Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer all plz 2. Future value The principal of the time value of money is probably the single most important concept in financial management. One

answer all plz

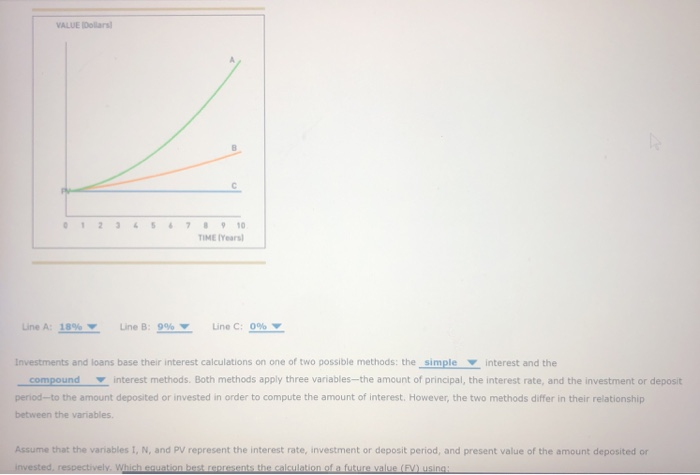

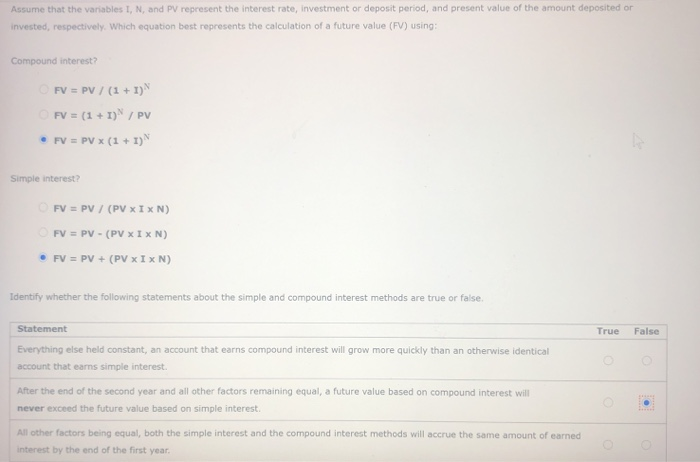

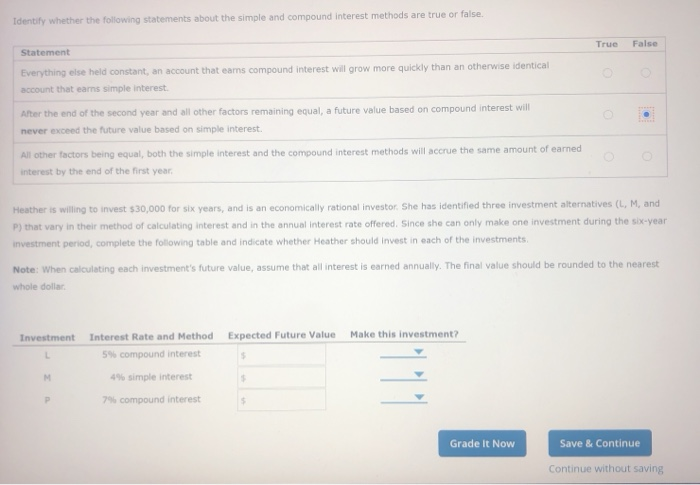

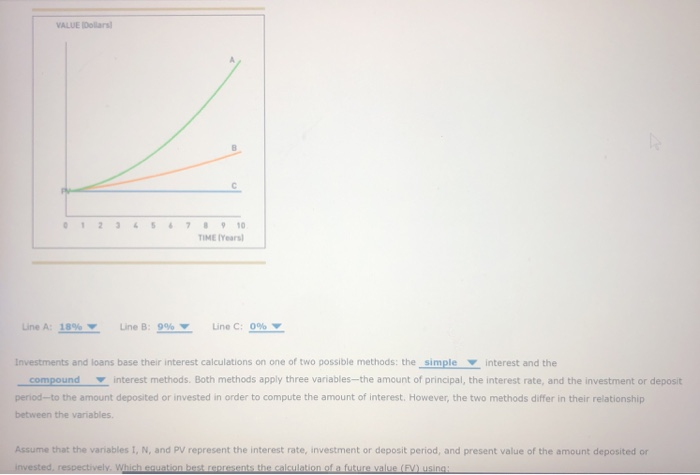

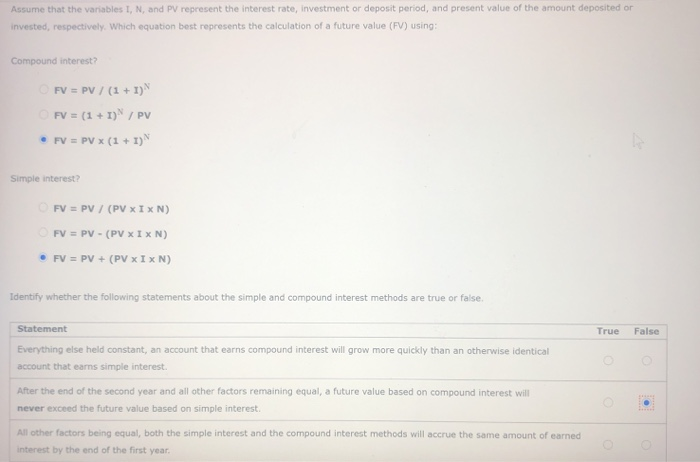

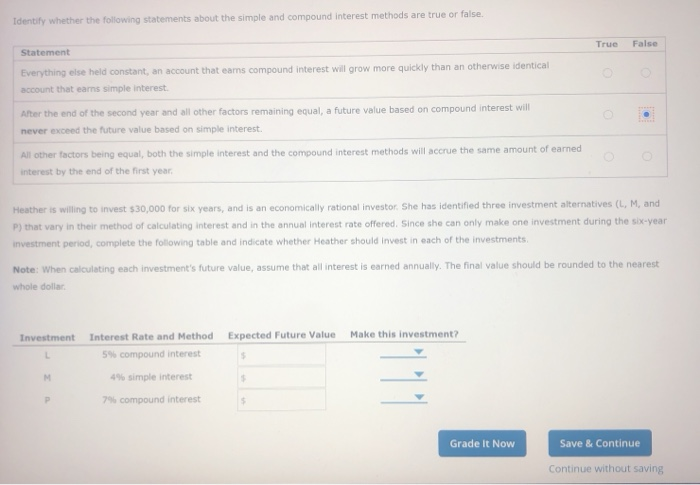

2. Future value The principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation a future value This process requires knowledge of the values of three of The process for converting present values into future values is called compounding four time-value-of-money variables. Which of the following is not one of these variables? The inflation rate indicating the change in average prices The interest rate (I) that could be earned by invested funds The present value (PV) of the amount invested The duration of the investment (N) All other things being equal, the numerical difference between a present and a future value corresponds to the amount of interest earned during the deposit or investment period. Each line on the following graph corresponds to an interest rate: 0%, 9%, or 18%. Identify the interest rate that corresponds with each line. VALUE Dollars VALUE Dollars 10 TIME IYears Line A: 18% Line B: 99% Line C: 0% Investments and loans base their interest calculations on one of two possible methods: the simple interest and the compound interest methods. Both methods apply three variables--the amount of principal, the interest rate, and the investment or deposit periodto the amount deposited or invested in order to compute the amount of interest. However, the two methods differ in their relationship between the variables. Assume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which ecuation best represents the calculation of a future value (FV) using: Assume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which equation best represents the calculation of a future value (FV) using: Compound interest? FV = PV / (1+1) FV = (1 + 1)"/PV