Answer below questions based on case study.

.

Question : Should Relax discontinue its sales to marginal accounts? Why or why not? Show calculations.

.

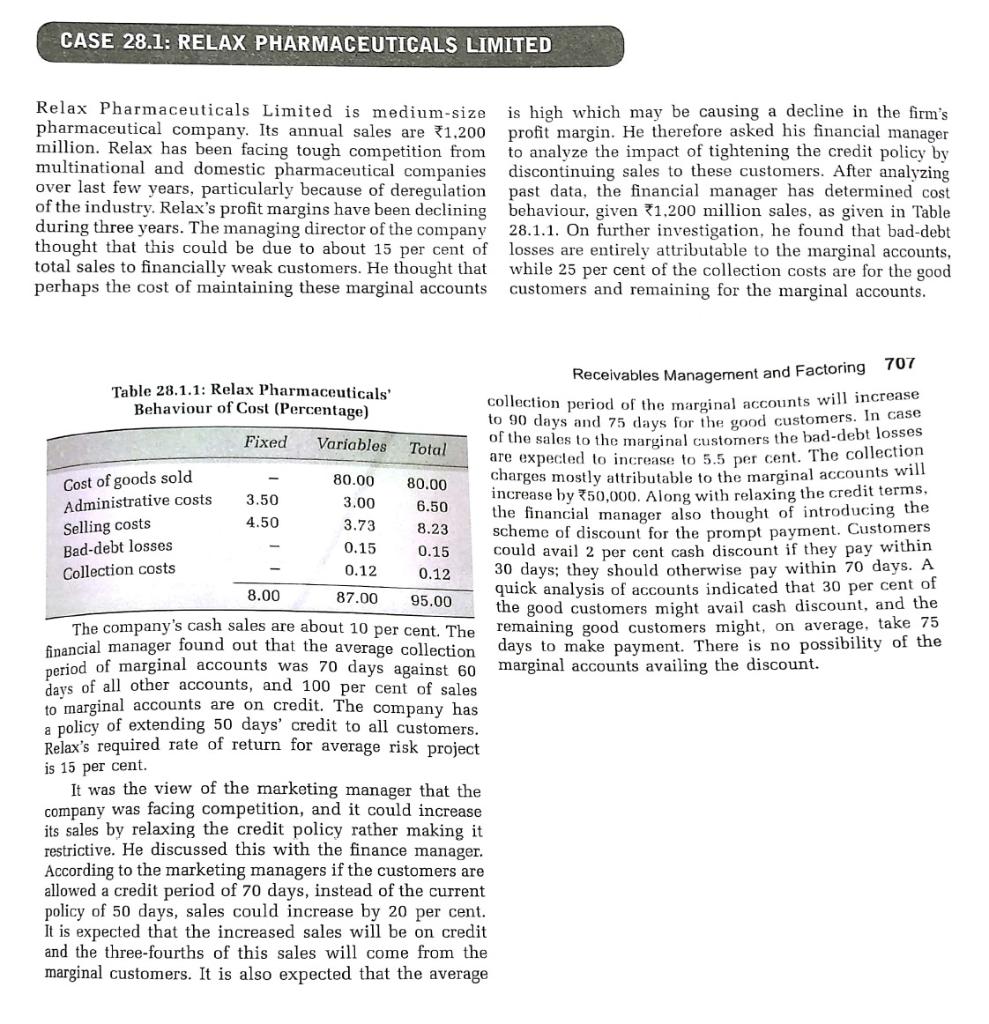

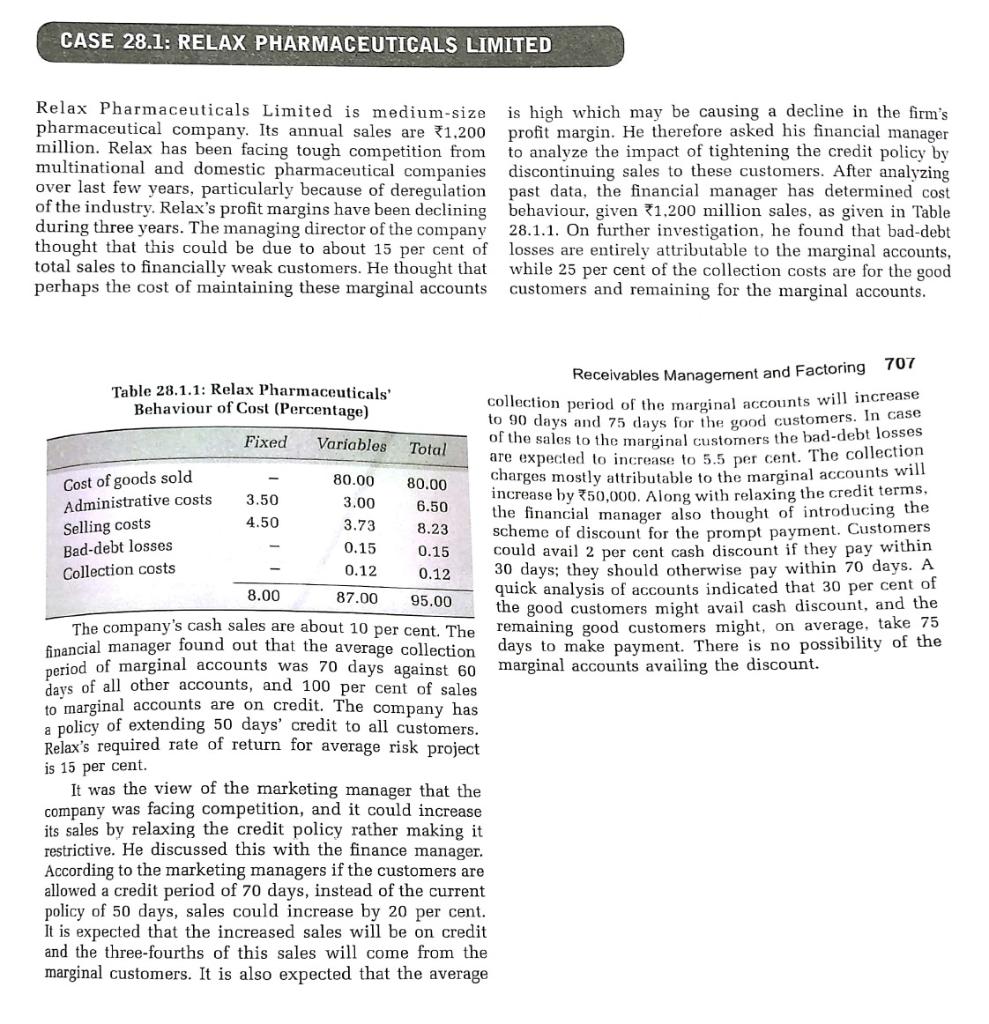

CASE 28.1: RELAX PHARMACEUTICALS LIMITED Relax Pharmaceuticals Limited is medium-size is high which may be causing a decline in the firm's pharmaceutical company. Its annual sales are 1.200 profit margin. He therefore asked his financial manager million. Relax has been facing tough competition from to analyze the impact of tightening the credit policy by multinational and domestic pharmaceutical companies discontinuing sales to these customers. After analyzing over last few years, particularly because of deregulation past data, the financial manager has determined cost of the industry. Relax's profit margins have been declining behaviour, given 1.200 million sales, as given in Table during three years. The managing director of the company 28.1.1. On further investigation, he found that bad-debt thought that this could be due to about 15 per cent of losses are entirely attributable to the marginal accounts, total sales to financially weak customers. He thought that while 25 per cent of the collection costs are for the good perhaps the cost of maintaining these marginal accounts customers and remaining for the marginal accounts. Cost of goods sold 80.00 Selling costs Bad-debt losses Collection costs 0.15 0.12 Receivables Management and Factoring 707 Table 28.1.1: Relax Pharmaceuticals Behaviour of Cost (Percentage) collection period of the marginal accounts will increase to 90 days and 75 days for the good customers. In case Fixed Variables Total of the sales to the marginal customers the bad-debt losses are expected to increase to 5.5 per cent. The collection 80.00 charges mostly attributable to the marginal accounts will Administrative costs 3.50 3.00 increase by 750,000. Along with relaxing the credit terms, 6.50 4.50 the financial manager also thought of introducing the 3.73 8.23 scheme of discount for the prompt payment. Customers 0.15 could avail 2 per cent cash discount if they pay within 0.12 30 days; they should otherwise pay within 70 days. A 