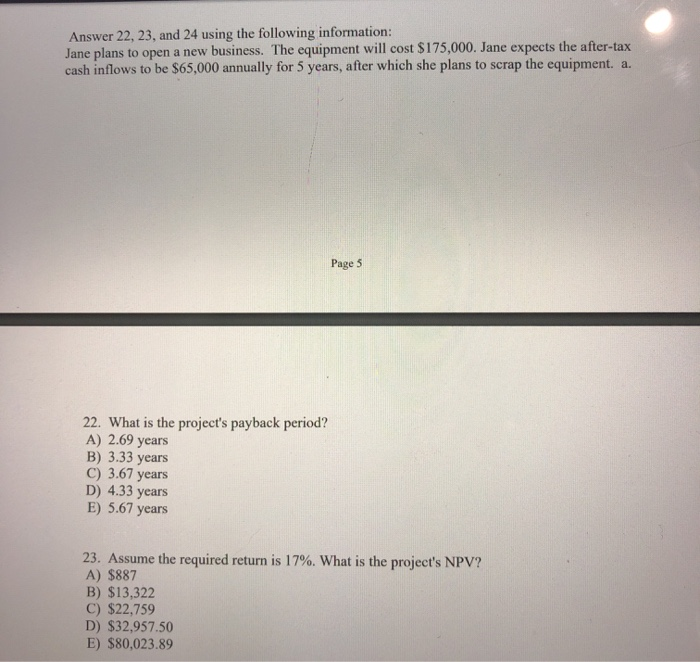

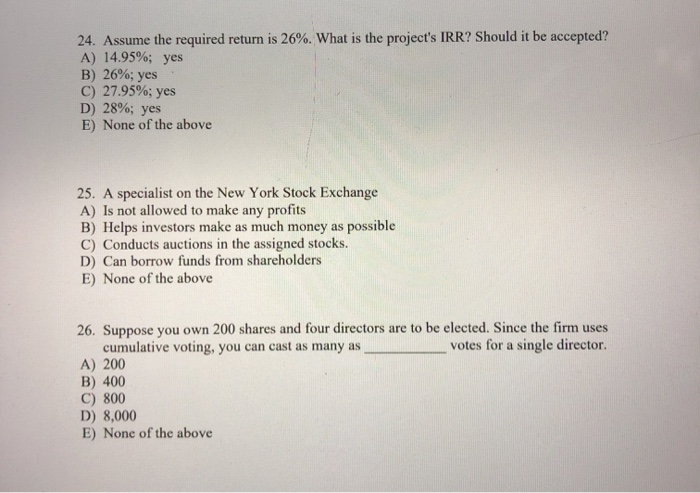

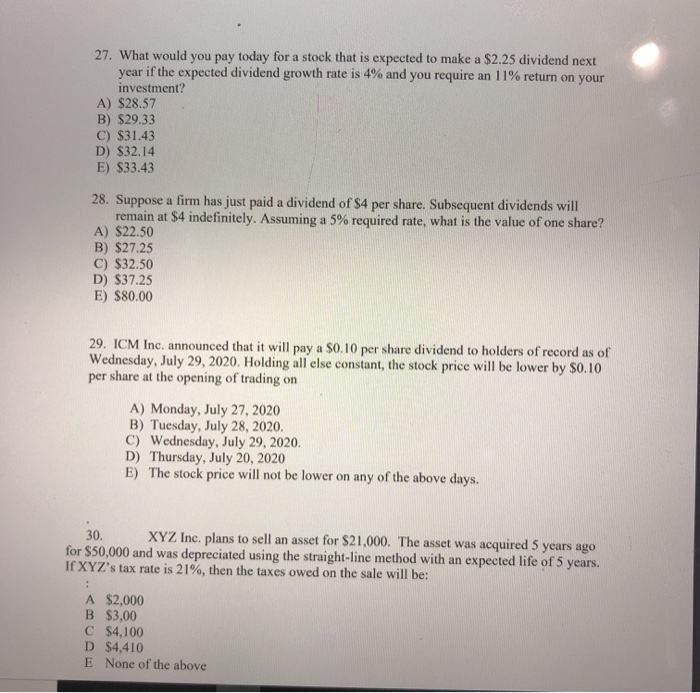

Answer 22, 23, and 24 using the following information: Jane plans to open a new business. The equipment will cost $175,000. Jane expects the after-tax cash inflows to be $65,000 annually for 5 years, after which she plans to scrap the equipment. a. Page 5 22. What is the project's payback period? A) 2.69 years B) 3.33 years C) 3.67 years D) 4.33 years E) 5.67 years 23. Assume the required return is 17%. What is the project's NPV? A) $887 B) $13,322 C) $22,759 D) $32,957.50 E) $80,023.89 24. Assume the required return is 26%. What is the project's IRR? Should it be accepted? A) 14.95%; yes B) 26%; yes C) 27.95%; yes D) 28%; yes E) None of the above 25. A specialist on the New York Stock Exchange A) Is not allowed to make any profits B) Helps investors make as much money as possible C) Conducts auctions in the assigned stocks. D) Can borrow funds from shareholders E) None of the above 26. Suppose you own 200 shares and four directors are to be elected. Since the firm uses cumulative voting, you can cast as many as votes for a single director. A) 200 B) 400 C) 800 D) 8,000 E) None of the above 27. What would you pay today for a stock that is expected to make a $2.25 dividend next year if the expected dividend growth rate is 4% and you require an 11% return on your investment? A) $28.57 B) $29.33 C) $31.43 D) $32.14 E) $33.43 28. Suppose a firm has just paid a dividend of $4 per share. Subsequent dividends will remain at $4 indefinitely. Assuming a 5% required rate, what is the value of one share? A) $22.50 B) $27.25 C) $32.50 D) $37.25 E) $80.00 29. ICM Inc. announced that it will pay a $0.10 per share dividend to holders of record as of Wednesday, July 29, 2020. Holding all else constant, the stock price will be lower by $0.10 per share at the opening of trading on A) Monday, July 27, 2020 B) Tuesday, July 28, 2020, C) Wednesday, July 29, 2020. D) Thursday, July 20, 2020 E) The stock price will not be lower on any of the above days. 30. XYZ Inc. plans to sell an asset for $21,000. The asset was acquired 5 years ago for $50,000 and was depreciated using the straight-line method with an expected life of 5 years. If XYZ's tax rate is 21%, then the taxes owed on the sale will be: A $2,000 B $3,00 C $4,100 D $4,410 E None of the above