answer 2,3,and 4 pls

4. If SecuriCorp's customer generates $50,000 in gross sales revenue and has $10,000 of direct costs, what is the customer margin for this customer?

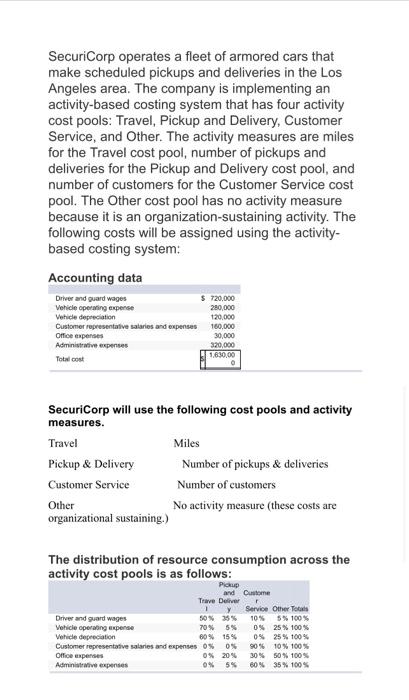

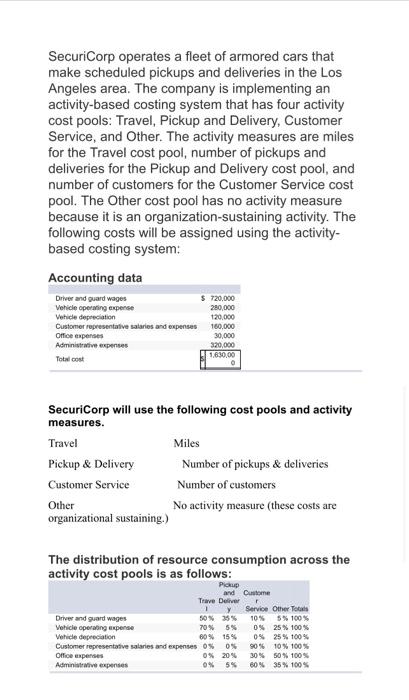

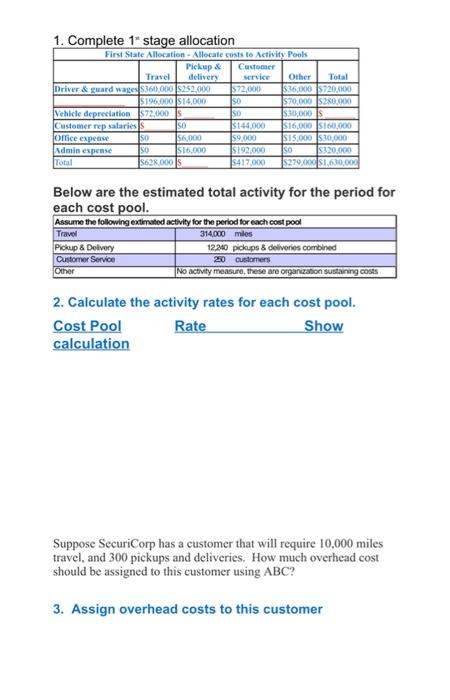

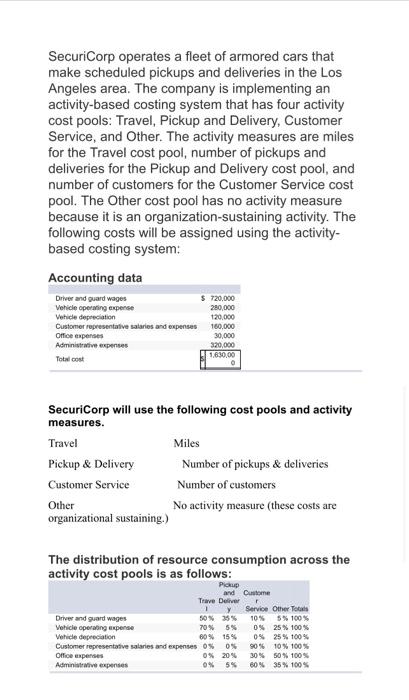

SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity- based costing system: Accounting data Driver and guard wages $ 720,000 Vehicle operating expense 280,000 Vohide depreciation 120.000 Customer representative salaries and expenses 160,000 Office expenses 30,000 Adminive expenses 320,000 Total cost 1,630,00 SecuriCorp will use the following cost pools and activity measures Travel Miles Pickup & Delivery Number of pickups & deliveries Customer Service Number of customers Other No activity measure these costs are organizational sustaining.) The distribution of resource consumption across the activity cost pools is as follows: Pickup and Custome Trave Deliver 1 y Service Other Total Driver and guard wages 50% 35% 10% 5% 100% Vehicle operating expense 70% 5% 0% 25% 100% Vahide depreciation 80% 15% 0% 25% 100% Customer representative salaries and expenses 0% 0% 90% 10% 100% Office expenses 20% 30% 50% 100% Administrive expenses 0% 5% 80% 35% 100% OS 1. Complete 1" stage allocation First State Allocation - Allocate costs to Activity Pools Pickup & Customer Travel delivery service Other Total Driver & guard wages $360,000 5.252.000 $72.000 $36,000 720,00 $196,000 $14,000 SO $70,000 $280.000 Vehicle depreciation $72.000 150 $30,000 Customer rp salaries Iso $144.000 $16.000 $160,000 Office expense so $6,000 $9.000 SI5.000 10.000 Admin pense ISO $16.000 $192.000 ISO Is320.000 Total S62.000 $417.000 279.000 $1.630,000 Below are the estimated total activity for the period for each cost pool. Assume the following extimated activity for the period for each cost pool Travel 314000 miles Pickup & Delivery 12.240 pickups & deliveries combined Customer Service 230 customers Other No activity measure, these are organization sustaining costs 2. Calculate the activity rates for each cost pool. Cost Pool Rate Show calculation Suppose SecuriCorp has a customer that will require 10,000 miles travel, and 300 pickups and deliveries. How much