Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer by true or false 13. A taxpayer is allowed the dependency benefits for a brother for whom over half the support was paid even

answer by true or false

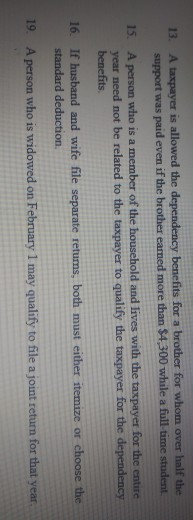

13. A taxpayer is allowed the dependency benefits for a brother for whom over half the support was paid even if the brother earned more than $4,300 while a full-time student 15. A person who is a member of the household and lives with the taxpayer for the entire year need not be related to the taxpayer to qualify the taxpayer for the dependency benefits. 16. If husband and wife file separate returns, both must either itemize or choose the standard deduction 19. A person who is widowed on February 1 may qualify to file a joint return for that yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started