answer me please i am stuck in this thank you.thumb will be up

answer me please i am stuck in this thank you.thumb will be up

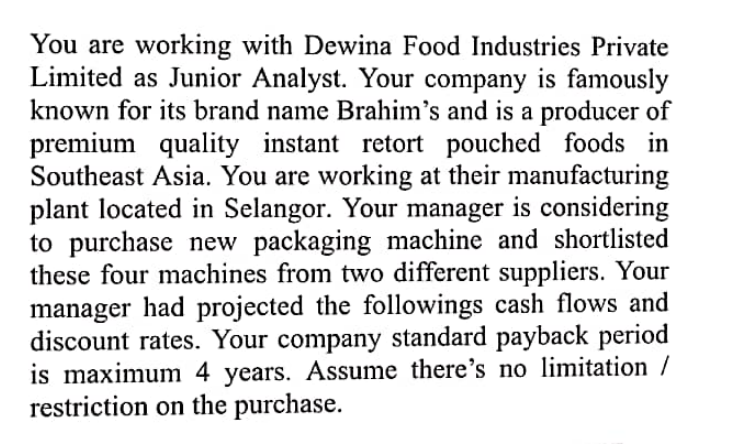

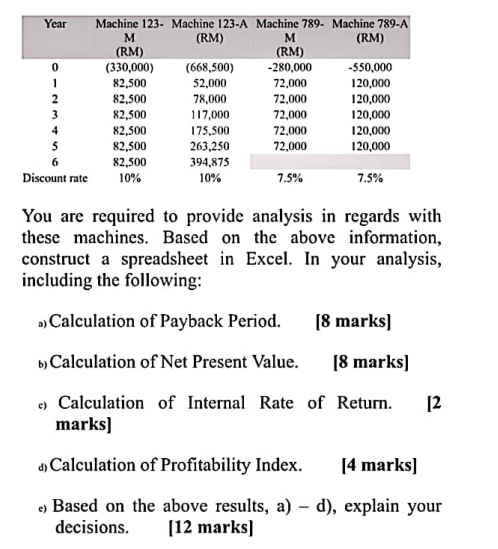

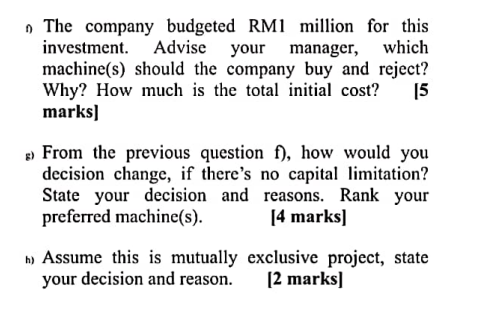

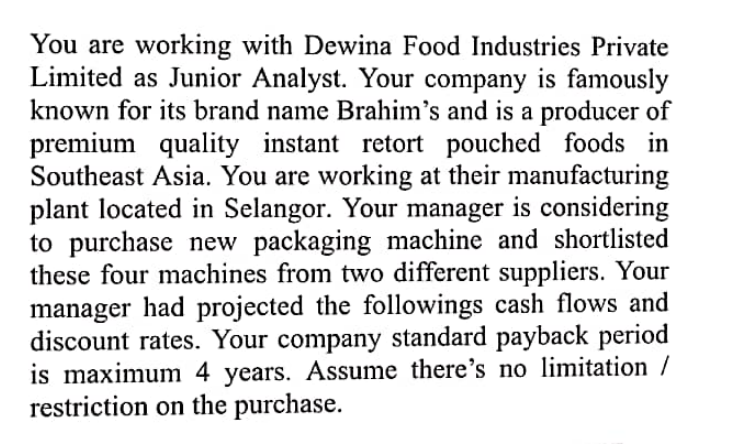

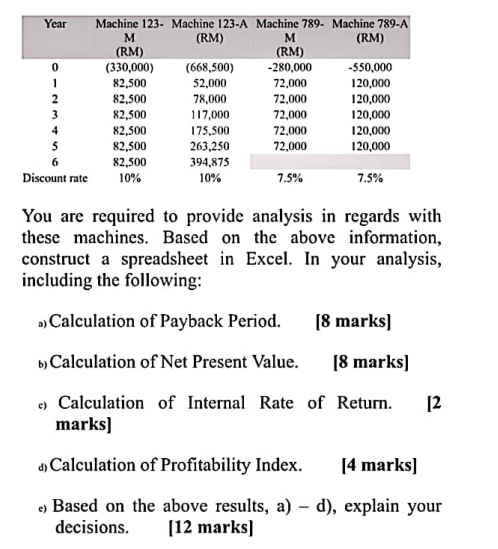

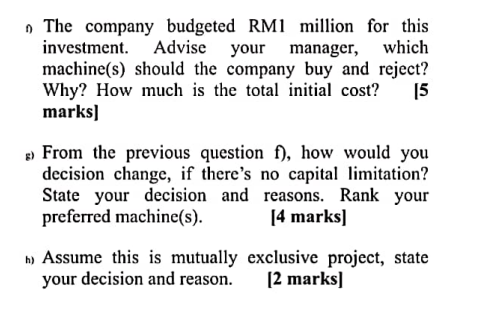

You are working with Dewina Food Industries Private Limited as Junior Analyst. Your company is famously known for its brand name Brahim's and is a producer of premium quality instant retort pouched foods in Southeast Asia. You are working at their manufacturing plant located in Selangor. Your manager is considering to purchase new packaging machine and shortlisted these four machines from two different suppliers. Your manager had projected the followings cash flows and discount rates. Your company standard payback period is maximum 4 years. Assume there's no limitation / restriction on the purchase. Year Machine 123- Machine 123-A Machine 789- Machine 789-A M (RM) M (RM) (RM) (RM) (330,000) (668,500) -280,000 -550,000 82,500 52,000 72,000 120,000 82.500 78,000 72.000 120,000 82,500 117,000 72,000 120,000 82.500 175.500 72.000 120,000 82.500 263,250 72,000 120,000 82,500 394,875 10% 10% 7.5% 7.5% 3 4 5 Discount rate You are required to provide analysis in regards with these machines. Based on the above information, construct a spreadsheet in Excel. In your analysis, including the following: .) Calculation of Payback Period. [8 marks) b) Calculation of Net Present Value. [8 marks] [2 e) Calculation of Internal Rate of Return. marks) d) Calculation of Profitability Index. [4 marks) c) Based on the above results, a) - d), explain your decisions. [12 marks] The company budgeted RM1 million for this investment. Advise your manager, which machine(s) should the company buy and reject? Why? How much is the total initial cost? marks) 15 3) From the previous question f), how would you decision change, if there's no capital limitation? State your decision and reasons. Rank