8.00 87.00 quick analysis of accounts indicated that 30 per cent of 95.00 the good customers might avail cash discount, and the The company's cash sales are about 10 per cent. The remaining good customers might, on average, take 75 financial manager found out that the average collection days to make payment. There is no possibility of the period of marginal accounts was 70 days against 60 marginal accounts availing the discount. days of all other accounts, and 100 per cent of sales to marginal accounts are on credit. The company has a policy of extending 50 days' credit to all customers. Relax's required rate of return for average risk project is 15 per cent. It was the view of the marketing manager that the company was facing competition, and it could increase its sales by relaxing the credit policy rather making it restrictive. He discussed this with the finance manager. According to the marketing managers if the customers are allowed a credit period of 70 days, instead of the current policy of 50 days, sales could increase by 20 per cent. It is expected that the increased sales will be on credit and the three-fourths of this sales will come from the marginal customers. It is also expected that the average CASE 28.1: RELAX PHARMACEUTICALS LIMITED Relax Pharmaceuticals Limited is medium-size is high which may be causing a decline in the firm's pharmaceutical company. Its annual sales are 1.200 profit margin. He therefore asked his financial manager million. Relax has been facing tough competition from to analyze the impact of tightening the credit policy by multinational and domestic pharmaceutical companies discontinuing sales to these customers. After analyzing over last few years, particularly because of deregulation past data, the financial manager has determined cost of the industry. Relax's profit margins have been declining behaviour, given 1.200 million sales, as given in Table during three years. The managing director of the company 28.1.1. On further investigation, he found that bad-debt thought that this could be due to about 15 per cent of losses are entirely attributable to the marginal accounts, total sales to financially weak customers. He thought that while 25 per