Answered step by step

Verified Expert Solution

Question

1 Approved Answer

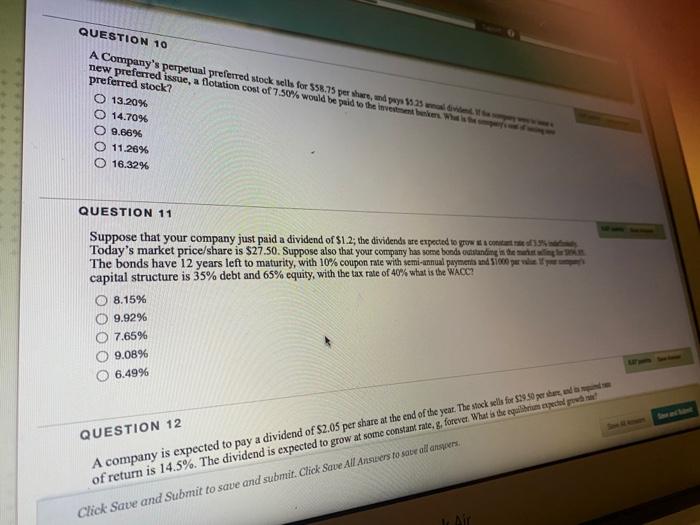

answer fast please QUESTION 10 A Company's perpetual preferred stock sells for $58.75 pet short, und 1523 watt new preferred issue, a flotation cost of

answer fast please

QUESTION 10 A Company's perpetual preferred stock sells for $58.75 pet short, und 1523 watt new preferred issue, a flotation cost of 7.50% would be paid to the verbeke Wa preferred stock? 0 13.20% 0 14.70% 9.66% 11.26% 16.32% QUESTION 11 Suppose that your company just paid a dividend of $1.2; the dividends are expected to grow contattate of Today's market price/share is $27.50. Suppose also that your company has some bonds outstanding in the stage The bonds have 12 years left to maturity, with 10% coupon rate with semi-annual payments and 51000 per la capital structure is 35% debt and 65% equity, with the tax rate of 40% what is the WACC? 8.15% 9.92% 7.6596 9.08% 6.49% QUESTION 12 A company is expected to pay a dividend of $2.05 per share at the end of the year. The stock sells for $19.50 per dared of return is 14.5%. The dividend is expected to grow at some constant rate, 8, forever. What is the equilibrium aspected Click Save and Submit to save and submit. Click Save All Answers to save all ages QUESTION 10 A Company's perpetual preferred stock sells for $58.75 pet short, und 1523 watt new preferred issue, a flotation cost of 7.50% would be paid to the verbeke Wa preferred stock? 0 13.20% 0 14.70% 9.66% 11.26% 16.32% QUESTION 11 Suppose that your company just paid a dividend of $1.2; the dividends are expected to grow contattate of Today's market price/share is $27.50. Suppose also that your company has some bonds outstanding in the stage The bonds have 12 years left to maturity, with 10% coupon rate with semi-annual payments and 51000 per la capital structure is 35% debt and 65% equity, with the tax rate of 40% what is the WACC? 8.15% 9.92% 7.6596 9.08% 6.49% QUESTION 12 A company is expected to pay a dividend of $2.05 per share at the end of the year. The stock sells for $19.50 per dared of return is 14.5%. The dividend is expected to grow at some constant rate, 8, forever. What is the equilibrium aspected Click Save and Submit to save and submit. Click Save All Answers to save all ages Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started