Answered step by step

Verified Expert Solution

Question

1 Approved Answer

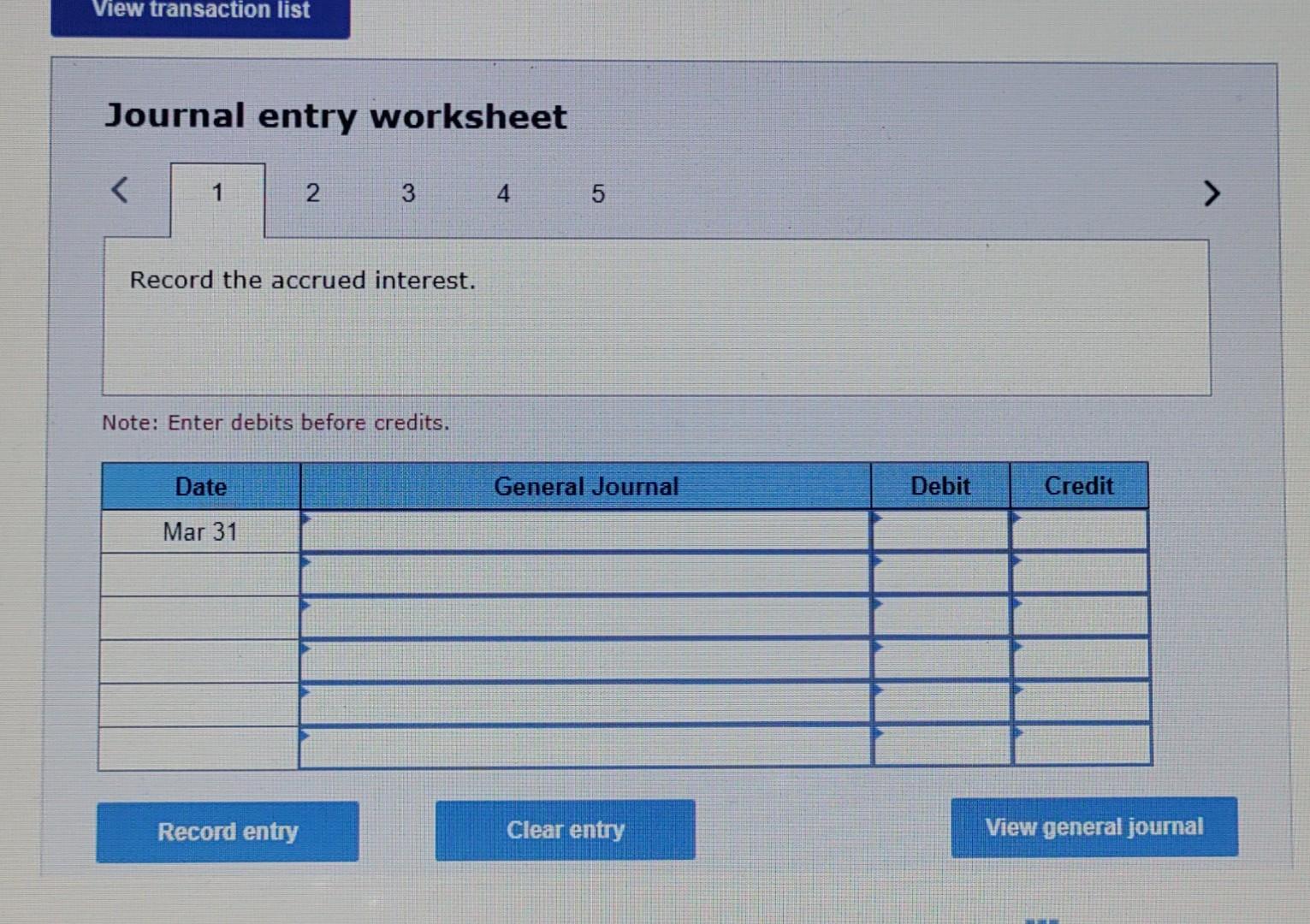

Answer all in tables. Journal entry worksheet 1 Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record

Answer all in tables.

