Answer all of these, please

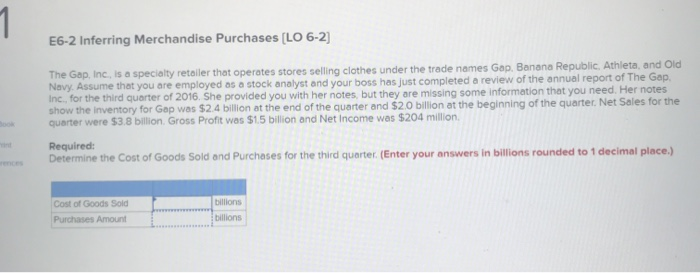

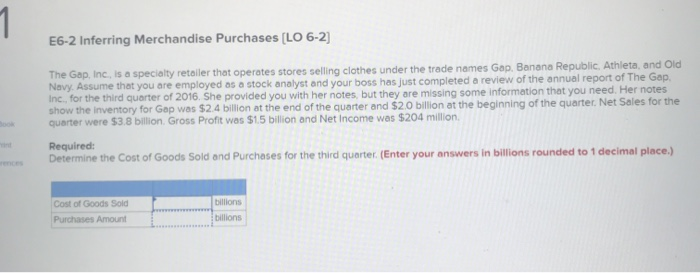

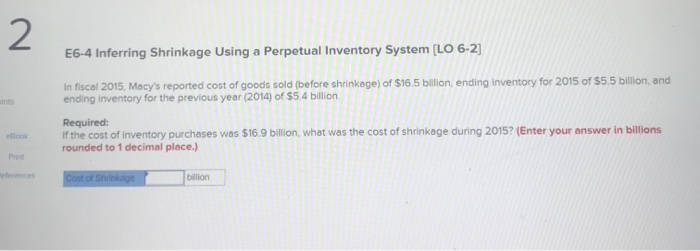

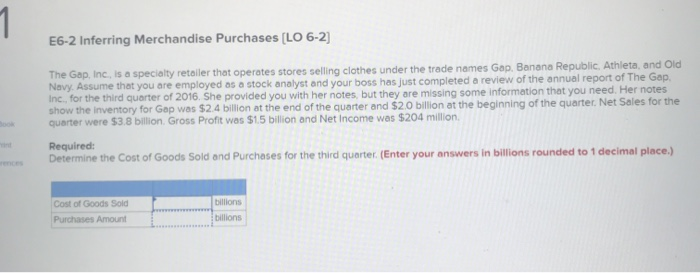

E6-2 Inferring Merchandise Purchases (LO 6-2] The Gap, Inc, is a specialty reteiler that operates stores selling clothes under the trade names Gap. Banana Republic. Athleta, and Old Navy. Assume that you are employed as a stock analyst and your boss has just completed a review of the annual report of The Gap. Inc, for the third quarter of 2016. She provided you with her notes, but they are missing some information that you need. Her notes show the inventory for Gap was $2.4 billion at the end of the quarter and $2.0 billion at the beginning of the quarter. Net Sales for the quarter were $3.8 billion. Gross Profit was $1.5 billion and Net Income was $204 million. ook Required: Determine the Cost of Goods Sold and Purchases for the third quarter. (Enter your answers in billions rounded Ito 1 decimal place.) ences billions Cost of Goods Sold billions Purchases Amount 2 E6-4 Inferring Shrinkage Using a Perpetual Inventory System [LO 6-2] In fiscal 2015, Mocy's reported cost of goods sold (before shrinkage) of $16.5 billion, ending inventory for 2015 of $5.5 billion, and ending inventory for the previous year (2014) of $5.4 billion. ints Required: If the cost of inventory purchases was $16.9 billion, what was the cost of shrinkage during 2015? (Enter your answer in billions rounded to 1 decimal place.) eBook Print billion eferences Cost of Shrinkage 7 Required Information PA6-1 Reporting Purchase Transactions between Wholesale and Retail Merchandisers Using Perpetual Inventory Systems [LO 6-3) nts [The following information applies to the questions displayed below] The transactions listed below are typical of those involving New Books Inc. and Readers Corner. New Books is a wholesale merchandiser and Readers' Corner is a retail merchandiser. Assume all sales of merchandise from New Books to Readers Corner are made with terms n/30, and the two companies use perpetual inventory systems. Assume the following transactions between the two companies occurred in the order listed during the year ended August 31 a New Books sold merchandise to Readers Corner at a selling price of $550,000. The merchandise had cost New Books $415,000 b Two days later, Readers' Corner complained to New Books that some of the merchandise differed from what Readers Corner had ordered. New Books agreed to give an allowance of $10,000 to Readers' Corner. Readers' Corner also returned some books, which had cost New Books $2.000 and had been sold to Readers' Corner for $3,500. c Just three days later, Readers' Comer paid New Books, which settled all amounts owed PA6-1 Part 2 2. Prepare the journal entries that Readers Corner would record. (If no entry is required for a transactlon/event, select "No Journal Entry Required" In the first account fleld.) Answer is not complete. Credit Transaction Debit No urnal Inventory 550,000 a. 550,000 Accounts Payable 10,000 Accounts Payable b. 10,000 Inventory Accounts Payable 540,000 3 Cash inventory