Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer asap no excel solution QUESTION 1 (a) What annual rate of interest compound monthly is equivalent to 12% per annum compounded quarterly? (3 marks)

answer asap no excel solution

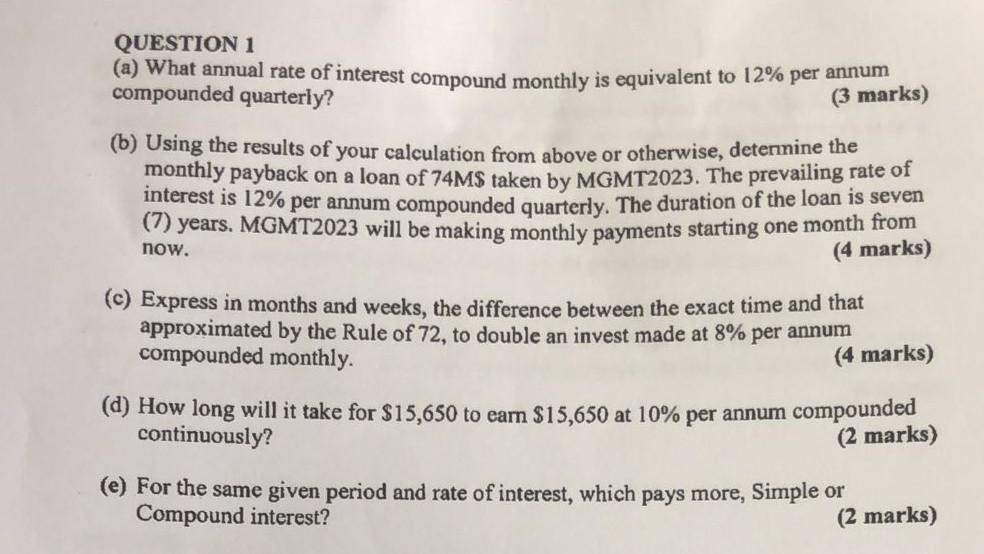

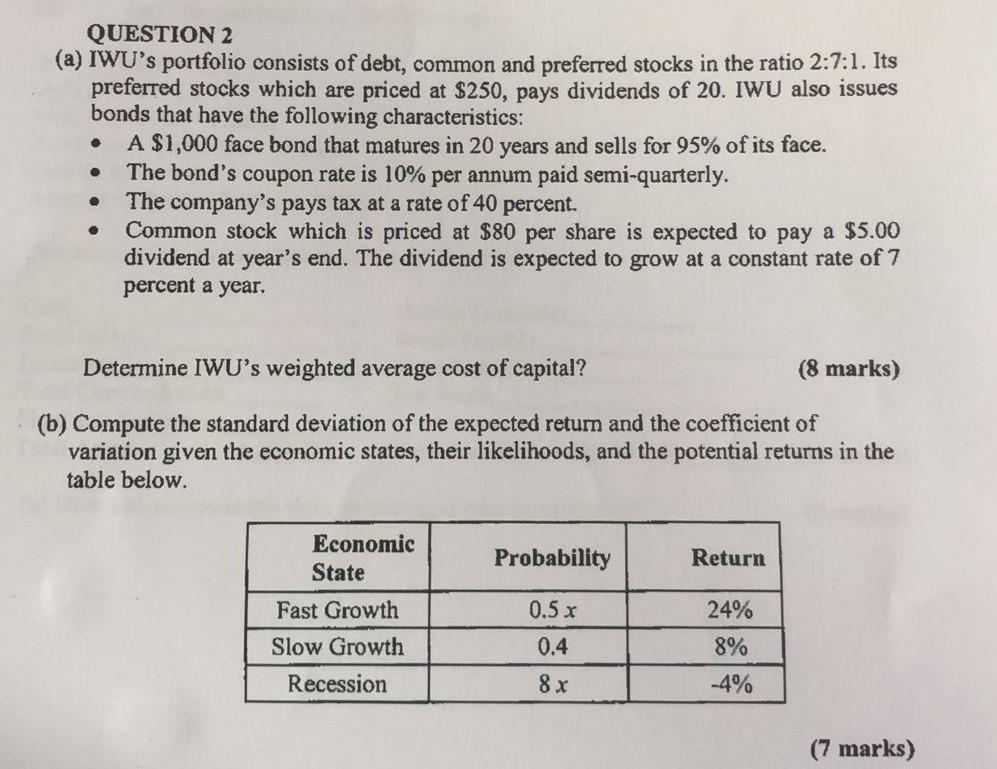

QUESTION 1 (a) What annual rate of interest compound monthly is equivalent to 12% per annum compounded quarterly? (3 marks) (b) Using the results of your calculation from above or otherwise, deternine the monthly payback on a loan of 74MS taken by MGMT2023. The prevailing rate of interest is 12% per annum compounded quarterly. The duration of the loan is seven (7) years. MGMT2023 will be making monthly payments starting one month from (4 marks) now. (c) Express in months and weeks, the difference between the exact time and that approximated by the Rule of 72, to double an invest made at 8% per annum compounded monthly. (4 marks) (d) How long will it take for $15,650 to earn $15,650 at 10% per annum compounded continuously? (2 marks) (e) For the same given period and rate of interest, which pays more, Simple or Compound interest? (2 marks) . QUESTION 2 (a) IWU's portfolio consists of debt, common and preferred stocks in the ratio 2:1:1. Its preferred stocks which are priced at $250, pays dividends of 20. IWU also issues bonds that have the following characteristics: A $1,000 face bond that matures in 20 years and sells for 95% of its face. The bond's coupon rate is 10% per annum paid semi-quarterly. The company's pays tax at a rate of 40 percent. Common stock which is priced at $80 per share is expected to pay a $5.00 dividend at year's end. The dividend is expected to grow at a constant rate of 7 percent a year. Determine IWU's weighted average cost of capital? (8 marks) (b) Compute the standard deviation of the expected return and the coefficient of variation given the economic states, their likelihoods, and the potential returns in the table below. Economic State Probability Return Fast Growth 0.52 24% 0.4 8% Slow Growth Recession 8x -4% (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started