Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer both parts a and b. You are trying to estimate the levered beta for Chesterton Enterprises, a company that operates in the retail and

Answer both parts a and b.

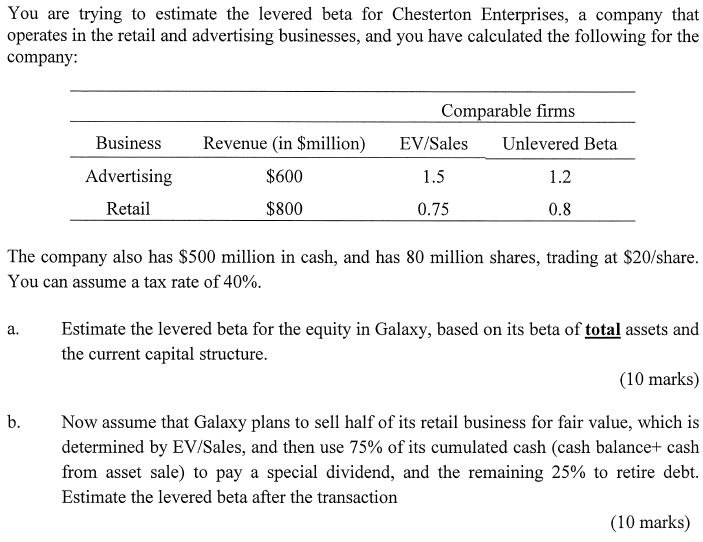

You are trying to estimate the levered beta for Chesterton Enterprises, a company that operates in the retail and advertising businesses, and you have calculated the following for the company: The company also has $500 million in cash, and has 80 million shares, trading at $20/ share. You can assume a tax rate of 40%. a. Estimate the levered beta for the equity in Galaxy, based on its beta of total assets and the current capital structure. (10 marks) b. Now assume that Galaxy plans to sell half of its retail business for fair value, which is determined by EV/Sales, and then use 75% of its cumulated cash (cash balance+ cash from asset sale) to pay a special dividend, and the remaining 25% to retire debt. Estimate the levered beta after the transaction (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started