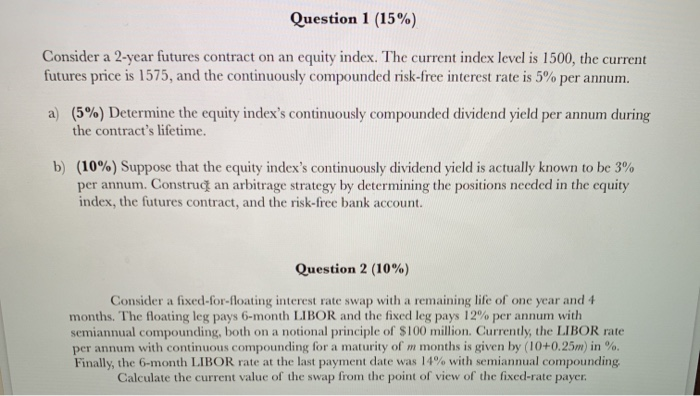

Question 1 (15%) Consider a 2-year futures contract on an equity index. The current index level is 1500, the current futures price is 1575 and the continuously compounded risk-free interest rate is 5% per annum. 5%) Determine the equity index's continuously compounded dividend yield per annum during the contract's lifetime. a b) 10%) Suppose that the equity index's continuously dividend yield is actually known to be 3% per annum. Construcg an arbitrage strategy by determining the positions needed in the equity index, the futures contract, and the risk-free bank account. Question 2 (10%) Consider a fixed-for-floating interest rate swap with a remaining life of one year and 4 months. The floating leg pays 6-month LIBOR and the fixed leg pays 12% per annum with semiannual compounding, both on a notional principle of $100 million. Currently, the LIBOR rate per annum with continuous compounding for a maturity of m months is given by (10+0.25m)in %. Finally, the 6-month LIBOR rate at the last payment date was 14% with semiannual compounding Calculate the current value of the swap from the point of view of the fixed-rate payer Question 1 (15%) Consider a 2-year futures contract on an equity index. The current index level is 1500, the current futures price is 1575 and the continuously compounded risk-free interest rate is 5% per annum. 5%) Determine the equity index's continuously compounded dividend yield per annum during the contract's lifetime. a b) 10%) Suppose that the equity index's continuously dividend yield is actually known to be 3% per annum. Construcg an arbitrage strategy by determining the positions needed in the equity index, the futures contract, and the risk-free bank account. Question 2 (10%) Consider a fixed-for-floating interest rate swap with a remaining life of one year and 4 months. The floating leg pays 6-month LIBOR and the fixed leg pays 12% per annum with semiannual compounding, both on a notional principle of $100 million. Currently, the LIBOR rate per annum with continuous compounding for a maturity of m months is given by (10+0.25m)in %. Finally, the 6-month LIBOR rate at the last payment date was 14% with semiannual compounding Calculate the current value of the swap from the point of view of the fixed-rate payer