your preferred machine(s). [4 marks) h) Assume this is mutually exclusive project, state your decision and reason. [2 marks] You are working with Dewina Food Industries Private Limited as Junior Analyst. Your company is famously known for its brand name Brahim's and is a producer of premium quality instant retort pouched foods in Southeast Asia. You are working at their manufacturing plant located in Selangor. Your manager is considering to purchase new packaging machine and shortlisted these four machines from two different suppliers. Your manager had projected the followings cash flows and discount rates. Your company standard payback period is maximum 4 years. Assume there's no limitation / restriction on the purchase. Year Machine 123- Machine 123-A Machine 789- Machine 789-A M (RM) M (RM) (RM) (RM) (330,000) (668,500) -280,000 -550,000 82,500 52,000 72,000 120,000 82.500 78,000 72.000 120,000 82,500 117,000 72,000 120,000 82.500 175.500 72.000 120,000 82.500 263,250 72,000 120,000 82,500 394,875 10% 10% 7.5% 7.5% 3 4 5 Discount rate You are required to provide analysis in regards with these machines. Based on the above information, construct a spreadsheet in Excel. In your analysis, including the following: .) Calculation of Payback Period. [8 marks) b) Calculation of Net Present Value. [8 marks] [2 e) Calculation of Internal Rate of Return. marks) d) Calculation of Profitability Index. [4 marks) c) Based on the above results, a) - d), explain your decisions. [12 marks] The company budgeted RM1 million for this investment. Advise your manager, which machine(s) should the company buy and reject? Why? How much is the total initial cost? marks) 15 3) From the previous question f), how would you decision change, if there's no capital limitation? State your decision and reasons. Rank your preferred machine(s). [4 marks) h) Assume this is mutually exclusive project, state your decision and reason. [2 marks]

answer me please i am stuck in this thank you.thumb will be up

answer me please i am stuck in this thank you.thumb will be up