FV = PV *(1 + 1) Simple interest FV = PV / (PV XIXN) FV = PV - (PV XIXN) FV = PV + (PV XIXN) Identify whether the following statements about the simple and compound interest methods are true or false, True False Statement Everything else held constant, an account that earns compound interest will grow more quickly than an otherwise identical account that earns simple interest. After the end of the second year and all other factors remaining equal, a future value based on compound interest will never exceed the future value based on simple interest . All other factors being equal, both the simple interest and the compound interest methods will accrue the same amount of earned interest by the end of the first year. Identify whether the following statements about the simple and compound interest methods are true or false, True False Statement Everything else held constant, an account that eams compound interest will grow more quickly than an otherwise identical account that earns simple interest . After the end of the second year and all other factors remaining equal, a future value based on compound interest will never exceed the future value based on simple interest. All other factors being equal, both the simple interest and the compound interest methods will accrue the same amount of earned interest by the end of the first year Heather is willing to invest $30,000 for six years, and is an economically rational investor. She has identified three investment alternatives (L, M, and P) that vary in their method of calculating interest and in the annual interest rate offered. Since she can only make one investment during the six-year investment period, complete the following table and indicate whether Heather should invest in each of the investments Note: When calculating each investment's future value, assume that all interest is earned annually. The final value should be rounded to the nearest whole dollar Investment Expected Future Value Make this investment? Interest Rate and Method 5% compound interest 4% simple interest M P 79 compound interest Grade It Now Save & Continue Continue without saving

