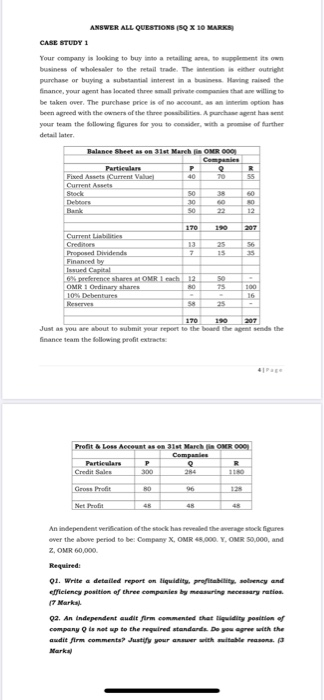

ANSWER ALL QUESTIONS 150 X 10 MARKS CASE STUDY 1 Your company is looking to buy into a retailing en topplement its own business of wholesaler to the retail trade. The intention is either outright purchase or buying a substantial interest in a business. Having raised the finance, your agent has located three small private companies that are willing to be taken over. The purchase price is of no account as an interim option has been agreed with the owner of the three posibilities Apachet has set your team the following figures for you to consider, with a promise of further detail anter 55 Balance Sheet as on 31st Marchi OMR 000 Carpanies Particulars Fised Assets Current Value 40 Current Assets 50 Der 30 50 12 190 207 15 170 Current Labs Credits 13 Proposed Dividende 7 Financed by Issuad Capital 6% preference shares OMR 1 cach 12 OMR 1 Ordinary shares 0 10% Debentures Reserves 58 75 100 25 170 190 207 Just as you are about to submit your report to the board the agent sends the finance team the following profit extracts Profit & Loss Account as on 31st Marchi OMR 000 Companies Particulars P R Credit Sales Gross Profit RD 96 Net Profit An independent verification of the stock has revealed the average stock figures over the above period to be: Company X OMR 45,000. Y. OMR 50,000, and Z. OMR 60,000 Required 01. Write a detailed report on liquidity profitability, solvency and efficiency position of three companies by measuring necessary ratios. 17 Markal 02. An Independent audit firm commented that liquidity position of company is set up to the required standards. Do you agree with the andie firm comments? Justify = ttata ram ( Mark ANSWER ALL QUESTIONS 150 X 10 MARKS CASE STUDY 1 Your company is looking to buy into a retailing en topplement its own business of wholesaler to the retail trade. The intention is either outright purchase or buying a substantial interest in a business. Having raised the finance, your agent has located three small private companies that are willing to be taken over. The purchase price is of no account as an interim option has been agreed with the owner of the three posibilities Apachet has set your team the following figures for you to consider, with a promise of further detail anter 55 Balance Sheet as on 31st Marchi OMR 000 Carpanies Particulars Fised Assets Current Value 40 Current Assets 50 Der 30 50 12 190 207 15 170 Current Labs Credits 13 Proposed Dividende 7 Financed by Issuad Capital 6% preference shares OMR 1 cach 12 OMR 1 Ordinary shares 0 10% Debentures Reserves 58 75 100 25 170 190 207 Just as you are about to submit your report to the board the agent sends the finance team the following profit extracts Profit & Loss Account as on 31st Marchi OMR 000 Companies Particulars P R Credit Sales Gross Profit RD 96 Net Profit An independent verification of the stock has revealed the average stock figures over the above period to be: Company X OMR 45,000. Y. OMR 50,000, and Z. OMR 60,000 Required 01. Write a detailed report on liquidity profitability, solvency and efficiency position of three companies by measuring necessary ratios. 17 Markal 02. An Independent audit firm commented that liquidity position of company is set up to the required standards. Do you agree with the andie firm comments? Justify = ttata ram ( Mark