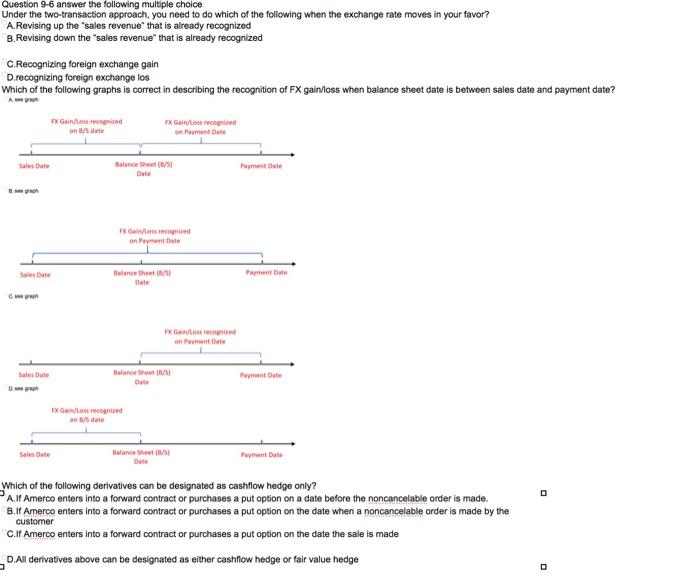

Question 9-6 answer the following multiple choice Under the two-transaction approach, you need to do which of the following when the exchange rate moves in your favor? A. Revising up the "sales revenue that is already recognized 8. Revising down the "sales revenue" that is already recognized C.Recognizing foreign exchange gain D.recognizing foreign exchange los Which of the following graphs is correct in describing the recognition of FX gain/loss when balance sheet date is between sales date and payment date? FX Gain/Los recognized FX Gain/Los recognized on 8/5 date on Payment Date Sales Date Payment Date Payment Date Payment Date FX Gain/Loss recognized on 5/5 date Sales Date Balance Sheet (8/1) Date Payment Date Which of the following derivatives can be designated as cashflow hedge only? A.If Amerco enters into a forward contract or purchases a put option on a date before the noncancelable order is made. B.If Amerco enters into a forward contract or purchases a put option on the date when a noncancelable order is made by the customer C.If Amerco enters into a forward contract or purchases a put option on the date the sale is made D.All derivatives above can be designated as either cashflow hedge or fair value hedge 0 8.graph Sales Date Sales Date Balance Sheet (8/5) Date FX Gain/Los recognized on Payment Date Balance Sheet (/) Date FX Gain/Less recognized on Perment Date Balance Sheet (0/5) Date 0 Question 9-6 answer the following multiple choice Under the two-transaction approach, you need to do which of the following when the exchange rate moves in your favor? A. Revising up the "sales revenue that is already recognized 8. Revising down the "sales revenue" that is already recognized C.Recognizing foreign exchange gain D.recognizing foreign exchange los Which of the following graphs is correct in describing the recognition of FX gain/loss when balance sheet date is between sales date and payment date? FX Gain/Los recognized FX Gain/Los recognized on 8/5 date on Payment Date Sales Date Payment Date Payment Date Payment Date FX Gain/Loss recognized on 5/5 date Sales Date Balance Sheet (8/1) Date Payment Date Which of the following derivatives can be designated as cashflow hedge only? A.If Amerco enters into a forward contract or purchases a put option on a date before the noncancelable order is made. B.If Amerco enters into a forward contract or purchases a put option on the date when a noncancelable order is made by the customer C.If Amerco enters into a forward contract or purchases a put option on the date the sale is made D.All derivatives above can be designated as either cashflow hedge or fair value hedge 0 8.graph Sales Date Sales Date Balance Sheet (8/5) Date FX Gain/Los recognized on Payment Date Balance Sheet (/) Date FX Gain/Less recognized on Perment Date Balance Sheet (0/5) Date 0