Answered step by step

Verified Expert Solution

Question

1 Approved Answer

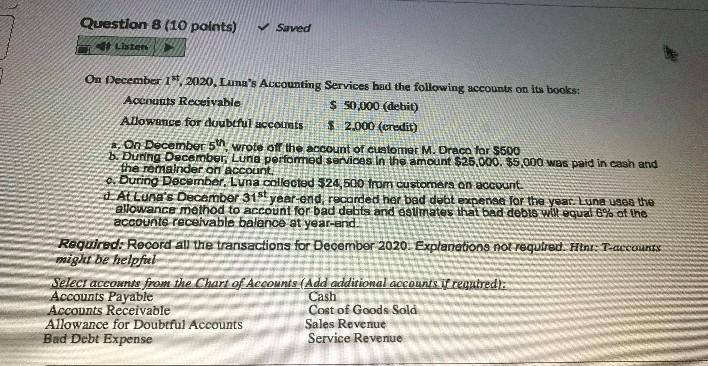

answer me quickly Question 8 (10 points) Saved Listen On December 1, 2020, Luna's Accounting Services had the following accounts on its books: Accounts Receivable

answer me quickly

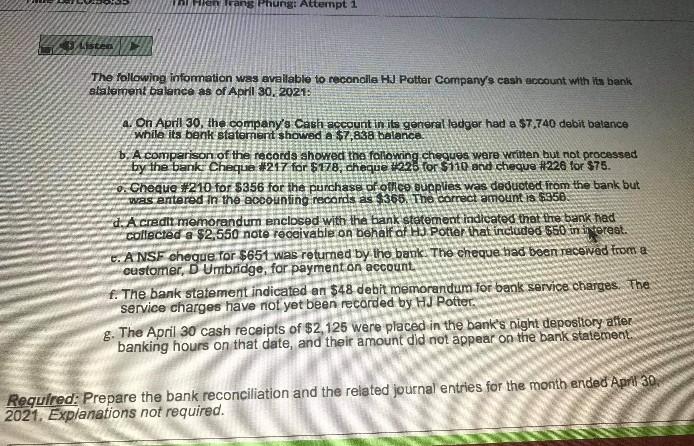

Question 8 (10 points) Saved Listen On December 1, 2020, Luna's Accounting Services had the following accounts on its books: Accounts Receivable $ 50.000 (debit) Allowance for doubtful accounts $2.000 (credit) 1. On December 5, wrote of the account of customer M. Draca for $500 b. During December Luna performed services in the amount $25.000. $5,000 was paid in cash and the remainder on account 0. During December, Luna collected $24,500 from customers an account d. At Luna's December 31st year-end, recorded her bad debt expense for the year. Luna usea the allowance method to account for bad debts and estimates that bad debis will equal 6% at the accounts receivable balance at year-end. Required: Record all the transactions for December 2020. Explanations not required. tnr: T-accounts might be helpful Select accounts from the Chart of Accounts (Add additional accounts, it regatred): Accounts Payable Cash Accounts Receivable Cost of Goods Sold Allowance for Doubtful Accounts Sales Revenue Bad Debt Expense Service Revenue Hemang Phung: Attempt 1 The following information was available to reconcile HJ Potter Company's cash account with its bank slalement balance as of April 30, 20213 4. On April 30, the company's Cash account in its general ledger had a $7,740 debit balance while its benk statement showed a $7,838 halance. b. A comparison of the records showed the following cheques were written but not processed by the bank Cheque #217 for $178, cheque #225 for $110 and cheque #226 for $75. 0. Cheque #210 for $356 for the purchase of office supplies was deducted from the bank but was entered in the accounting records as $365. The correct amount is $958. d. A credii memorandum enclosed with the bank statement indicated that the bank had collected & $2,550 note receivable on behalf of HJ Potter included $50 in interest. c. A NSF chegue for $651 was returned by the bank. The cheque had been received from a customer, D Umbridge, for payment on account f. The bank statement indicated an $48 debit memorandum for bank service charges. The service charges have not yet been recorded by HJ Potter. g. The April 30 cash receipts of $2,125 were placed in the bank's night depository after banking hours on that date, and their amount did not appear on the bank statement Required: Prepare the bank reconciliation and the related journal entries for the month ended Apr 30. 2021. Explanations not requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started