Answer ALL Questions Question 1 Jazz Pic is a manufacturing company. The cash and bank balance is expected to be 1,500 on 1 June

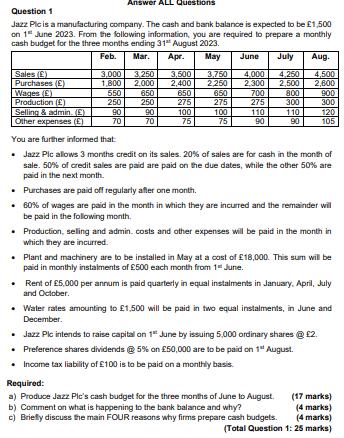

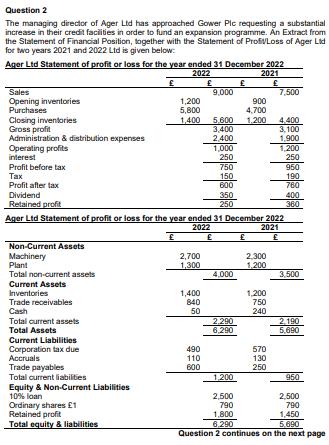

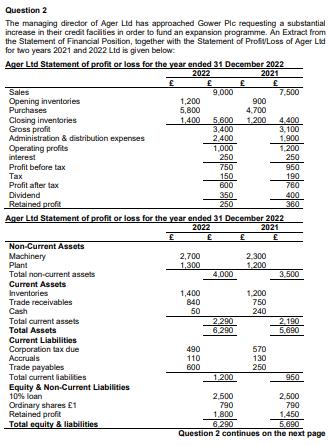

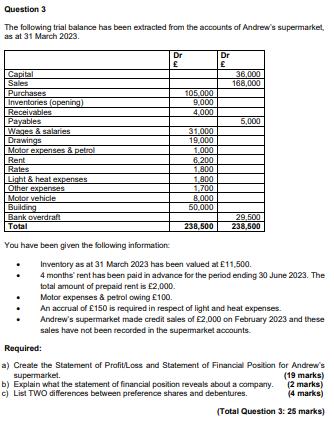

Answer ALL Questions Question 1 Jazz Pic is a manufacturing company. The cash and bank balance is expected to be 1,500 on 1 June 2023. From the following information, you are required to prepare a monthly cash budget for the three months ending 31 August 2023. Feb. Mar. Apr. May June July Aug. Sales (E) Purchases (E) Wages () Production () Selling & admin. (E) Other expenses (E) 3,000 1,800 550 250 90 70 3,250 3,500 2.000 2,400 650 250 90 70 650 275 100 75 3,750 2,250 650 275 100 75 4,000 2,300 700 275 110 90 4,250 2,500 800 300 110 90 4,500 2,600 900 300 You are further informed that Jazz Plc allows 3 months credit on its sales. 20% of sales are for cash in the month of sale. 50% of credit sales are paid are paid on the due dates, while the other 50% are paid in the next month. 120 105 Purchases are paid off regularly after one month. 60% of wages are paid in the month in which they are incurred and the remainder will be paid in the following month. Production, selling and admin. costs and other expenses will be paid in the month in which they are incurred. Plant and machinery are to be installed in May at a cost of 18,000. This sum will be paid in monthly instalments of 500 each month from 1 June. Required: a) Produce Jazz Pic's cash budget for the three months of June to August. b) Comment on what is happening to the bank balance and why? c) Briefly discuss the main FOUR reasons why firms prepare cash budgets. Rent of 5,000 per annum is paid quarterly in equal instalments in January, April, July and October. Jazz Plc intends to raise capital on 1 June by issuing 5,000 ordinary shares @ 2. Preference shares dividends @ 5% on 50,000 are to be paid on 1" August. Income tax liability of 100 is to be paid on a monthly basis. Water rates amounting to 1,500 will be paid in two equal instalments, in June and December. (17 marks) (4 marks) (4 marks) (Total Question 1: 25 marks) Question 2 The managing director of Ager Ltd has approached Gower Plc requesting a substantial increase in their credit facilities in order to fund an expansion programme. An Extract from the Statement of Financial Position, together with the Statement of ProfiLoss of Ager Lid for two years 2021 and 2022 Ltd is given below: Ager Ltd Statement of profit or loss for the year ended 31 December 2022 2022 2021 Sales Opening inventories Purchases Closing inventories Gross profit Administration & distribution expenses Operating profits interest Profit before tax Tax Profit after tax Dividend Retained profit Non-Current Assets Machinery Plant Total non-current assets Current Assets Inventories Trade receivables Cash Total current assets Total Assets Current Liabilities Corporation tax due Accruals Trade payables Total current liabilities Equity & Non-Current Liabilities 10% loan Ordinary shares 1 Retained profit Total equity & liabilities 1,200 5,800 1,400 2,700 1,300 Ager Ltd Statement of profit or loss for the year ended 31 December 2022 2022 2021 1,400 840 50 490 110 600 9.000 5,600 3,400 2,400 1,000 250 750 150 600 350 250 4,000 900 4,700 1,200 2,290 6,290 2,300 1,200 1,200 750 7,500 240 4,400 3,100 1,900 570 130 250 1,200 250 950 190 760 400 360 3,500 2,190 5,690 1.200 2,500 790 1,800 6,290 Question 2 continues on the next page 960 2,500 790 1,450 5.690 Question 2 The managing director of Ager Ltd has approached Gower Plc requesting a substantial increase in their credit facilities in order to fund an expansion programme. An Extract from the Statement of Financial Position, together with the Statement of ProfiLoss of Ager Lid for two years 2021 and 2022 Ltd is given below: Ager Ltd Statement of profit or loss for the year ended 31 December 2022 2022 2021 Sales Opening inventories Purchases Closing inventories Gross profit Administration & distribution expenses Operating profits interest Profit before tax Tax Profit after tax