Answer all plz

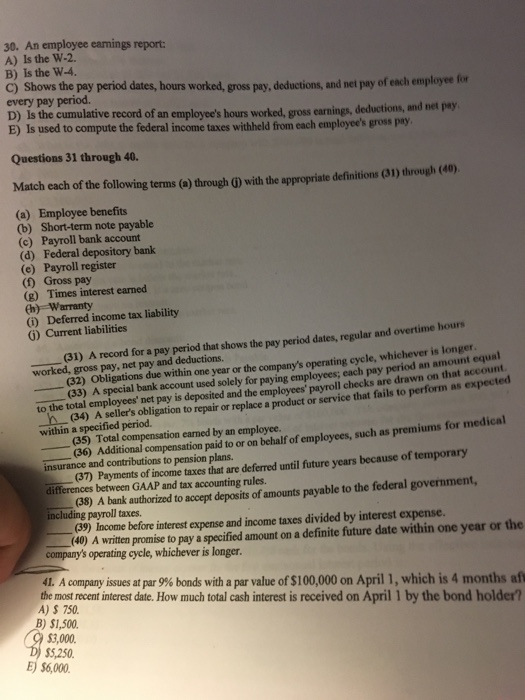

An employee earnings report: A) Is the W-2. B) Is the W-4. C) Shows the pay period dates, hours worked, gross pay, deductions, and net pay of each employee for every pay period. D) Is the cumulative record of an employee's hours worked, gross earnings, deductions, and net pay. E) Is used to compute the federal income taxes withheld from each employee's gross pay. Match each of the following terms (a) through (j) with the appropriate definitions (31) through (40). (a) Employee benefits (b) Short-term note payable (c) Payroll bank account (d) Federal depository bank (e) Payroll register (f) Gross pay (g) Times interest earned (h) Warranty (i) Deferred income tax liability (j) Current liabilities _____ A record for a pay period that shows the pay period dates, regular and overtime hours worked, gross pay, net pay and deductions. _____ Obligations due within one year or the company's operating cycle, whichever is longer. _____ A special bank account used solely for paying employees: each pay period an amount equal to the total employee's net pay is deposited and the employees' payroll checks are drawn on that account. _____ A seller's obligation to repair or replace a product or service that fails to perform as expected within a specified period. _____ The compensation earned by an employee. _____ Additional compensation paid to or on behalf of employees, such as premiums for medical insurance and contributions to pension plans. _____ Payments of income taxes that are deferred until future years because of temporary differences between GAAP and tax accounting rules. _____ A bank authorized to accept deposits of amounts payable to the federal government, including payroll taxes. _____ Income before interest expense and income taxes divided by interest expense. _____ A written promise to pay a specified amount on a definite future date within one year or the company's operating cycle, whichever is longer. A company issues at par 9% bonds with a par value of exist100,000 on April 1, which is 4 months after the most recent interest date. How much total cash interest is received on April 1 by the bond holder? A) exist 750. B) exist1, 500. C) exist3,000. D) exist5, 250. E) exist6,000

Answer all plz

Answer all plz