Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all pls $244,000. a. How should the $1,020,000 in development costs be classified? b. How should the $244,000 sale price for the existing line

answer all pls

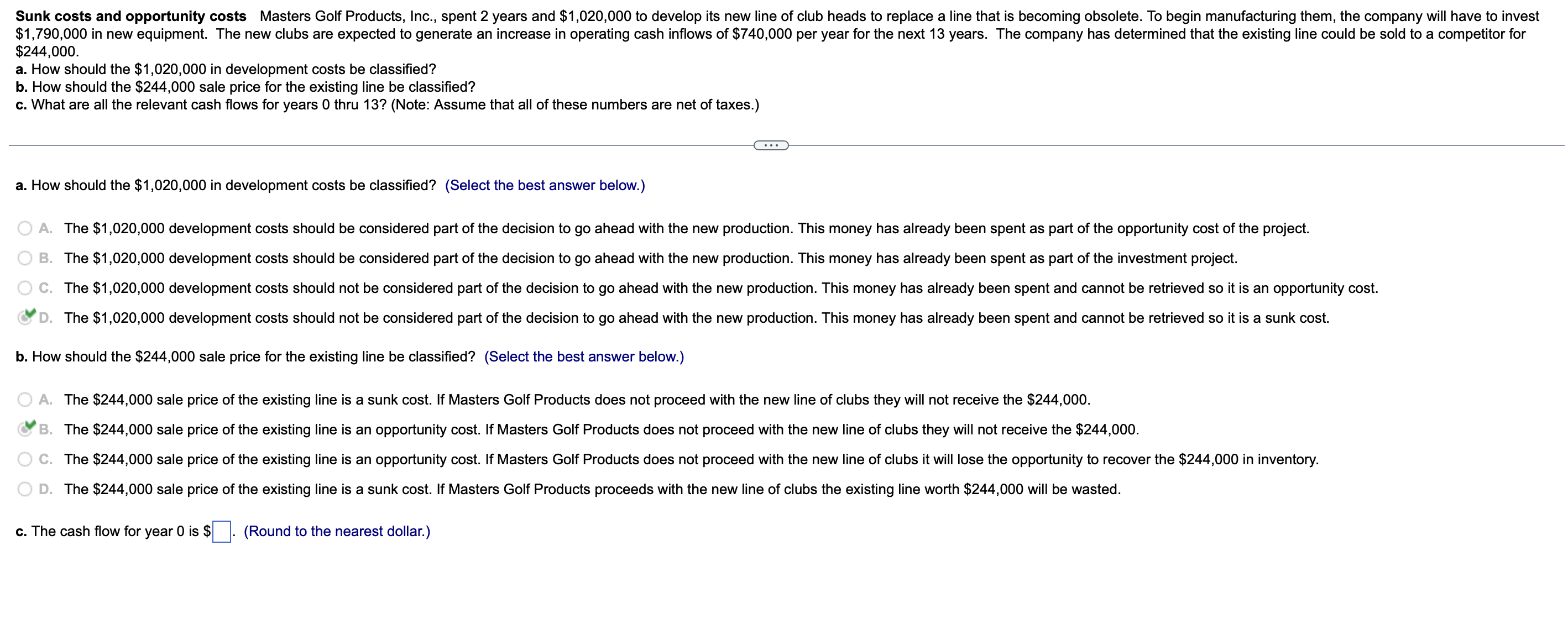

$244,000. a. How should the $1,020,000 in development costs be classified? b. How should the $244,000 sale price for the existing line be classified? c. What are all the relevant cash flows for years 0 thru 13? (Note: Assume that all of these numbers are net of taxes.) a. How should the $1,020,000 in development costs be classified? (Select the best answer below.) A. The $1,020,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the opportunity cost of the project. B. The $1,020,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the investment project. b. How should the $244,000 sale price for the existing line be classified? (Select the best answer below.) A. The $244,000 sale price of the existing line is a sunk cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $244,000. B. The $244,000 sale price of the existing line is an opportunity cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $244,000. D. The $244,000 sale price of the existing line is a sunk cost. If Masters Golf Products proceeds with the new line of clubs the existing line worth $244,000 will be wasted. c. The cash flow for year 0 is $ (Round to the nearest dollar.)

$244,000. a. How should the $1,020,000 in development costs be classified? b. How should the $244,000 sale price for the existing line be classified? c. What are all the relevant cash flows for years 0 thru 13? (Note: Assume that all of these numbers are net of taxes.) a. How should the $1,020,000 in development costs be classified? (Select the best answer below.) A. The $1,020,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the opportunity cost of the project. B. The $1,020,000 development costs should be considered part of the decision to go ahead with the new production. This money has already been spent as part of the investment project. b. How should the $244,000 sale price for the existing line be classified? (Select the best answer below.) A. The $244,000 sale price of the existing line is a sunk cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $244,000. B. The $244,000 sale price of the existing line is an opportunity cost. If Masters Golf Products does not proceed with the new line of clubs they will not receive the $244,000. D. The $244,000 sale price of the existing line is a sunk cost. If Masters Golf Products proceeds with the new line of clubs the existing line worth $244,000 will be wasted. c. The cash flow for year 0 is $ (Round to the nearest dollar.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started