answer all three questions for a thumbs up please

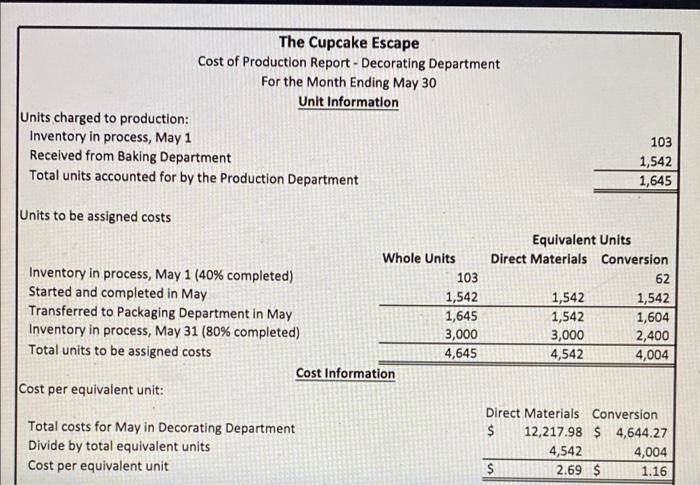

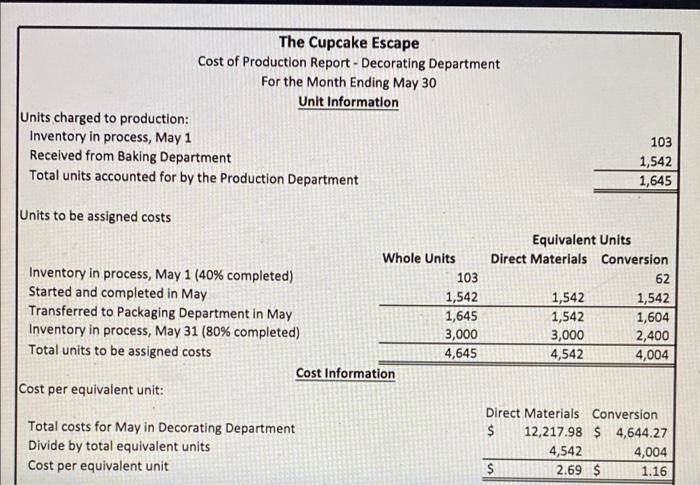

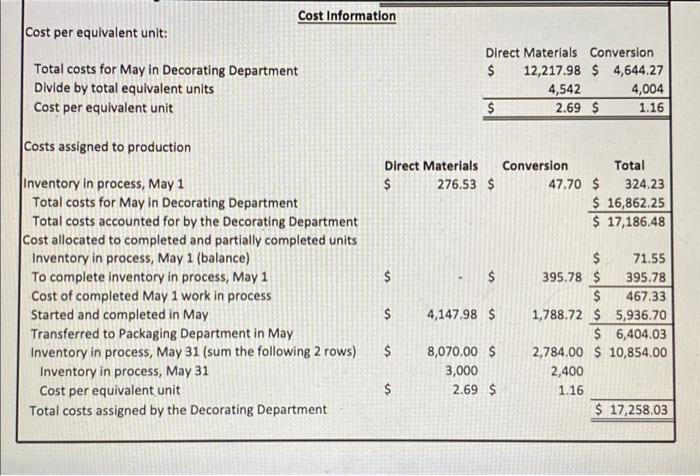

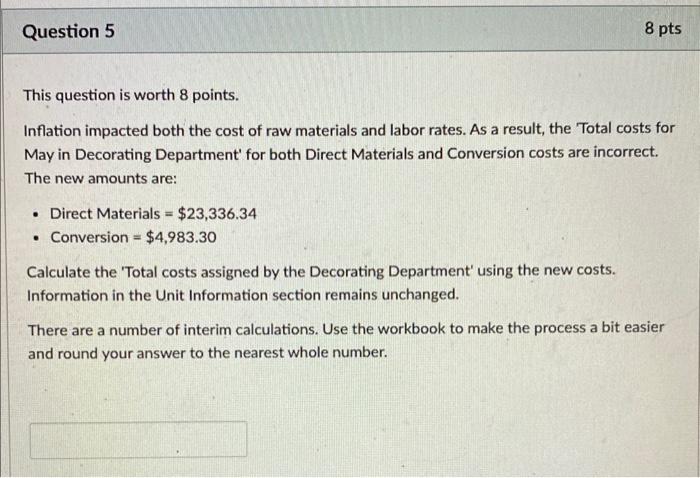

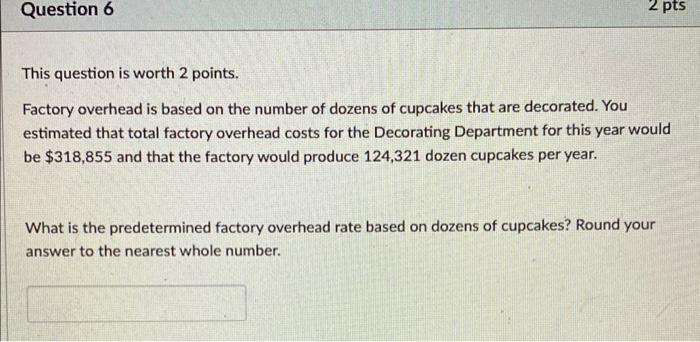

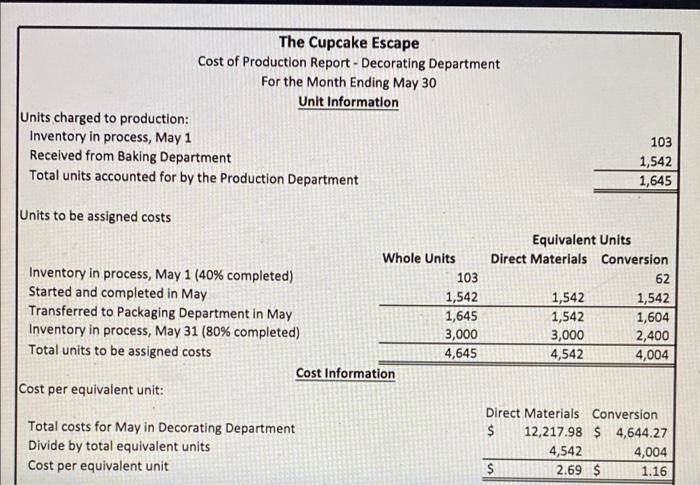

The Cupcake Escape Cost of Production Report - Decorating Department For the Month Ending May 30 Unit Information Units charged to production: Inventory in process, May 1 Recelved from Baking Department Total units accounted for by the Production Department Units to be assigned costs Inventory in process, May 1 ( 40% completed) Started and completed in May Transferred to Packaging Department in May Inventory in process, May 31 ( 80% completed) Total units to be assigned costs Cost per equivalent unit: Total costs for May in Decorating Department Divide by total equivalent units Cost per equivalent unit Cost Information Cost per equivalent unit: Total costs for May in Decorating Department Divide by total equivalent units Cost per equivalent unit Costs assigned to production Inventory in process, May 1 Total costs for May in Decorating Department Total costs accounted for by the Decorating Department Cost allocated to completed and partially completed units Inventory in process, May 1 (balance) To complete inventory in process, May 1 Cost of completed May 1 work in process Started and completed in May Transferred to Packaging Department in May Inventory in process, May 31 (sum the following 2 rows) $8,070.00$2,784.00$10,854.00 Inventory in process, May 31 Cost per equivalent unit Total costs assigned by the Decorating Department This question is worth 8 points. Inflation impacted both the cost of raw materials and labor rates. As a result, the Total costs for May in Decorating Department' for both Direct Materials and Conversion costs are incorrect. The new amounts are: - Direct Materials =$23,336.34 - Conversion =$4,983.30 Calculate the 'Total costs assigned by the Decorating Department' using the new costs. Information in the Unit Information section remains unchanged. There are a number of interim calculations. Use the workbook to make the process a bit easier and round your answer to the nearest whole number. This question is worth 2 points. Factory overhead is based on the number of dozens of cupcakes that are decorated. You estimated that total factory overhead costs for the Decorating Department for this year would be $318,855 and that the factory would