overhead cost should be assigned to this customer using ABC? 3. Assign overhead costs to this customer SecuriCorp operates a fleet of armored cars that make scheduled pickups and deliveries in the Los Angeles area. The company is implementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity- based costing system: Accounting data Driver and guard wages $ 720,000 Vehicle operating expense 280,000 Vohide depreciation 120.000 Customer representative salaries and expenses 160,000 Office expenses 30,000 Adminive expenses 320,000 Total cost 1,630,00 SecuriCorp will use the following cost pools and activity measures Travel Miles Pickup & Delivery Number of pickups & deliveries Customer Service Number of customers Other No activity measure these costs are organizational sustaining.) The distribution of resource consumption across the activity cost pools is as follows: Pickup and Custome Trave Deliver 1 y Service Other Total Driver and guard wages 50% 35% 10% 5% 100% Vehicle operating expense 70% 5% 0% 25% 100% Vahide depreciation 80% 15% 0% 25% 100% Customer representative salaries and expenses 0% 0% 90% 10% 100% Office expenses 20% 30% 50% 100% Administrive expenses 0% 5% 80% 35% 100% OS 1. Complete 1" stage allocation First State Allocation - Allocate costs to Activity Pools Pickup & Customer Travel delivery service Other Total Driver & guard wages $360,000 5.252.000 $72.000 $36,000 720,00 $196,000 $14,000 SO $70,000 $280.000 Vehicle depreciation $72.000 150 $30,000 Customer rp salaries Iso $144.000 $16.000 $160,000 Office expense so $6,000 $9.000 SI5.000 10.000 Admin pense ISO $16.000 $192.000 ISO Is320.000 Total S62.000 $417.000 279.000 $1.630,000 Below are the estimated total activity for the period for each cost pool. Assume the following extimated activity for the period for each cost pool Travel 314000 miles Pickup & Delivery 12.240 pickups & deliveries combined Customer Service 230 customers Other No activity measure, these are organization sustaining costs 2. Calculate the activity rates for each cost pool. Cost Pool Rate Show calculation Suppose SecuriCorp has a customer that will require 10,000 miles travel, and 300 pickups and deliveries. How much overhead cost should be assigned to this customer using ABC? 3. Assign overhead costs to this customer