Dividend Retained profit Non-Current Assets Machinery Plant Total non-current assets Current Assets Inventories Trade receivables Cash Total current assets Total Assets Current Liabilities Corporation tax due Accruals Trade payables Total current liabilities Equity & Non-Current Liabilities 10% loan Ordinary shares 1 Retained profit Total equity & liabilities 1,200 5,800 1,400 2,700 1,300 Ager Ltd Statement of profit or loss for the year ended 31 December 2022 2022 2021 1,400 840 50 490 110 600 9.000 5,600 3,400 2,400 1,000 250 750 150 600 350 250 4,000 900 4,700 1,200 2,290 6,290 2,300 1,200 1,200 750 7,500 240 4,400 3,100 1,900 570 130 250 1,200 250 950 190 760 400 360 3,500 2,190 5,690 1.200 2,500 790 1,800 6,290 Question 2 continues on the next page 960 2,500 790 1,450 5.690 Question 3 The following trial balance has been extracted from the accounts of Andrew's supermarket, as at 31 March 2023. Capital Sales Purchases Inventaries (opening) Receivables Payables Wages & salaries Drawings Motor expenses & petrol Rent Rates Light & heat expenses Other expenses Motor vehicle Building Bank overdraft Total You have been given the following information: Dr 105.000 9,000 4,000 31,000 19,000 1,000 6,200 1,800 1,800 1,700 8.000 50,000 238,500 Dr 36,000 168,000 5,000 29,500 238,500 Inventory as at 31 March 2023 has been valued at 11,500. 4 months' rent has been paid in advance for the period ending 30 June 2023. The total amount of prepaid rent is 2,000. Motor expenses & petrol owing 100. An accrual of 150 is required in respect of light and heat expenses. Andrew's supermarket made credit sales of 2,000 on February 2023 and these sales have not been recorded in the supermarket accounts. Required: a) Create the Statement of Profit/Loss and Statement of Financial Position for Andrew's (19 marks) (2 marks) (4 marks) (Total Question 3: 25 marks) supermarket. b) Explain what the statement of financial position reveals about a company. c) List TWO differences between preference shares and debentures. Required: a) You need to assess the validity of this proposition by calculating the following financial ratios: i) Gross profit margin i) Operating profit margin ii) Return of capital employed iv) Current ratio v) Acid test ratio vi) Trade receivable days vi) Trade payable days vii) Inventory days (16 marks) b) Interpret the ratios computed for 2021 and 2022. Further, and using the above computed ratios, advise Gower Plc whether it could grant the request made by the managing director of Ager Ltd. (9 marks) (Total Question 2: 25 marks) Question 3 The following trial balance has been extracted from the accounts of Andrew's supermarket, as at 31 March 2023. Capital Sales Purchases Inventaries (opening) Receivables Payables Wages & salaries Drawings Motor expenses & petrol Rent Rates Light & heat expenses Other expenses Motor vehicle Building Bank overdraft Total You have been given the following information: Dr 105.000 9,000 4,000 31,000 19,000 1,000 6,200 1,800 1,800 1,700 8.000 50,000 238,500 Dr 36,000 168,000 5,000 29,500 238,500 Inventory as at 31 March 2023 has been valued at 11,500. 4 months' rent has been paid in advance for the period ending 30 June 2023. The total amount of prepaid rent is 2,000. Motor expenses & petrol owing 100. An accrual of 150 is required in respect of light and heat expenses. Andrew's supermarket made credit sales of 2,000 on February 2023 and these sales have not been recorded in the supermarket accounts. Required: a) Create the Statement of Profit/Loss and Statement of Financial Position for Andrew's (19 marks) (2 marks) (4 marks) (Total Question 3: 25 marks) supermarket. b) Explain what the statement of financial position reveals about a company. c) List TWO differences between preference shares and debentures.

Step by Step Solution

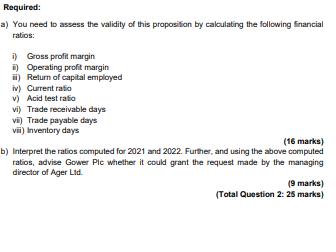

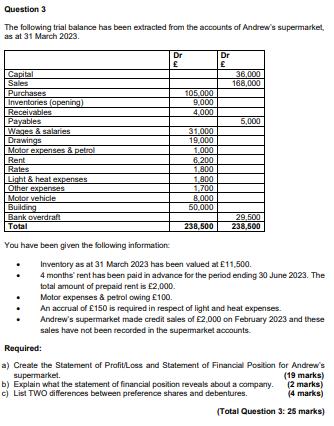

There are 3 Steps involved in it

Step: 1

1 C The main reasons why firms prepare cash budgets are to forecast 2 b Based on the ratios computed it appears that Ager Ltd has seen a slight improv...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started