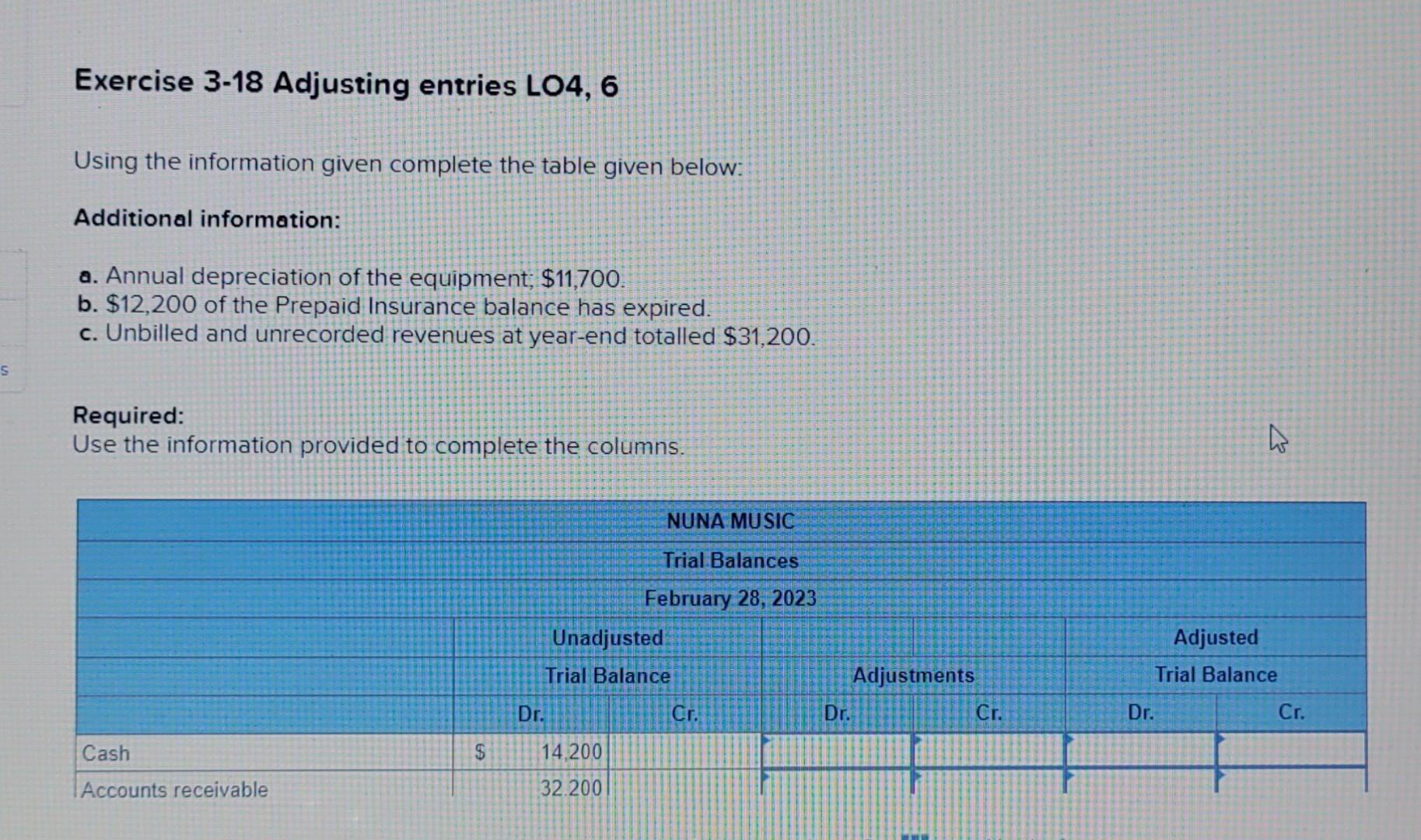

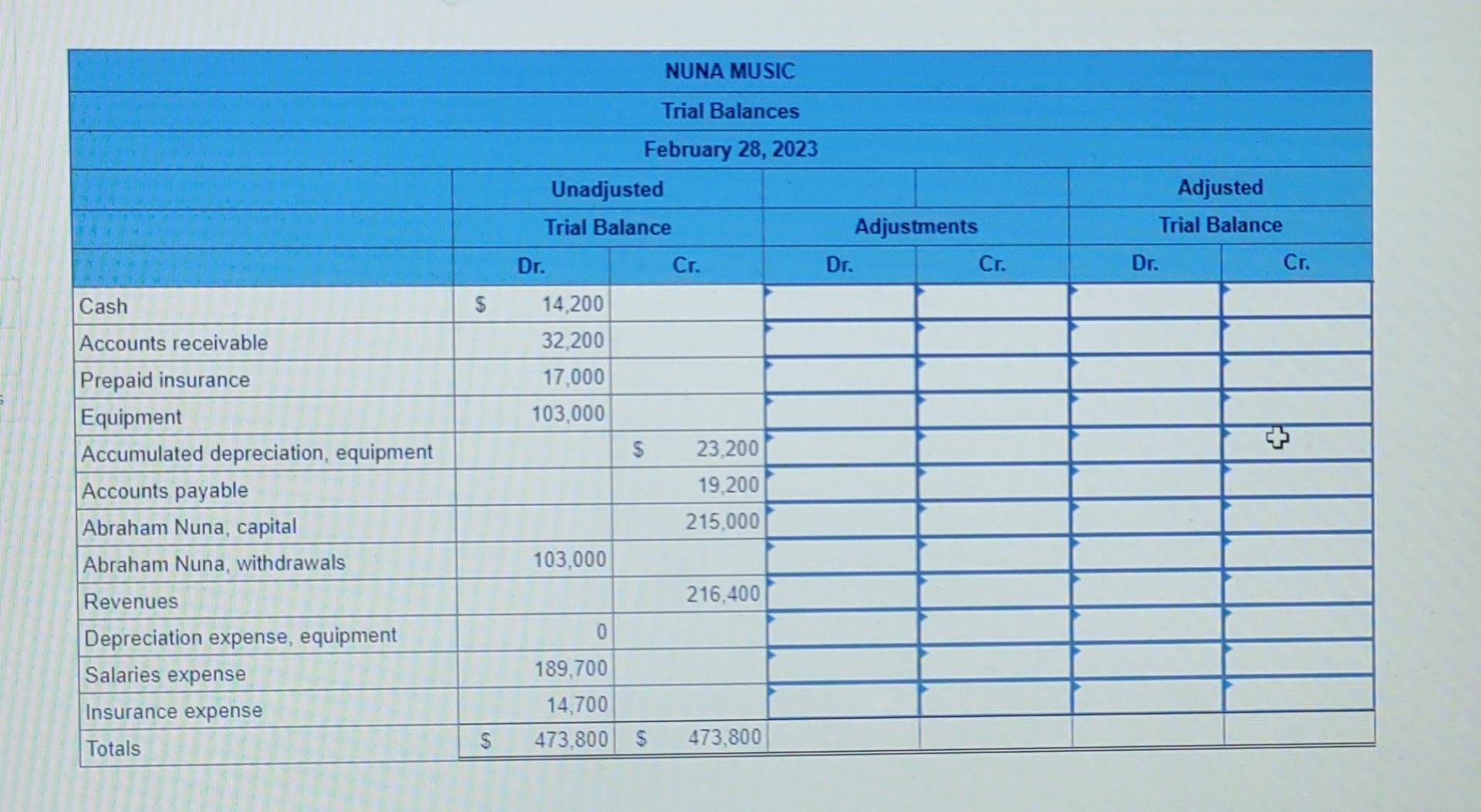

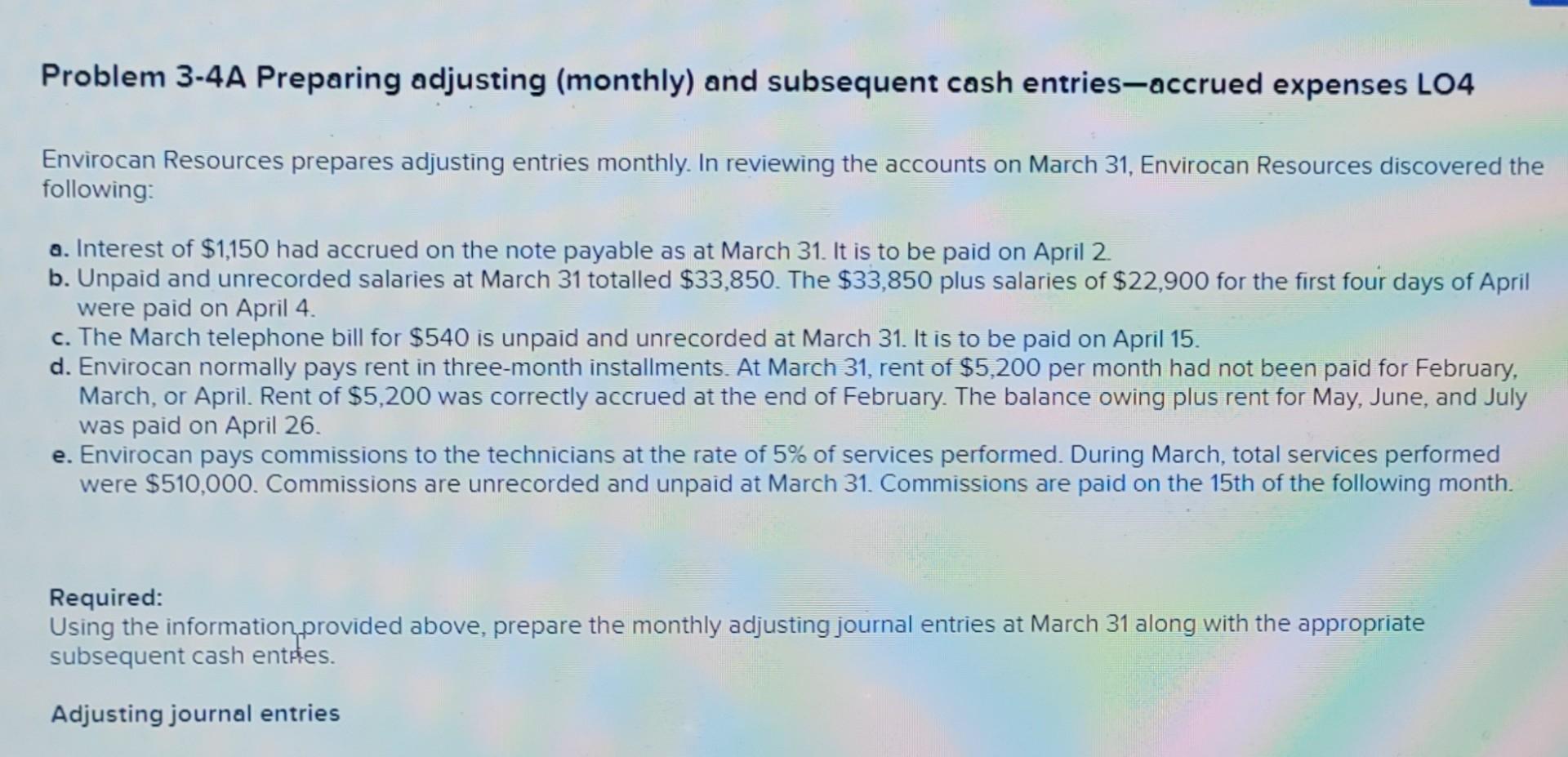

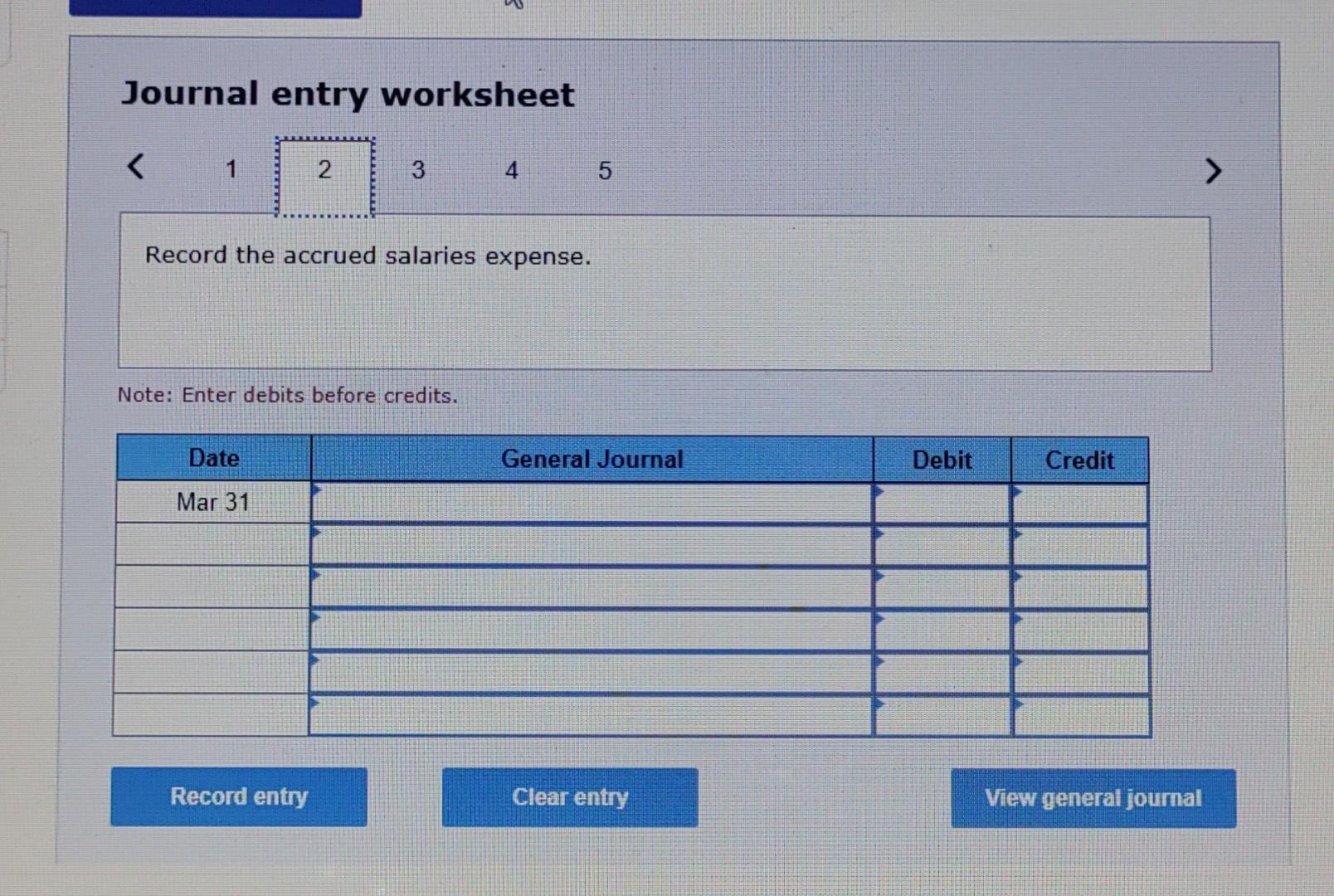

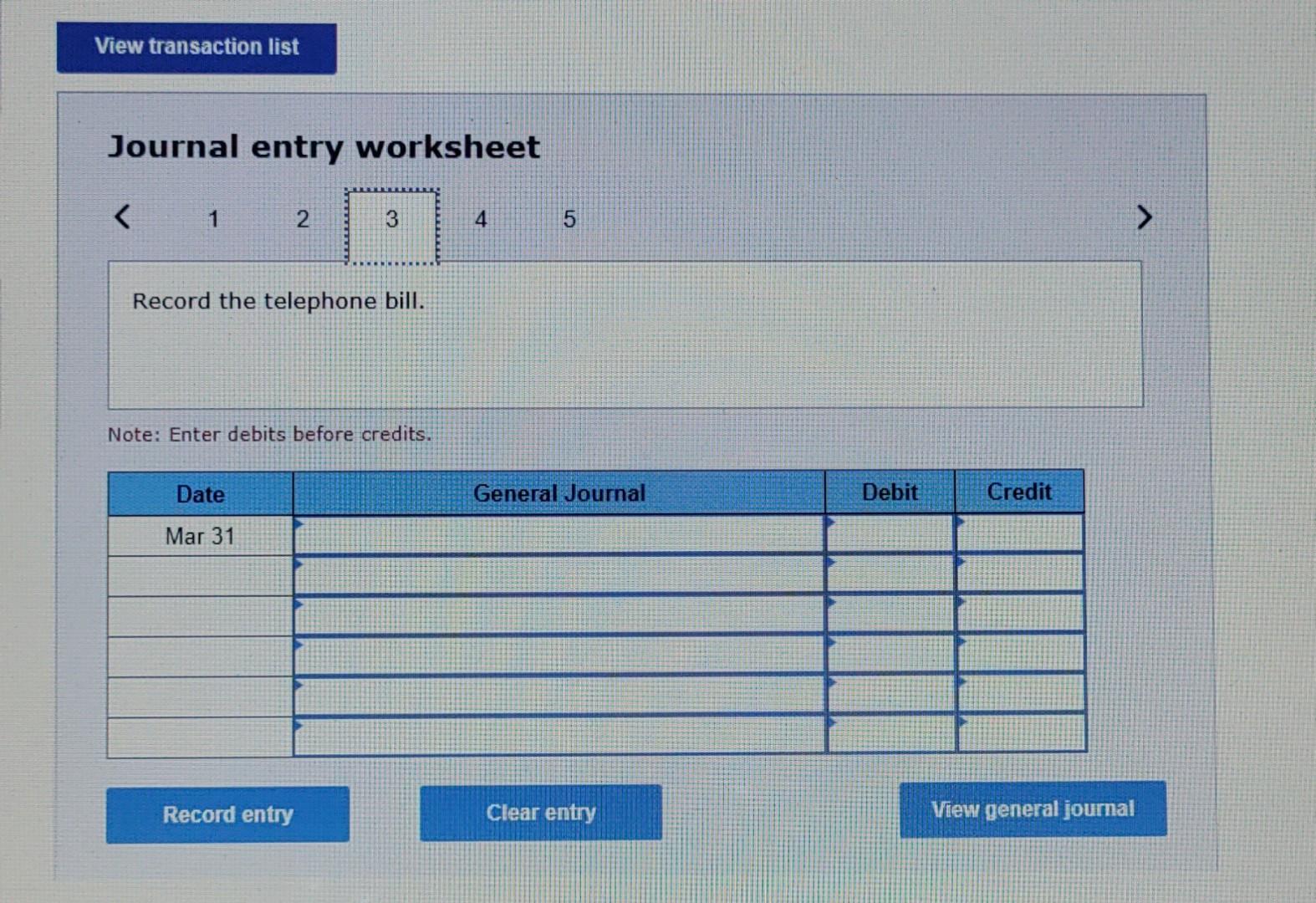

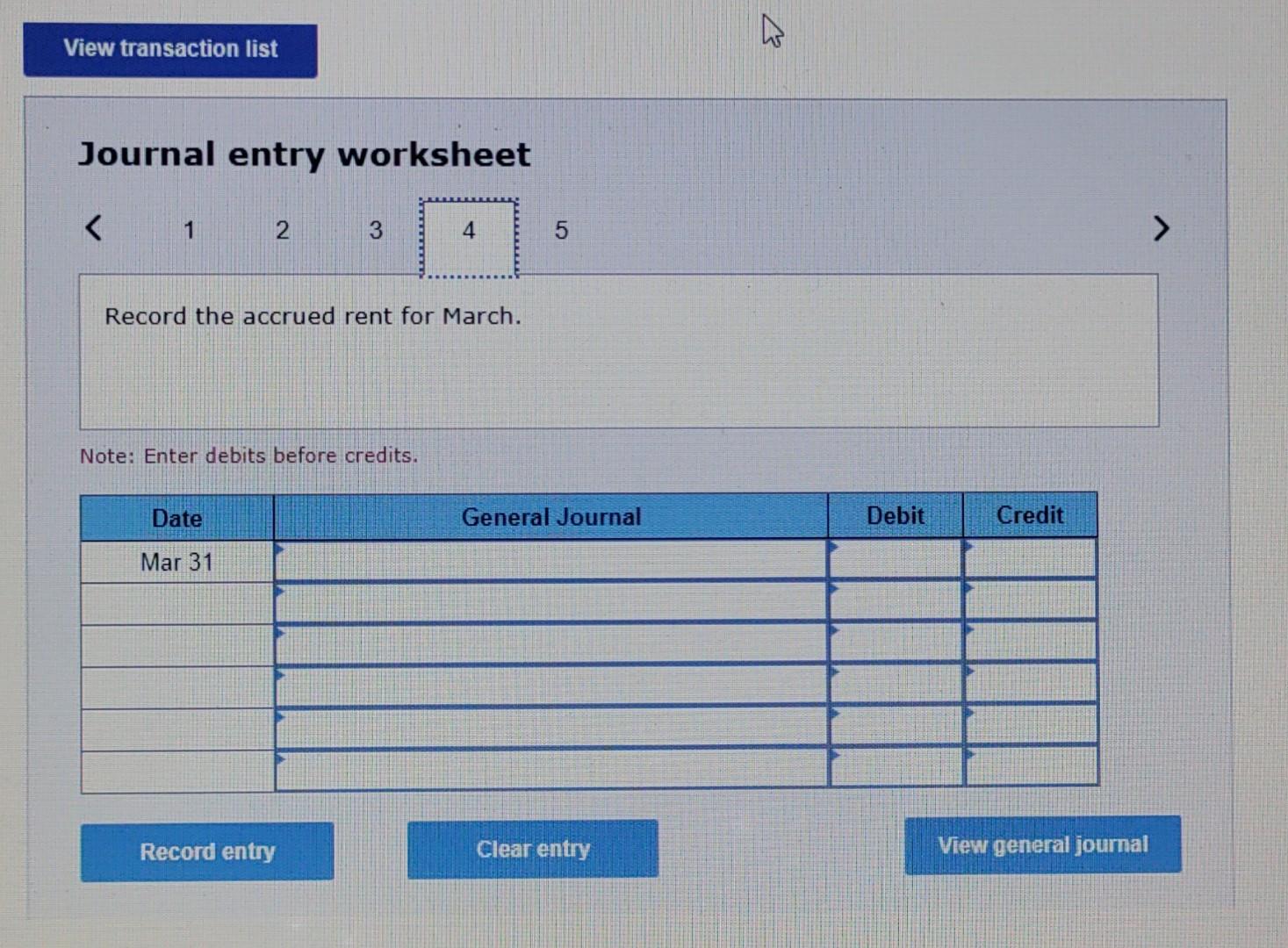

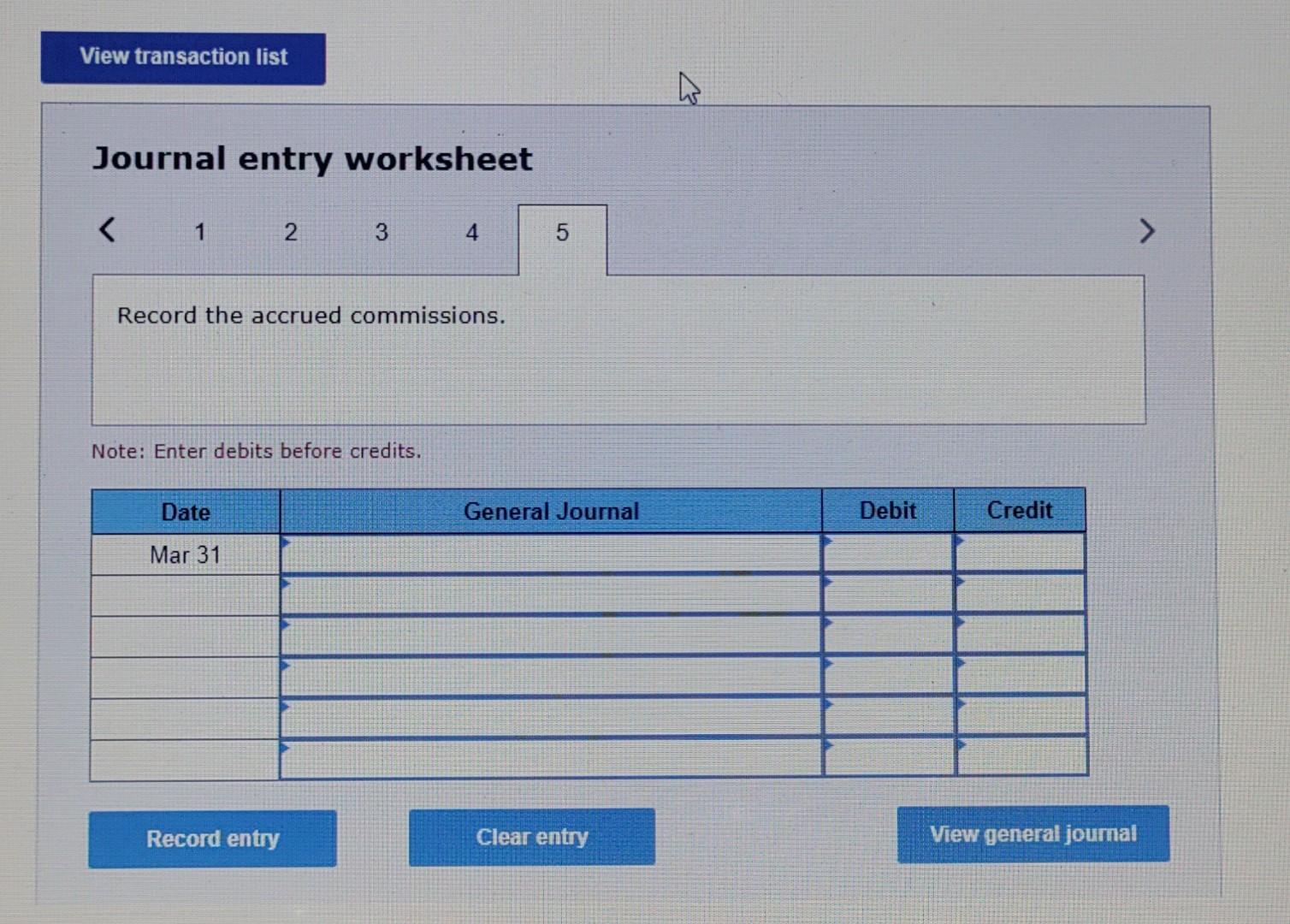

Journal entry worksheet 1 Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Record the accrued salaries expense. Note: Enter debits before credits. Exercise 3-18 Adjusting entries LO4, 6 