Answered step by step

Verified Expert Solution

Question

1 Approved Answer

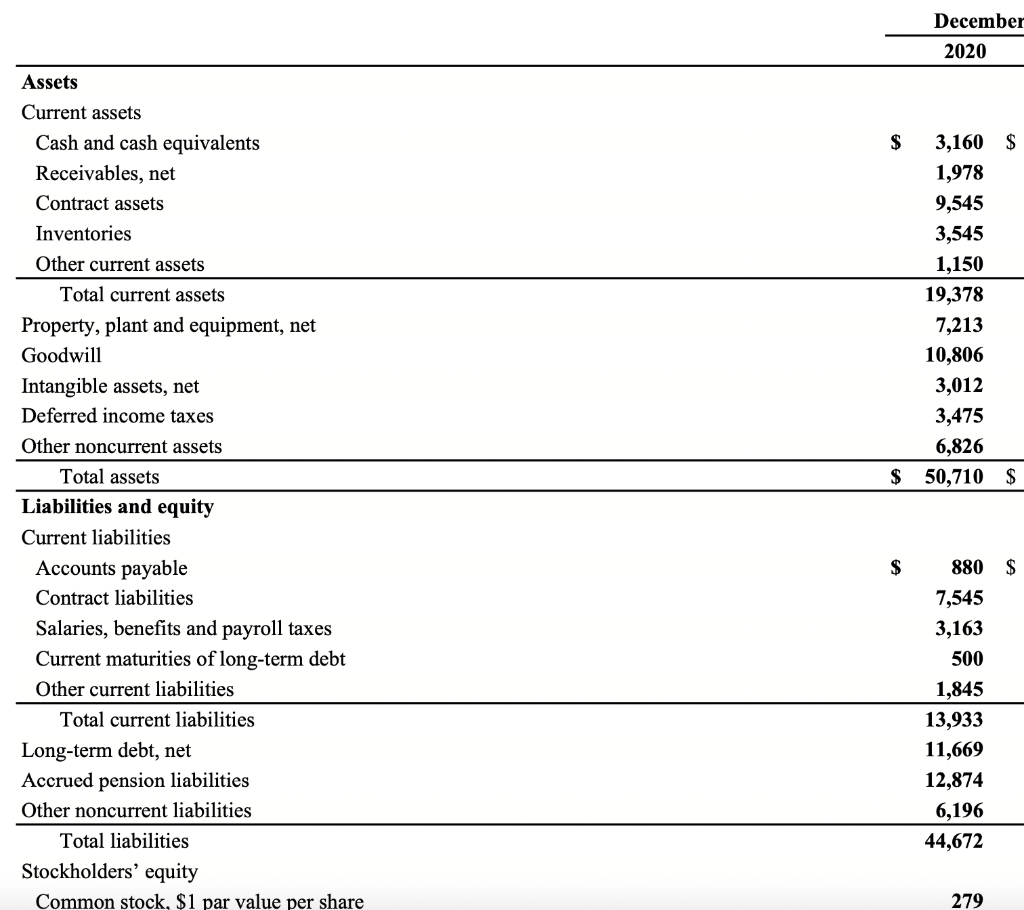

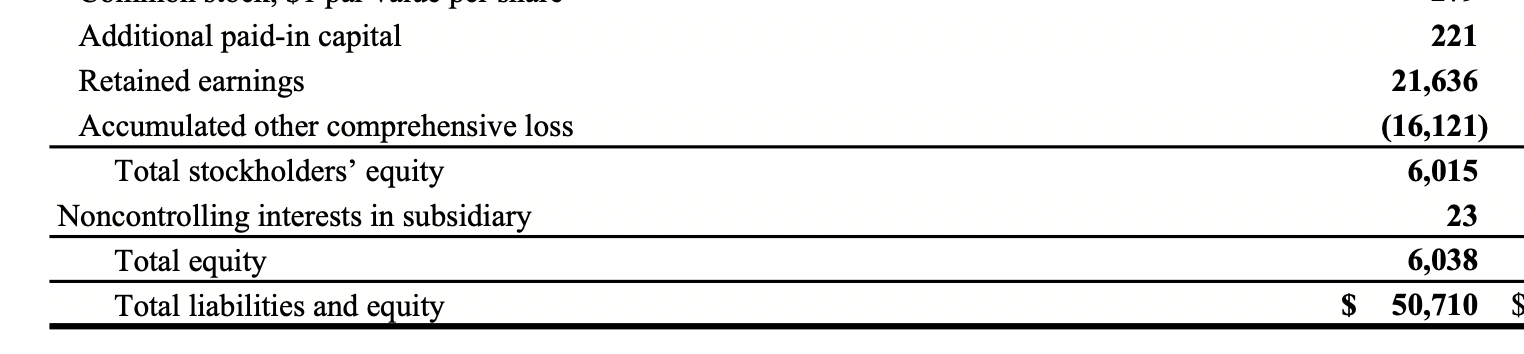

In excel, perform horizontal analysis of the balance sheet. Summarize the balance sheet results of the horizontal analysis. Simply select some of the higher or

In excel, perform horizontal analysis of the balance sheet.

Summarize the balance sheet results of the horizontal analysis. Simply select some of the higher or lower %s to discuss. Focus on items you feel are more relevant and telling of the company operations. For example, you could write one paragraph on each section of the balance sheet i.e. assets, liabilities, equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started