Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer ad explain, do not copy. write ownn better. Credit rating agencies (CRAS) issue ratings on bonds and loans that indicate the risk of default.

answer ad explain, do not copy. write ownn better.

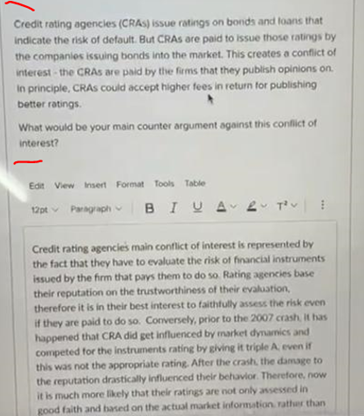

Credit rating agencies (CRAS) issue ratings on bonds and loans that indicate the risk of default. But CRAs are paid to issue those ratings by the companies issuing bonds into the market. This creates a conflict of interest the CRAS are paid by the firms that they publish opinions on In principle, CRAs could accept higher fees in return for publishing better ratings What would be your main counter argument against this conflict of interest? Edit View insert Format Tools Table 12ptParagraph BI VALTU Credit rating agencies main conflict of interest is represented by the fact that they have to evaluate the risk of financial instruments issued by the firm that pays them to do so Rating agencies base their reputation on the trustworthiness of their evaluation, therefore it is in their best interest to faithfully assess the risk even if they are paid to do so. Conversely, prior to the 2007 crash It has happened that CRA did get influenced by market dynamics and competed for the instruments rating by giving it triple A even if this was not the appropriate rating. After the crash the damage to the reputation drastically influenced their behavior. Therefore, now it is much more likely that their ratings are not only assessed in good faith and based on the actual market information rather than Credit rating agencies (CRAS) issue ratings on bonds and loans that indicate the risk of default. But CRAs are paid to issue those ratings by the companies issuing bonds into the market. This creates a conflict of interest the CRAS are paid by the firms that they publish opinions on In principle, CRAs could accept higher fees in return for publishing better ratings What would be your main counter argument against this conflict of interest? Edit View insert Format Tools Table 12ptParagraph BI VALTU Credit rating agencies main conflict of interest is represented by the fact that they have to evaluate the risk of financial instruments issued by the firm that pays them to do so Rating agencies base their reputation on the trustworthiness of their evaluation, therefore it is in their best interest to faithfully assess the risk even if they are paid to do so. Conversely, prior to the 2007 crash It has happened that CRA did get influenced by market dynamics and competed for the instruments rating by giving it triple A even if this was not the appropriate rating. After the crash the damage to the reputation drastically influenced their behavior. Therefore, now it is much more likely that their ratings are not only assessed in good faith and based on the actual market information rather thanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started