Using the information given complete the table given below: Additional information: a. Annual depreciation of the equipment, $11,700 b. $12,200 of the Prepaid Insurance balance has expired. c. Unbilled and unrecorded revenues at year-end totalled \$31,200. Required: Use the information provided to complete the columns. \begin{tabular}{|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{9}{|c|}{ NUNA MUSIC } \\ \hline \multicolumn{9}{|c|}{ Trial Balances } \\ \hline \multicolumn{9}{|c|}{ February 28, 2023} \\ \hline & \multicolumn{4}{|c|}{ Unadjusted } & & & \multicolumn{2}{|c|}{ Adjusted } \\ \hline & \multicolumn{4}{|c|}{ Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Trial Balance } \\ \hline & & Dr. & & Cr. & Dr. & Cr. & Dr. & Cr. \\ \hline Cash & $ & 14,200 & & & & & & \\ \hline Accounts receivable & & 32,200 & & & & & & \\ \hline Prepaid insurance & & 17,000 & & & & & & \\ \hline Equipment & & 103,000 & & & & & & \\ \hline Accumulated depreciation, equipment & & & $ & 23,200 & & & & \\ \hline Accounts payable & & & & 19,200 & & & & \\ \hline Abraham Nuna, capital & & & & 215,000 & & & & \\ \hline Abraham Nuna, withdrawals & & 103,000 & & & & & & \\ \hline Revenues & & & & 216,4007 & & & & \\ \hline Depreciation expense, equipment & & 0 & & & & & & \\ \hline Salaries expense & & 189,700 & & & & & & \\ \hline Insurance expense & & 14,700 & & & & & & \\ \hline Totals & $ & 473,800 & $ & 473,800 & & & & \\ \hline \end{tabular} Problem 3-4A Preparing adjusting (monthly) and subsequent cash entries-accrued expenses LO4 Envirocan Resources prepares adjusting entries monthly. In reviewing the accounts on March 31, Envirocan Resources discovered the following: a. Interest of $1,150 had accrued on the note payable as at March 31. It is to be paid on April 2. b. Unpaid and unrecorded salaries at March 31 totalled $33,850. The $33,850 plus salaries of $22,900 for the first four days of April were paid on April 4. c. The March telephone bill for $540 is unpaid and unrecorded at March 31. It is to be paid on April 15. d. Envirocan normally pays rent in three-month installments. At March 31, rent of $5,200 per month had not been paid for February, March, or April. Rent of $5,200 was correctly accrued at the end of February. The balance owing plus rent for May, June, and July was paid on April 26. e. Envirocan pays commissions to the technicians at the rate of 5% of services performed. During March, total services performed were $510,000. Commissions are unrecorded and unpaid at March 31. Commissions are paid on the 15th of the following month. Required: Using the informationprovided above, prepare the monthly adjusting journal entries at March 31 along with the appropriate subsequent cash entries. Adjusting journal entries Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet 1234 Note: Enter debits before creditsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started