Answered step by step

Verified Expert Solution

Question

1 Approved Answer

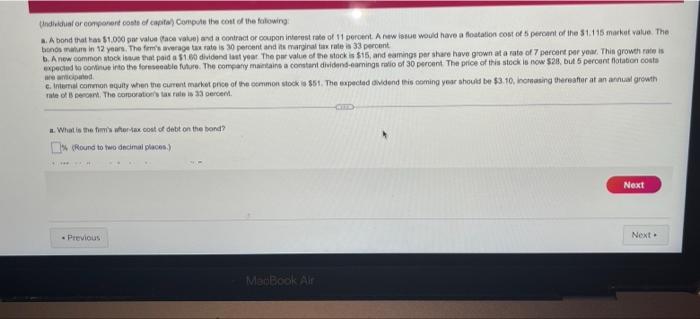

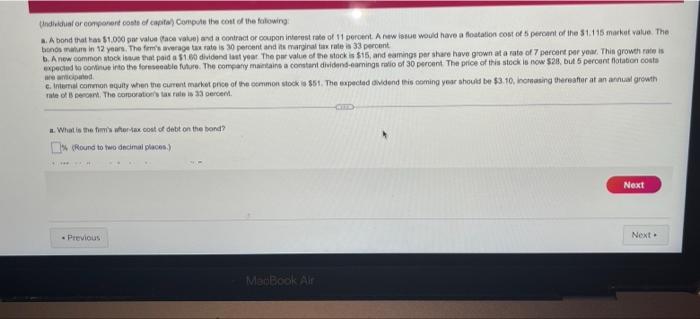

ANSWER indichifor component cost of capita) Compute the cost of the following A bond that has 51.000 par value acea) and a contract or coupon

ANSWER

indichifor component cost of capita) Compute the cost of the following A bond that has 51.000 par value acea) and a contract or coupon Interest rate of 11 percent. A new se would have a frontation cost of percent of the 51.115 market value The bons mature in 12 years. The firm's wverage tax rate is 30 percent and its marginal tax rate is 33 percent b. A new common stock see that paid a $1.60 dividend last year The per value of the stock is $15, and carings par sare have grown at a rate of 7 percent per year. This growth rate is expected to come into the foreseeable future. The company maintains a constant dividend carings ratio of 30 percent. The price of this stock is now $28, but 6 percent flotation costa wered 6. Internal common equity when the current market price of the common stock $51. The expected didend this coming your should be $3.10, nomasing thereafter at an annual growth rate of the corporations tax rate is 33 percent a. What is the wher-tax cost of debt on the bond? Is Round to wo decimal places) Next . Previous Next MacBook Air (Individual or component costs of capital) Compute the cost of the following: a. What is the firm's after-tax cost of debt on the bond? 1% (Round to two decimal places.) b. What is the cost of external common equity? % (Round to two decimal places.) c. What is the cost of internal common equity? % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started