Answer correctly for thumbs up. please don't skip questions because this is my second post for this question.

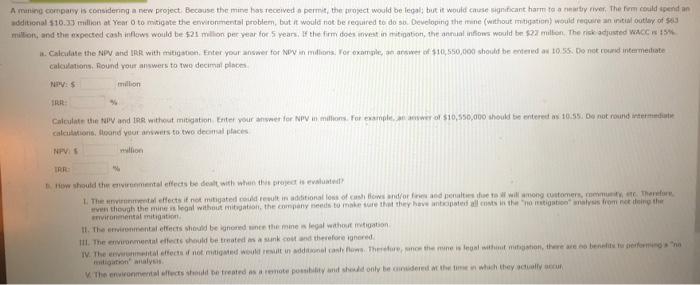

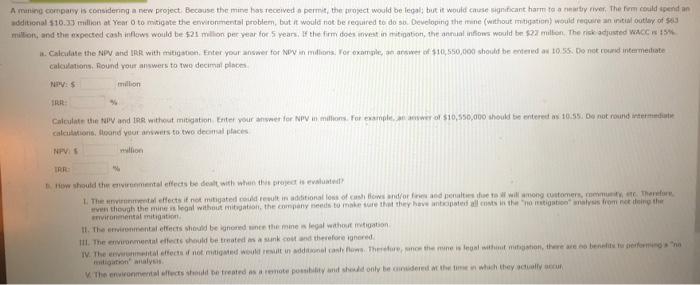

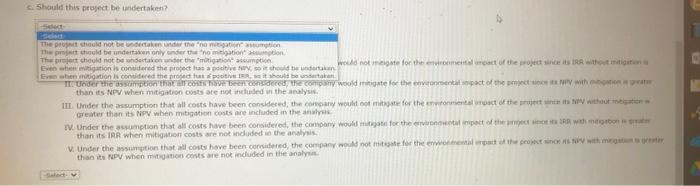

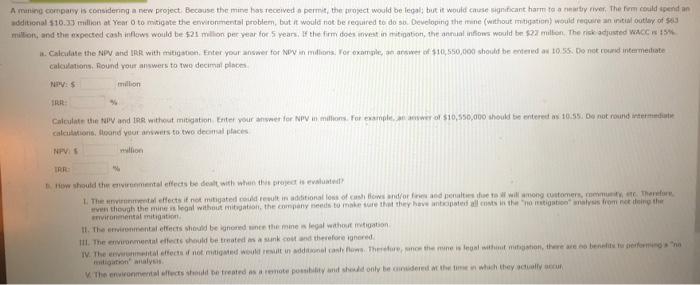

A mining company is considering a new project Because the mine has received a permit the project would be legal; but it would cause inticant harmony river The fim could spend an additional $10.3.3 million at Year o to mitigate the environmental problem, but it would not be required to do so. Developing the mine (without mitigation) would require an initial outlery of su million, and the expected cash flows would be $21 million per year for 5 years, the firm des invest in motion, the ones would be $2 million. The risk adjusted ACC 1. Calculate the NPV and IRR with minion Enter your answer for Noy in die vor exemple, one of $30,550,000 should be entered at 10.55. Do not own intermediate calculations, Round your answers to Two decimal place NPV: million IRR Calculate the NPV and IRR without mitigation Enter your answer for NPV in milions. For examples of $10,550,000 should be entered as 10:55. Do not round intermediate calculations, Ioand your answers to two decimal places NPV S wo IRRE How should the environmental fleds be dealt with when the project is evaluated 1. The vetfects it not mitigated court in additional loss of shows and/or free and at the tow will mong customers, The en though the minion without mitigation, the company need to make sure that they have not allots in the originals from not doing the environmental mitin II. The environmental effects should be gonder the mines legal without tation III. The environmental efects should be treated as a su cand therefore ignored IV. The fectif not me would result in additional Ther, theme is tool within on, there are benefits sition analys The environment affects shed to treated as a remote possibility and should only bendered the time in which they actually Should this project be undertaken? Sect The prophet not be taken under the home The hould be undertaken only under the notion The present theold not be taken under their cumption when itigation considered the protect has been the industand not for the entire act of the projects in their Er when ition is considered the produit should be take T. Under the motion that cove been considered, the company wooldriate for the environmentpact of the pict with than its NPV when mitigation costs are not included in the analysis II. Under the assumption that all costs have been considered the company would come for the most act of the prints without me greater than its NPV when mitigation costs are included in the IV. Under the assumption that all costs have been considered, the company would mate for the tapect of the combo than its IRR when mitigation costs are not included in the analysis V. Under the assumption that all costs have been considered the company not for the event at the project with me than its NPV when mation costs are not included in the analy