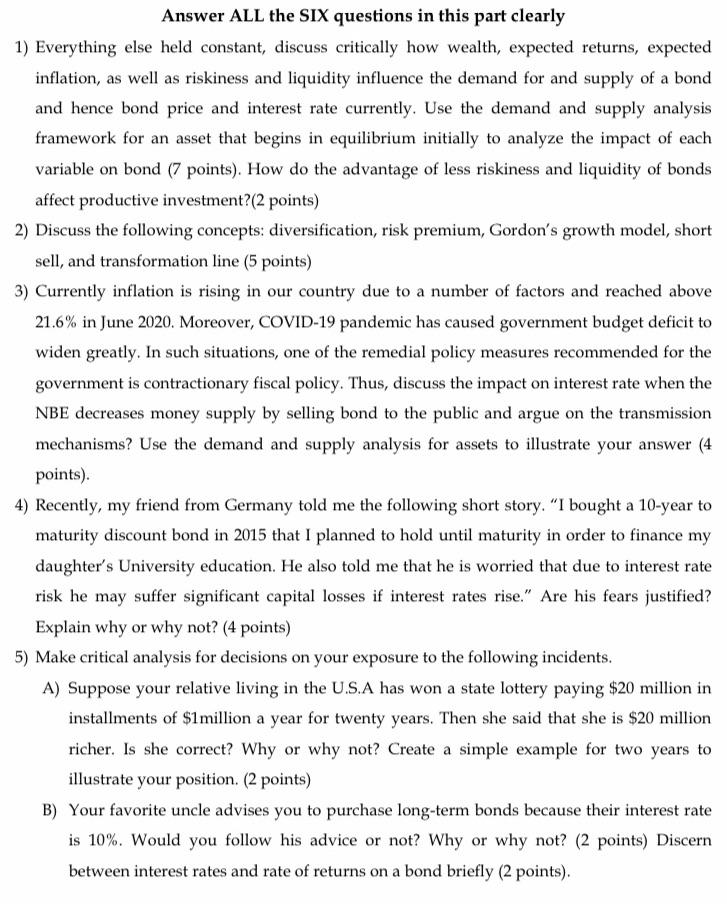

Answer ALL the SIX questions in this part clearly 1) Everything else held constant, discuss critically how wealth, expected returns, expected inflation, as well as riskiness and liquidity influence the demand for and supply of a bond and hence bond price and interest rate currently. Use the demand and supply analysis framework for an asset that begins in equilibrium initially to analyze the impact of each variable on bond {2 points]. How do the advantage of less riskiness and liquidity of bonds affect productive investment?[2 points} 2} Discuss the following concepts: diversification, risk premium, Gordon's growth model, short sell, and transformation line {5 points) 3) Currently ination is rising in our country due to a number of factors and reached above 21.6% in lune 220. Moreover, CDVID-'l? pandemic has caused government budget deficit to widen greatly. In such situations, one of the remedial policy measures recommended for the government is contractionary fiscal policy. Thus, discuss the impact on interest rate when the NEE decreases money supply by selling bond to the public and argue on the transmission mechanisms? Use the demand and supply analysis for assets to illustrate your answer {4 points). 4} Recently, my friend from Germany told me the following short story. "I bought a 10-year to maturity discount bond in 2015 that I planned to hold until maturity in order to finance my daughter' s University education. He also told me that he is worried that due to interest rate risk he may suffer significant capital losses if interest rates rise.\" Are his fears justified? Explain why or why not? {4 points] 5} Make critical analysis for decisions on your exposure to the following incidents. A) Suppose your relative living in the USA has won a state lottery paying $223 million in installments of $1million a year for twenty years. Then she said that she is $20 million richer. Is she correct? Why or why not? Create a simple example for two years to illustrate your position. (2 points] B] Your favorite uncle advises you to purchase long-term bonds because their interest rate is 10%. 1Would you follow his advice or not? Why or why not? (2 points) Discern between interest rates and rate of returns on a bond briey (2 points]