produce 124,321 dozen cupcakes per year. What is the predetermined factory overhead rate based on dozens of cupcakes? Round your answer to the nearest whole number. This question is worth 2 points. It is time to update the accounting records with the information from the Cost of Production Report. Refer to the Cost of Production report for the amount to transfer to the Packaging Department. Debit Credit It is June 1, 2022 and the secret is out! Your catering is such a hit that you finally opened a small bakery just around the corner called The Cupcake Escape. You no longer track costs by job. You have switched to a process costing system and have three different major processes: baking, decorating, and packaging. Cupcakes are transferred to the decorating department immediately after they are 'turned out' from their baking pans. Cupcakes are cooled in the decorating department chiller for at least 2 hours to ensure optimal conditions before applying the frosting. This is why there is inventory in process at the end of a period. You reviewed the Cost of Production Report for the Decorating Department for the month of May. The report does not seem correct when it is compared to the reports submitted by the Baking Department and Packaging Department. See the Cost of Production Report - Decorating Department below. A spreadsheet is also attached to help answer the following questions. The Cupcake Escape Cost of Production Report - Decorating Department For the Month Ending May 30 Unit Information Units charged to production: Inventory in process, May 1 Recelved from Baking Department Total units accounted for by the Production Department Units to be assigned costs Inventory in process, May 1 ( 40% completed) Started and completed in May Transferred to Packaging Department in May Inventory in process, May 31 ( 80% completed) Total units to be assigned costs Cost per equivalent unit: Total costs for May in Decorating Department Divide by total equivalent units Cost per equivalent unit Cost Information Cost per equivalent unit: Total costs for May in Decorating Department Divide by total equivalent units Cost per equivalent unit Costs assigned to production Inventory in process, May 1 Total costs for May in Decorating Department Total costs accounted for by the Decorating Department Cost allocated to completed and partially completed units Inventory in process, May 1 (balance) To complete inventory in process, May 1 Cost of completed May 1 work in process Started