Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer asap Question 9 A. Vesbra Inc has been asked to submit a bid on two prospective jobs, one for Wynton Inc and the other

answer asap

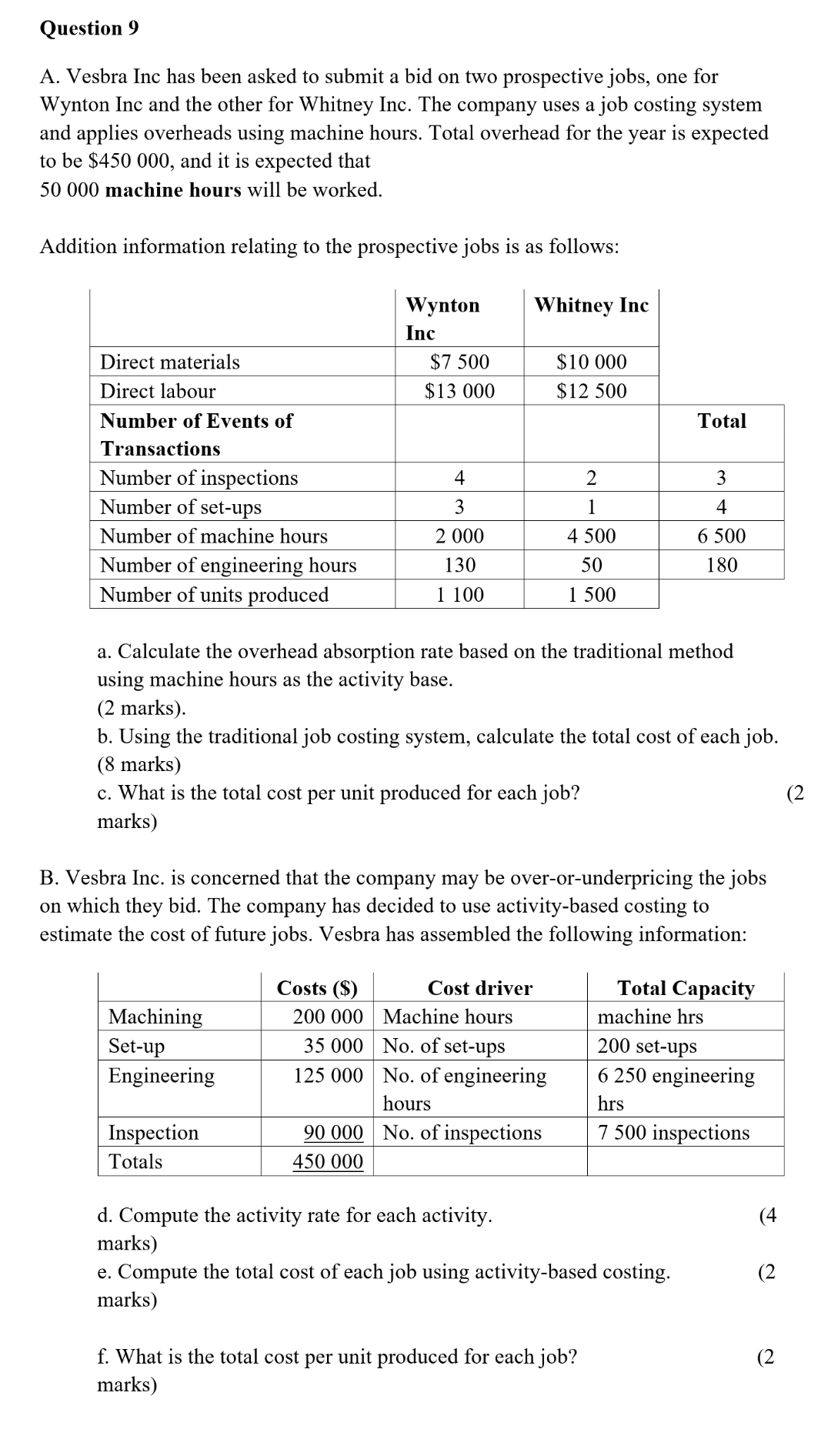

Question 9 A. Vesbra Inc has been asked to submit a bid on two prospective jobs, one for Wynton Inc and the other for Whitney Inc. The company uses a job costing system and applies overheads using machine hours. Total overhead for the year is expected to be $450 000, and it is expected that 50 000 machine hours will be worked. Addition information relating to the prospective jobs is as follows: Whitney Inc Wynton Inc $7 500 $13 000 $10 000 $12 500 Total Direct materials Direct labour Number of Events of Transactions Number of inspections Number of set-ups Number of machine hours Number of engineering hours Number of units produced 4 2 3 1 4 3 2 000 4 500 50 6 500 180 130 1 100 1 500 a. Calculate the overhead absorption rate based on the traditional method using machine hours as the activity base. (2 marks). b. Using the traditional job costing system, calculate the total cost of each job. (8 marks) c. What is the total cost per unit produced for each job? (2 marks) B. Vesbra Inc. is concerned that the company may be over-or-underpricing the jobs on which they bid. The company has decided to use activity-based costing to estimate the cost of future jobs. Vesbra has assembled the following information: Machining Set-up Engineering Costs ($) Cost driver 200 000 Machine hours 35 000 No. of set-ups 125 000 No. of engineering hours 90 000 No. of inspections 450 000 Total Capacity machine hrs 200 set-ups 6 250 engineering hrs 7 500 inspections Inspection Totals (4 d. Compute the activity rate for each activity. marks) e. Compute the total cost of each job using activity-based costing. marks) (2 (2 f. What is the total cost per unit produced for each job? marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started