2. Future value The principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation a future value This process requires knowledge of the values of three of The process for converting present values into future values is called compounding four time-value-of-money variables. Which of the following is not one of these variables? The inflation rate indicating the change in average prices The interest rate (I) that could be earned by invested funds The present value (PV) of the amount invested The duration of the investment (N) All other things being equal, the numerical difference between a present and a future value corresponds to the amount of interest earned during the deposit or investment period. Each line on the following graph corresponds to an interest rate: 0%, 9%, or 18%. Identify the interest rate that corresponds with each line. VALUE Dollars VALUE Dollars 10 TIME IYears Line A: 18% Line B: 99% Line C: 0% Investments and loans base their interest calculations on one of two possible methods: the simple interest and the compound interest methods. Both methods apply three variables--the amount of principal, the interest rate, and the investment or deposit periodto the amount deposited or invested in order to compute the amount of interest. However, the two methods differ in their relationship between the variables. Assume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which ecuation best represents the calculation of a future value (FV) using: Assume that the variables I, N, and PV represent the interest rate, investment or deposit period, and present value of the amount deposited or invested, respectively. Which equation best represents the calculation of a future value (FV) using: Compound interest? FV = PV / (1+1) FV = (1 + 1)"/PV FV = PV *(1 + 1) Simple interest FV = PV / (PV XIXN) FV = PV - (PV XIXN) FV = PV + (PV XIXN) Identify whether the following statements about the simple and compound interest methods are true or false, True False Statement Everything else held constant, an account that earns compound interest will grow more quickly than an otherwise identical account that earns simple interest. After the end of the second year and all other factors remaining equal, a future value based on compound interest will never exceed the future value based on simple interest . All other factors being equal, both the simple interest and the compound interest methods will accrue the same amount of earned interest by the end of the first year. Identify whether the following statements about the simple and compound interest methods are true or false, True False Statement Everything else held constant, an account that eams compound interest will grow more quickly than an otherwise identical account that earns simple interest . After the end of the second year and all other factors remaining equal, a future value based on compound interest will never exceed the future value based on simple interest. All other factors being equal, both the simple interest and the compound interest methods will accrue the same amount of earned interest by the end of the first year Heather is willing to invest $30,000 for six years, and is an economically rational investor. She has identified three investment alternatives (L, M, and P) that vary in their method of calculating interest and in the annual interest rate offered. Since she can only make one investment during the six-year investment period, complete the following table and indicate whether Heather should invest in each of the investments Note: When calculating each investment's future value, assume that all interest is earned annually. The final value should be rounded to the nearest whole dollar Investment Expected Future Value Make this investment? Interest Rate and Method 5% compound interest 4% simple interest M P 79 compound interest Grade It Now Save & Continue Continue without saving

answer all plz

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started