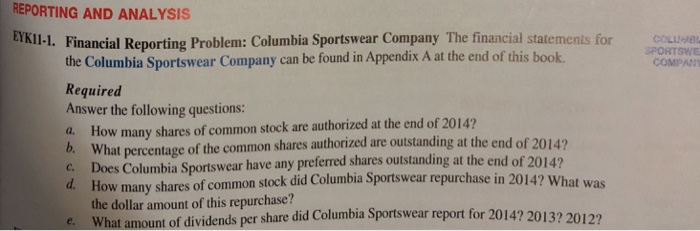

answer a-e please type and submit in word or pdf so that i can print it please NO HANDWRITINGS

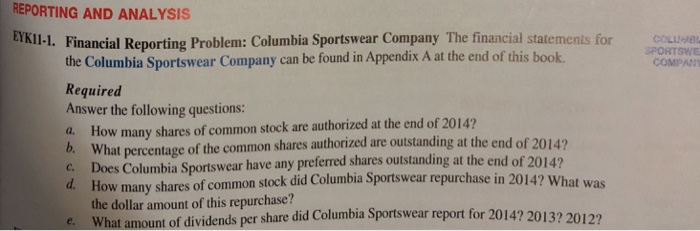

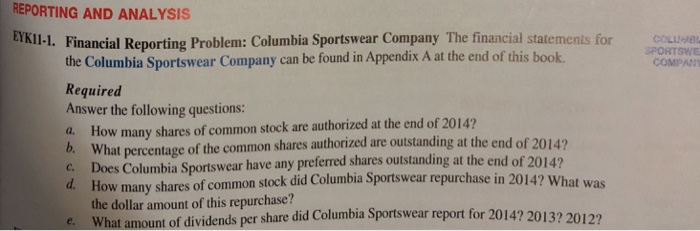

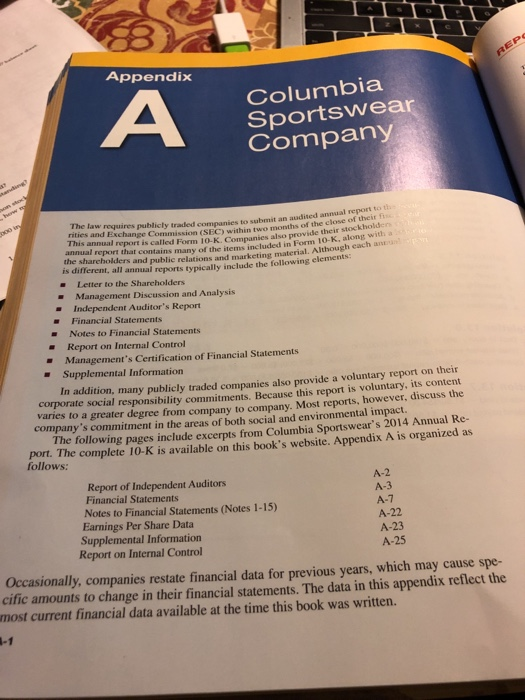

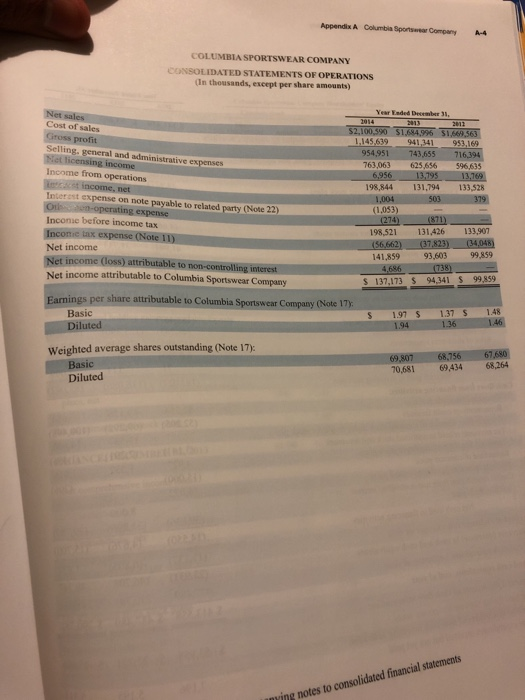

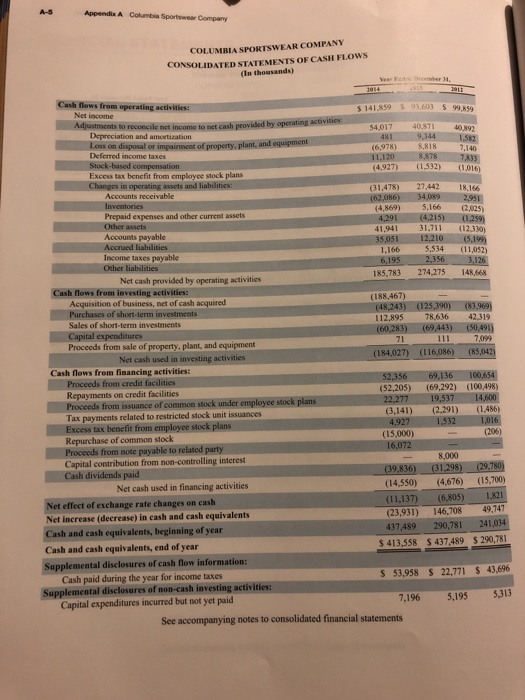

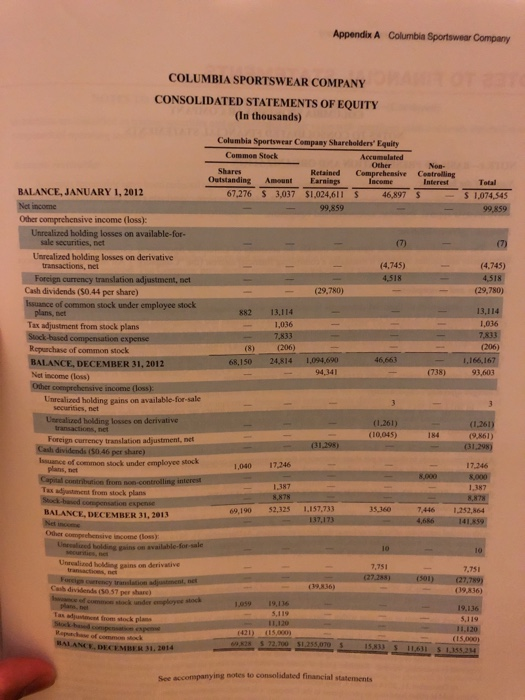

REPORTING AND ANALYSIS BVkil-1. Financial Reporting Problem: Columbia Sportswear Company The financial statements for oLLise the Columbia Sportswear Company can be found in Appendix A at the end of this book COMPAN Required Answer the following questions: a. b. ow many shares of common stock are authorized at the end of 2014 outstanding at the end of 2014? What percentage of the common shares authorized are c. Does Columbia Sportswear have any preferred shares outstanding at the end of 2014? d. How many shares of common stock did Columbia Sportswear repurchase in 201 4? What was the dollar amount of this repurchase? What amount of dividends per share did Columbia Sportswear report for 2014? 20132 20122 e. Appendix Columbia Sportswear Company law requires publicly traded companies to submit an aadited a is called Form 10-K. Companies the shareholders and public relations and marketing material. Although rities and Exchange Com This mission (SEC) within two months of the close of their f also provide their stockholden included in Form 10-K, along with a anmual report annual report that contains many of the items is different, all annual reports typically include the following elements: Letter to the Sharcholders Management Discussion and Analysis -Independent Auditor's Report Financial Statements - Notes to Financial Statements Report on Internal Control Management's Certification of Financial Statements Supplemental Information In addition, many publicly traded companies also provide a voluntary report on their corporate social responsibility commitments. Because this report is voluntary, its content varies to a greater degree from company to company. Most reports, however, di company's commitment in the areas of both social and environmental impact. The following pages include excerpts from Columbia Sportswear's 2014 Annual Re port. The complete 10-K is available on this book's website. Appendix A is organized as follows: A-2 Report of Independent Auditors Financial Statements Notes to Financial Statements (Notes 1-15) Earnings Per Share Data Supplemental Information A-3 A-7 A-22 A-23 A-25 Report on Internal Control Occasionally, companies restate financial data for previous years, which may cause spe- cific amounts to change in their financial statements. The data in this appendix reflect the most current financial data available at the time this book was written. -1 3 Appendix A Columbia