Question

Answer all question based on the picture given. Thank you Answer all 13 question based on the picture given. 1. Initial outlay of PZ is

Answer all question based on the picture given. Thank you

Answer all 13 question based on the picture given.

Answer all 13 question based on the picture given.

1. Initial outlay of PZ is RM_______________.

2. Terminal Value of PZ is RM_____________.

3. Total present value of PZ is RM_____________.

4. Total future value of PZ is RM___________.

5. The payback period for PZ is __________ period.

6. The net present value of PZ is RM____________.

7. The profitability index for PZ is __________.

8. The internal rate of return for PZ is _________%.

9. The modified internal rate of return for PZ is _________%.

10. The equivalent annual annuity (EAA) for PZ is RM________________.

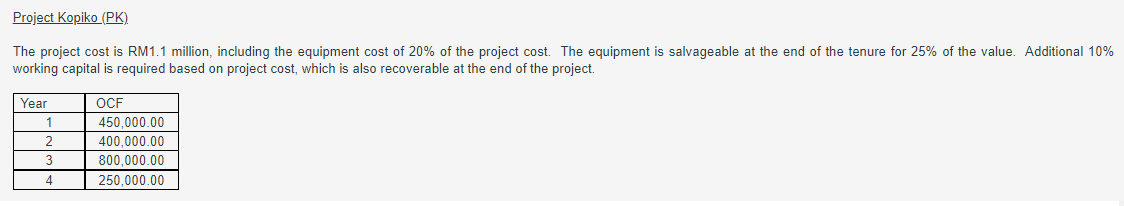

11. The discounted payback period for PK is __________ period.

12. Total future value of PK is RM___________.

13. The equivalent annual annuity (EAA) for PK is RM________________.

Project Kopiko (PK) The project cost is RM1.1 million, including the equipment cost of 20% of the project cost. The equipment is salvageable at the end of the tenure for 25% of the value. Additional 10% working capital is required based on project cost, which is also recoverable at the end of the project. Year 1 2 4 OCF 450,000.00 400,000.00 800,000.00 250,000.00 Project Kopiko (PK) The project cost is RM1.1 million, including the equipment cost of 20% of the project cost. The equipment is salvageable at the end of the tenure for 25% of the value. Additional 10% working capital is required based on project cost, which is also recoverable at the end of the project. Year 1 2 4 OCF 450,000.00 400,000.00 800,000.00 250,000.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started