Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER 7- ACQUISITION THROUGH SELF-CONSTRUCTION to uninstall the equipment and restore the installation site at the end of the equipment's 8-year useful life, a process

ANSWER 7- ACQUISITION THROUGH SELF-CONSTRUCTION

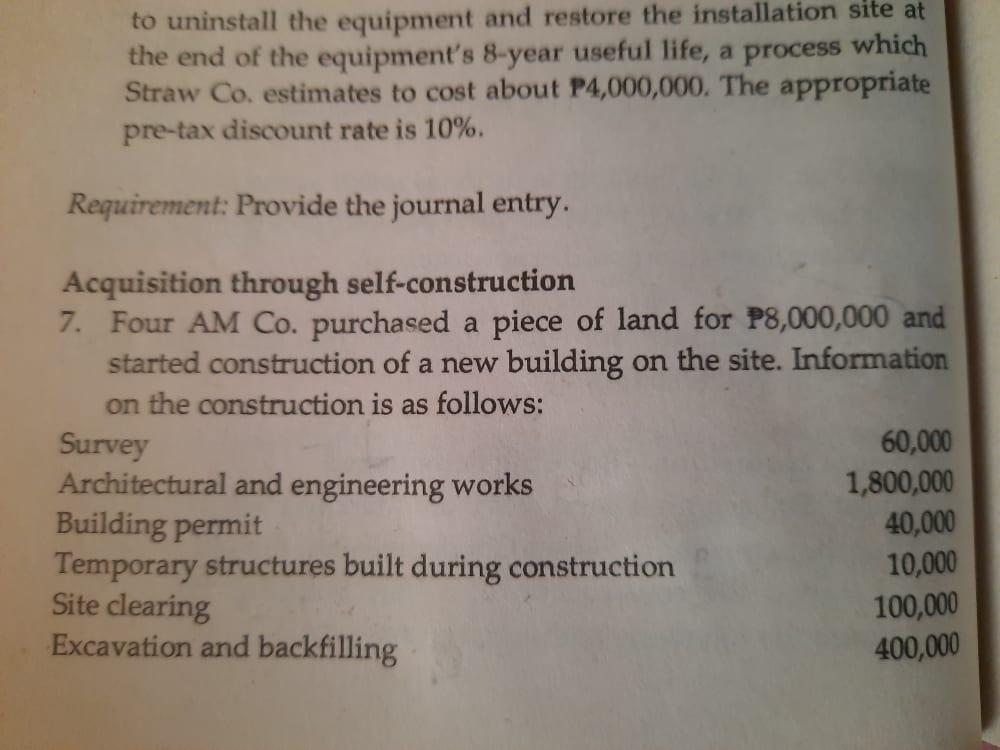

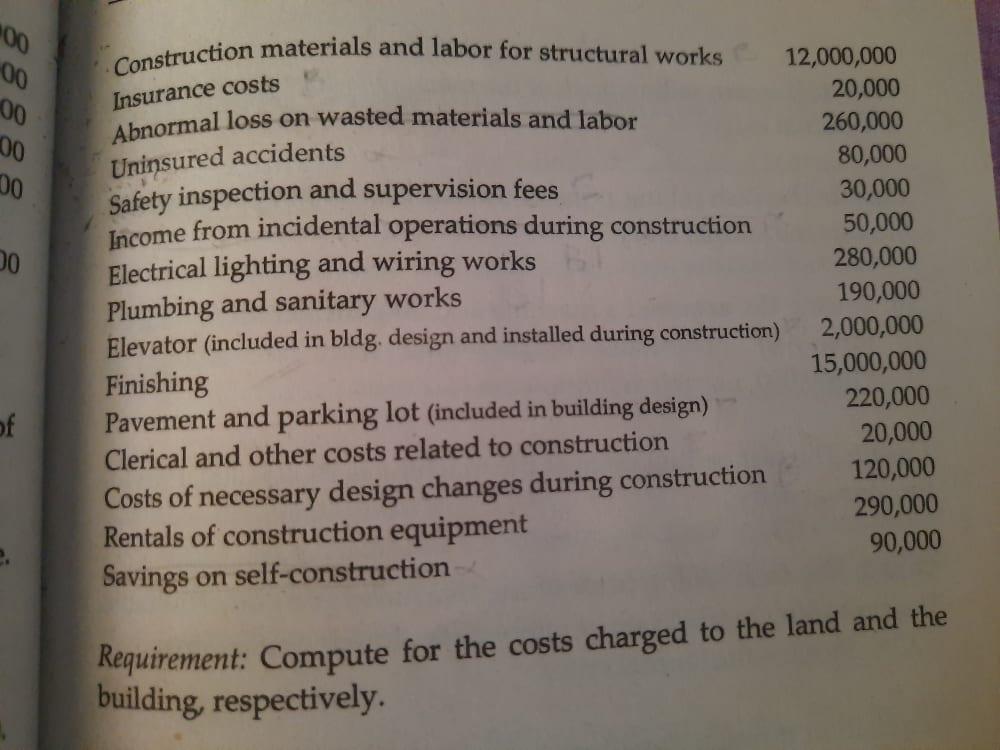

to uninstall the equipment and restore the installation site at the end of the equipment's 8-year useful life, a process which Straw Co. estimates to cost about P4,000,000. The appropriate pre-tax discount rate is 10%. Requirement: Provide the journal entry. Acquisition through self-construction 7. Four AM Co. purchased a piece of land for P8,000,000 and started construction of a new building on the site. Information on the construction is as follows: Survey 60,000 Architectural and engineering works 1,800,000 Building permit 40,000 Temporary structures built during construction 10,000 Site clearing Excavation and backfilling 400,000 100,000 *00 00 00 Insurance costs 00 DO Uninsured accidents Construction materials and labor for structural works Abnormal loss on wasted materials and labor 12,000,000 20,000 260,000 80,000 Safety inspection and supervision fees 30,000 Income from incidental operations during construction 50,000 DO Electrical lighting and wiring works 280,000 Plumbing and sanitary works 190,000 Elevator (included in bldg. design and installed during construction) 2,000,000 Finishing 15,000,000 of Pavement and parking lot (included in building design) 220,000 Clerical and other costs related to construction 20,000 120,000 Costs of necessary design changes during construction Rentals of construction equipment 290,000 90,000 Savings on self-construction Requirement: Compute for the costs charged to the land and the building, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started