Sportswear Company FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) December 31 2014 ASSETS s 413,558 S 437.489 91,755 Current Assets: and cash 27,267 344,390 Short-term investments Inventories Prepaid unts receivable, net (Note 6) 384,650 329,228 57.001 52.041 income taxes (Note 11 expenses and other current assets 39,175 291,563 68,594 1,266,0411,250,472 279,373 Total current assets Property, plant, and equipment, net Note 7) 143,731 36,288 14,438 Goodwill (Notes 3, 8) s 1,792,209 S 1,605,588 Total assets LIABILITIES AND EQUITY Current Liabilities: 173,557 120,397 ts payable Accrued liabilities (Note 10) 144,288 14,388 7.251 Income taxes payable (Note 11) Deferred income taxes (Note 11) Total current liabilities 169 373,120 15,728 49 -term liabilit Income taxes payable (Note 11) 35,435 29.527 13,984 9,388 erred income taxes (Note 11) Total liabilities 436,975352,724 Commitments and contingencies (Note 14) Shareholders' Equity: stock: 10,000 shares authorized; none issued and Commont stok (oo r valbe) 250,00 shares authorized, 69,828 and (69,190 issued2.700 2.325 and outstanding (Note 15) Accumulated other comprehensive income (Note 18) 15,833 Total Columbia Sportswear Company shareholders' equity 1,343,603 1,245,418 Non-controlling interest (Note 5) 11,631 Total 1,355,2341,252,864 S 1,792,209 S 1,605,588 Total liabilities and equity Appendix A Columbia Spontswear Company -4 COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Eaded December 31 Net Cost of sales 1.145.639 941341 953.169 954,951743,6557 763,063 625,656596,635 Selling, general and administrative expenses Income from operations 198,844 131,794 133,528 net Interest expense on note payable to related party (Note 22) Inconse before income tax (1,053) 198,521 131,426 141,859 93,603 99,859 133,907 Net income Net income (loss) attributable to Net income attributable to Columbia Sportswear Company S 137,173 $ 94341 S 99,859 s tributable to Columbia Spontswer Companty Chole 17)1 15 14 1.37 S 1.48 197 S Basic Weighted average shares outstanding (Note 17): 70,681 69,434 68,264 Diluted dated g notes to Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Cash flews from operating activities: S 141.859 93,603 $ 99,59 Adjustmcnts to recoscile net income to net cash provided by operating 54,01740,8714089 Depreciation and amoetization Loss on disposal or Deferred income taxes t of property, plant, and equipment 6.978)8,818 7.140 11,120 (4.927) (1.532) (1,016) Excess tax benefit from employee stock plans (31,478) 27,442 18,166 (62,086) 34,089 2951 (4,869)5,166 (2,025) Prepaid expenses and other current assets 4,291 (4,215) (259) 41,941 31.711(12,330) Accrued liabilities 35,051 10 1,166 5,534 (11,052) Income taxes payable Other liabilities 6.195 2,356 3,126 185,783 274,275 148,668 Net cash provided by operating activities