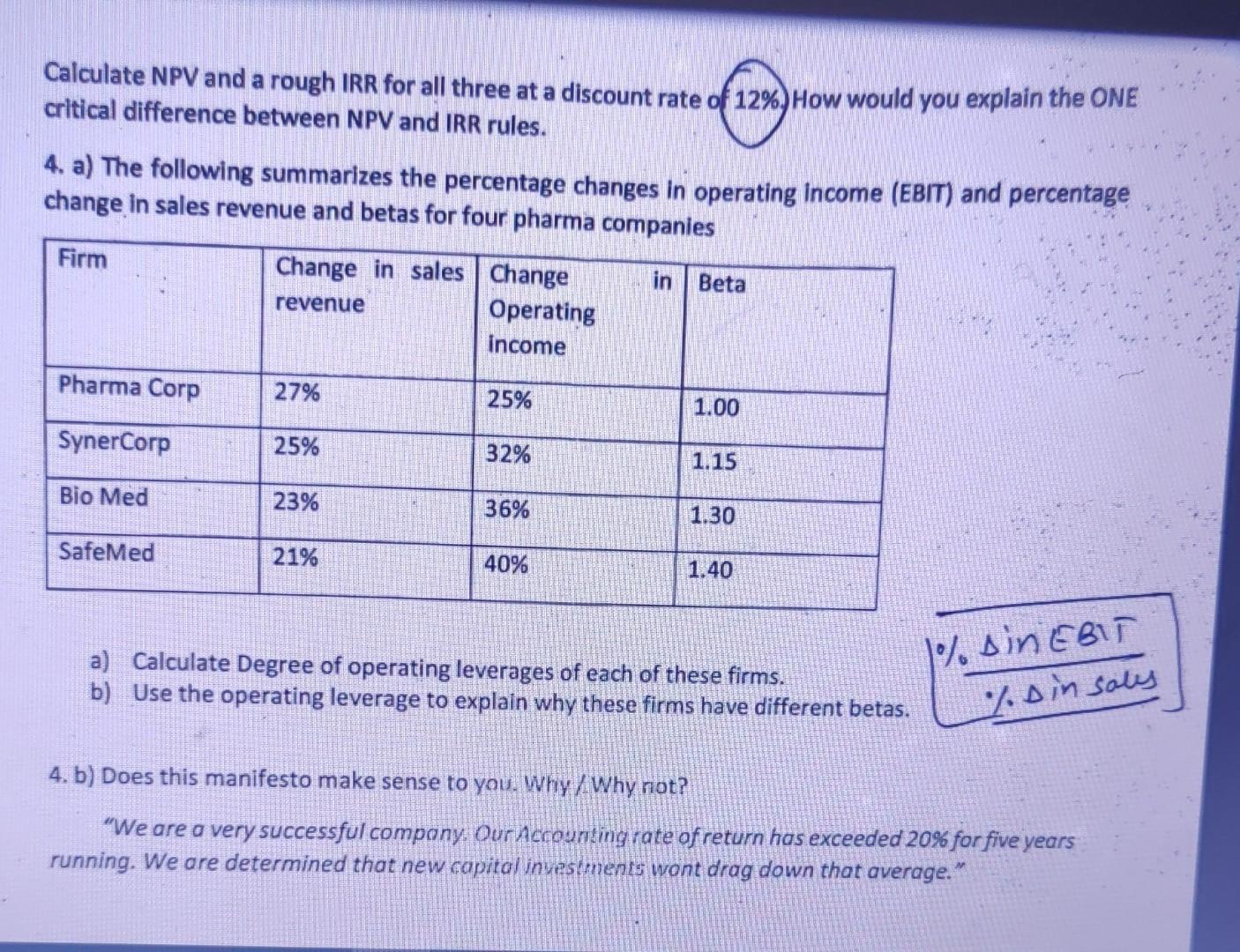

1.a) What type of risk can be reduced or eliminated by holding a larger portfolio? Why? b) Jet Airlines has a beta of 1.50. The standard deviation in the market portfolio is 22% and Jet has a standard deviation of 66%. Estimate the correlation between Jet and market portfolio. 2.0) Battle Mountain is a company that mines Gold silver and copper in mines in South Africa and Australia. The beta of the stock is 0.30. Given the volatility in commodity prices how do you explain the low beta? b) Here are prices of three bonds Bond Coupon 2% 4% 8% Price 81.62 98.39 133.42 If coupons are paid annually, which bond offers the highest and lowestfyield to maturity? (PLEASE DON'T CALCULATE YTMS!!!). Which bond had the longest and shortest durations? ( Again no need to calculate duration) 3. You have to pick between three mutually exclusive projects with the following cash flows to them: Year 0 Project A (10000)* 8000 7000 1 2. Project B 5000 5000 (8000) Project C (15000) 10000 10000 *indicates () negative cash flows Calculate NPV and a rough IRR for all three at a discount rate of 12%) How would you explain the ONE critical difference between NPV and IRR rules. 4. a) The following summarizes the percentage changes in operating Income (EBIT) and percentage change in sales revenue and betas for four pharma companies Firm in Beta Change in sales Change revenue Operating Income Pharma Corp 27% 25% 1.00 SynerCorp 25% 32% 1.15 Bio Med 23% 36% 1.30 SafeMed 21% 40% 1.40 a) Calculate Degree of operating leverages of each of these firms. b) Use the operating leverage to explain why these firms have different betas. 1% sinEBIT %. Din sales 4. b) Does this manifesto make sense to you. Why? Why not? "We are a very successful company. Our Accounting rate of return has exceeded 20% for five years running. We are determined that new capital investments wont drag down that average. 1.a) What type of risk can be reduced or eliminated by holding a larger portfolio? Why? b) Jet Airlines has a beta of 1.50. The standard deviation in the market portfolio is 22% and Jet has a standard deviation of 66%. Estimate the correlation between Jet and market portfolio. 2.0) Battle Mountain is a company that mines Gold silver and copper in mines in South Africa and Australia. The beta of the stock is 0.30. Given the volatility in commodity prices how do you explain the low beta? b) Here are prices of three bonds Bond Coupon 2% 4% 8% Price 81.62 98.39 133.42 If coupons are paid annually, which bond offers the highest and lowestfyield to maturity? (PLEASE DON'T CALCULATE YTMS!!!). Which bond had the longest and shortest durations? ( Again no need to calculate duration) 3. You have to pick between three mutually exclusive projects with the following cash flows to them: Year 0 Project A (10000)* 8000 7000 1 2. Project B 5000 5000 (8000) Project C (15000) 10000 10000 *indicates () negative cash flows Calculate NPV and a rough IRR for all three at a discount rate of 12%) How would you explain the ONE critical difference between NPV and IRR rules. 4. a) The following summarizes the percentage changes in operating Income (EBIT) and percentage change in sales revenue and betas for four pharma companies Firm in Beta Change in sales Change revenue Operating Income Pharma Corp 27% 25% 1.00 SynerCorp 25% 32% 1.15 Bio Med 23% 36% 1.30 SafeMed 21% 40% 1.40 a) Calculate Degree of operating leverages of each of these firms. b) Use the operating leverage to explain why these firms have different betas. 1% sinEBIT %. Din sales 4. b) Does this manifesto make sense to you. Why? Why not? "We are a very successful company. Our Accounting rate of return has exceeded 20% for five years running. We are determined that new capital investments wont drag down that averageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started