and completed in May Transferred to Packaging Department in May Inventory in process, May 31 (sum the following 2 rows) $8,070.00$2,784.00$10,854.00 Inventory in process, May 31 Cost per equivalent unit Total costs assigned by the Decorating Department This question is worth 8 points. Inflation impacted both the cost of raw materials and labor rates. As a result, the Total costs for May in Decorating Department' for both Direct Materials and Conversion costs are incorrect. The new amounts are: - Direct Materials =$23,336.34 - Conversion =$4,983.30 Calculate the 'Total costs assigned by the Decorating Department' using the new costs. Information in the Unit Information section remains unchanged. There are a number of interim calculations. Use the workbook to make the process a bit easier and round your answer to the nearest whole number. This question is worth 2 points. Factory overhead is based on the number of dozens of cupcakes that are decorated. You estimated that total factory overhead costs for the Decorating Department for this year would be $318,855 and that the factory would produce 124,321 dozen cupcakes per year. What is the predetermined factory overhead rate based on dozens of cupcakes? Round your answer to the nearest whole number. This question is worth 2 points. It is time to update the accounting records with the information from the Cost of Production Report. Refer to the Cost of Production report for the amount to transfer to the Packaging Department. Debit Credit It is June 1, 2022 and the secret is out! Your catering is such a hit that you finally opened a small bakery just around the corner called The Cupcake Escape. You no longer track costs by job. You have switched to a process costing system and have three different major processes: baking, decorating, and packaging. Cupcakes are transferred to the decorating department immediately after they are 'turned out' from their baking pans. Cupcakes are cooled in the decorating department chiller for at least 2 hours to ensure optimal conditions before applying the frosting. This is why there is inventory in process at the end of a period. You reviewed the Cost of Production Report for the Decorating Department for the month of May. The report does not seem correct when it is compared to the reports submitted by the Baking Department and Packaging Department. See the Cost of Production Report - Decorating Department below. A spreadsheet is also attached to help answer the following questions