cent of the collection costs are for the good perhaps the cost of maintaining these marginal accounts customers and remaining for the marginal accounts. Cost of goods sold 80.00 Selling costs Bad-debt losses Collection costs 0.15 0.12 Receivables Management and Factoring 707 Table 28.1.1: Relax Pharmaceuticals Behaviour of Cost (Percentage) collection period of the marginal accounts will increase to 90 days and 75 days for the good customers. In case Fixed Variables Total of the sales to the marginal customers the bad-debt losses are expected to increase to 5.5 per cent. The collection 80.00 charges mostly attributable to the marginal accounts will Administrative costs 3.50 3.00 increase by 750,000. Along with relaxing the credit terms, 6.50 4.50 the financial manager also thought of introducing the 3.73 8.23 scheme of discount for the prompt payment. Customers 0.15 could avail 2 per cent cash discount if they pay within 0.12 30 days; they should otherwise pay within 70 days. A 8.00 87.00 quick analysis of accounts indicated that 30 per cent of 95.00 the good customers might avail cash discount, and the The company's cash sales are about 10 per cent. The remaining good customers might, on average, take 75 financial manager found out that the average collection days to make payment. There is no possibility of the period of marginal accounts was 70 days against 60 marginal accounts availing the discount. days of all other accounts, and 100 per cent of sales to marginal accounts are on credit. The company has a policy of extending 50 days' credit to all customers. Relax's required rate of return for average risk project is 15 per cent. It was the view of the marketing manager that the company was facing competition, and it could increase its sales by relaxing the credit policy rather making it restrictive. He discussed this with the finance manager. According to the marketing managers if the customers are allowed a credit period of 70 days, instead of the current policy of 50 days, sales could increase by 20 per cent. It is expected that the increased sales will be on credit and the three-fourths of this sales will come from the marginal customers. It is also expected that the average