Answered step by step

Verified Expert Solution

Question

1 Approved Answer

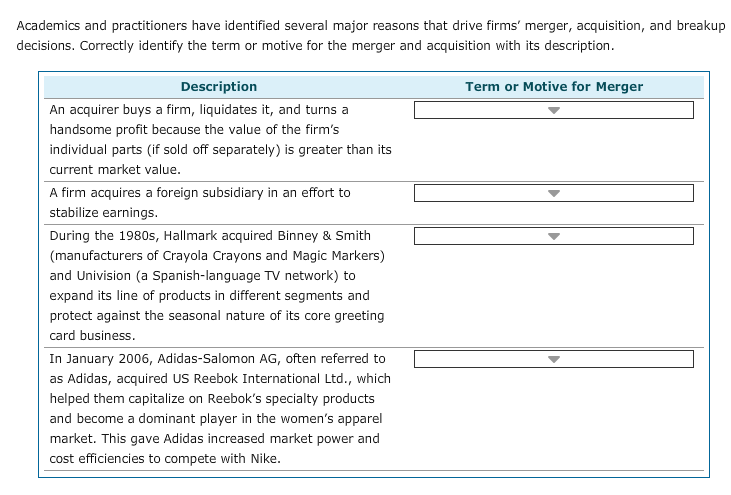

Answer choices for 1st part: diversification, managers' personal incentives, breakup value, or tax considerations Answer choices for 2nd part: diversification, synergy, breakup value, or managers'

Answer choices for 1st part: diversification, managers' personal incentives, breakup value, or tax considerations

Answer choices for 2nd part: diversification, synergy, breakup value, or managers' personal incentives

Answer choices for 3rd part: diversification, managers' personal incentives, breakup value, or tax considerations

Answer choices for 4th part: managers' personal incentives, breakup value, synergy, or tax considerations

Academics and practitioners have identified several major reasons that drive firms' merger, acquisition, and breakup decisions. Correctly identify the term or motive for the merger and acquisition with its descriptionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started