Cash flows from investing activities: Acquisition of business, net of cash acquired (188,467) (48243) (125,390) (83,969) 112,895 78,636 42,319 (60,283) 69,443) (50,491) Sales of short-term investments expenditures Proceeds from sale of property, plant, and equipment 71 Net cash used in investing activities (184,027) (116,086) (85,042) Cash flows from financing activities: Proceeds from credit facilities Repayments on credit facilities Proceeds from issuance of common stock under employee stock Tax payments related to restricted stock unit issuances (52,205) (69,292) (100,498) (3,141) (2.291) (1.486) 4,927 (15,000) 16,072 tax benefit from employee stock plans (206) Repurchase of common stock Proceeds from note payable to related party Capital contribution from non-controlling interest Cash dividends paid 8,000 (39,836) (31.298) (29,780 (14,380) (4,676) (15,700) Net cash used in financing activities Net effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents (11.137) (6,805) 1821 (23,931) 146,70849,747 437,489290,781 241 ash and cash equivalents, beginning of year Cash and cash equivalents, end of year Supplemental disclosures of cash fnow information: Supplemental disclosures of non-cash investing activities: S413,558 $ 437.489 $ 290,781 22,771 S 43,696 5,195 5,313 Cash paid during the year for income taxes S 53,958 Capital expenditures incurred but not yet paid 7,196 See accompanying notes to consolidated financial statements Appendix A Columbia Sportswear Company COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF EQUITY (In thousands) Columbia Sportswear Compaay Shareholders' Equity Common Stock Accumulated Other Retained Comprehensive Cestrolling lacome Shares Outstanding Amount Earnings BALANCE, JANUARY 1,017,273 30 3102:.0NS Interest Total 67.276 3,037 $1,024,611 46,897 $ 1,074,545 99,859 Other comprehensive income (loss): holding losses on available-for- sale securities, net Uarealized holding losses on derivative (4,745) ,518 (4.745) 4,518 (29,780) net Cash dividends (S0.44 per share) (29,780) of common stock under employee stock 882 13,114 13,114 Tax adjustment from stock plans 7,833 (206) (206) Repurchase of common stock BALANCE, DECEMBER 31, 2012 Net income (loss) Other 166,1 93,603 68,1 6 94,341 ve income (loss): relized bolding gains on available- for sale securities, net holding losses on derivative (1.261) (10,045) (1.261) (9,861) Cash dividends (50.46 per ssuance of common stock under employee stock 1,040 17,246 17.246 plans, net Tax adijustment from stock plans BALANCE, DECEMBER 31, 2013 1.387 8,878 69,190 52,325 1.157,733 35.360 7446 1,252,864 Unalined holding sains on derivative 7,751 7.751 (39,836) 39,836) 1,059 19,136 from stock plans 5,119 11,120 421) (15.000) 69,828 S 72,700 $1.255 DECEMBER 31, 2014 notes to consolidated financial statements