Answered step by step

Verified Expert Solution

Question

1 Approved Answer

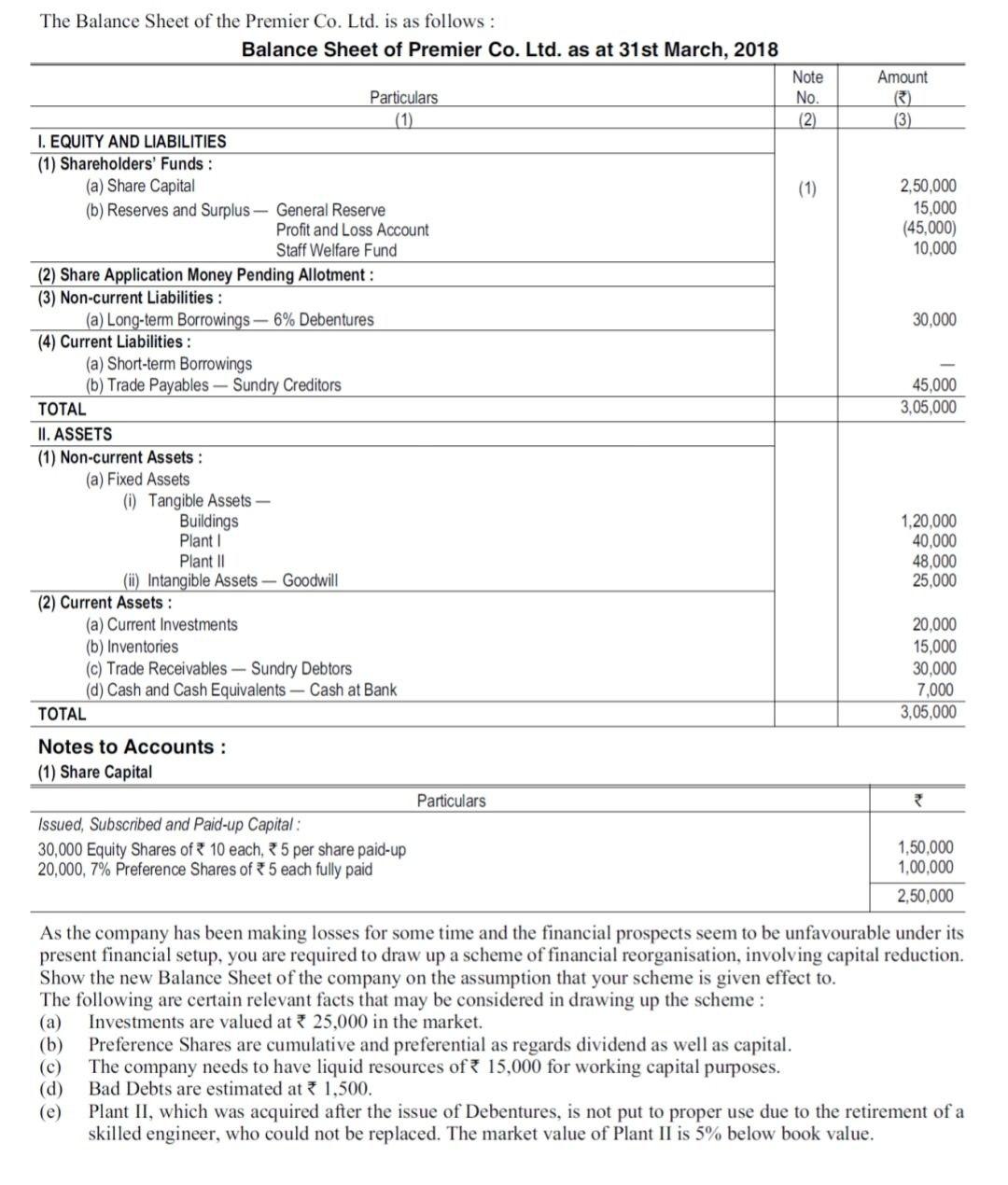

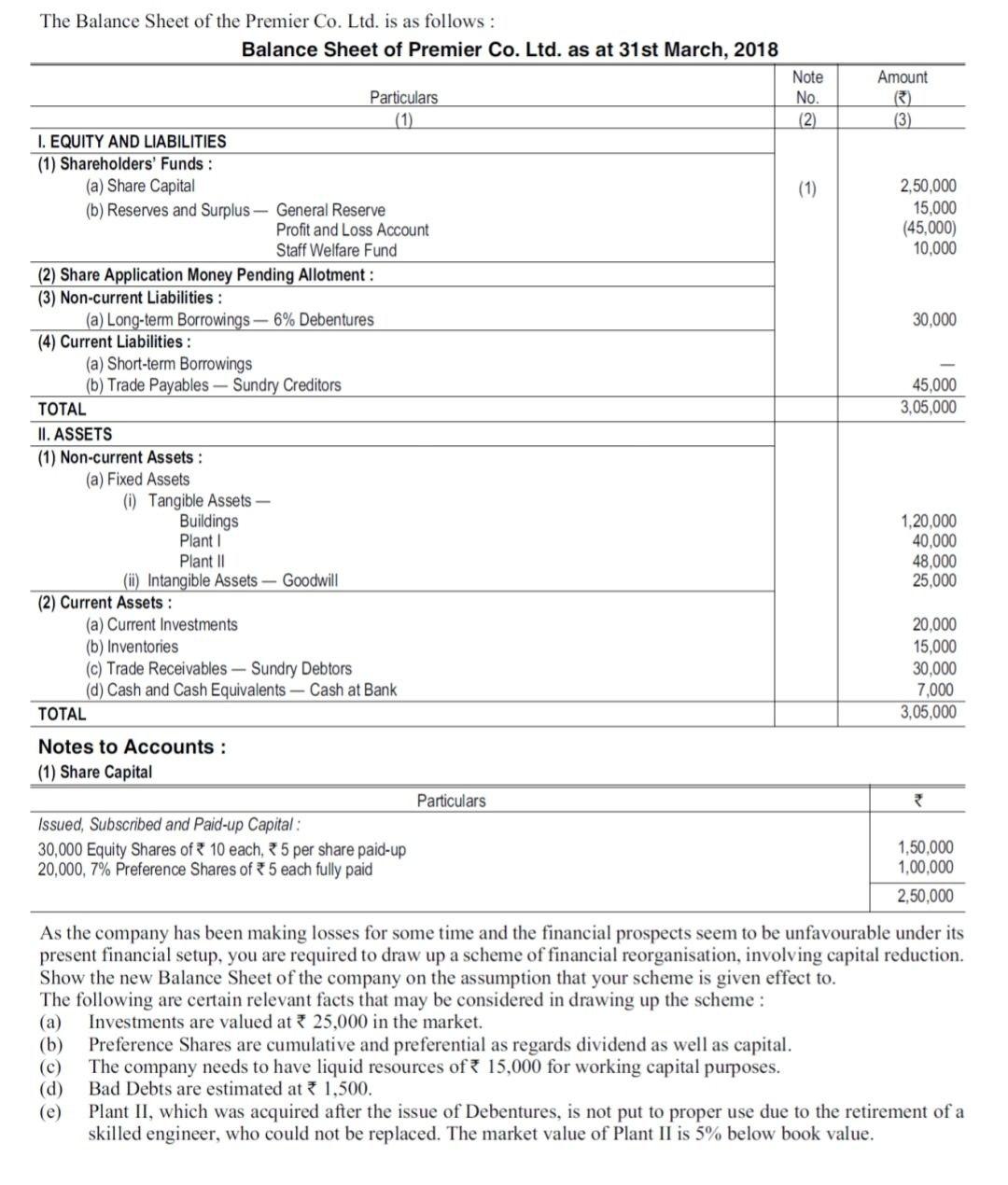

Answer all questions otherwise I will give negative feedback. The Balance Sheet of the Premier Co. Ltd. is as follows : Balance Sheet of Premier

Answer all questions otherwise I will give negative feedback.

The Balance Sheet of the Premier Co. Ltd. is as follows : Balance Sheet of Premier Co. Ltd. as at 31st March, 2018 As the company has been making losses for some time and the financial prospects seem to be unfavourable under its present financial setup, you are required to draw up a scheme of financial reorganisation, involving capital reduction. Show the new Balance Sheet of the company on the assumption that your scheme is given effect to. The following are certain relevant facts that may be considered in drawing up the scheme : (a) Investments are valued at 25,000 in the market. (b) Preference Shares are cumulative and preferential as regards dividend as well as capital. (c) The company needs to have liquid resources of 15,000 for working capital purposes. (d) Bad Debts are estimated at 1,500. (e) Plant II, which was acquired after the issue of Debentures, is not put to proper use due to the retirement of a skilled engineer, who could not be replaced. The market value of Plant II is 5% below book value. The Balance Sheet of the Premier Co. Ltd. is as follows : Balance Sheet of Premier Co. Ltd. as at 31st March, 2018 As the company has been making losses for some time and the financial prospects seem to be unfavourable under its present financial setup, you are required to draw up a scheme of financial reorganisation, involving capital reduction. Show the new Balance Sheet of the company on the assumption that your scheme is given effect to. The following are certain relevant facts that may be considered in drawing up the scheme : (a) Investments are valued at 25,000 in the market. (b) Preference Shares are cumulative and preferential as regards dividend as well as capital. (c) The company needs to have liquid resources of 15,000 for working capital purposes. (d) Bad Debts are estimated at 1,500. (e) Plant II, which was acquired after the issue of Debentures, is not put to proper use due to the retirement of a skilled engineer, who could not be replaced. The market value of Plant II is 5% below book value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started