Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer only asap ty QUIZ: FAR 2 - Partnership Formation and Operation Multiple Choice. Select the letter of the correct answer. Use the answer sheet

answer only asap ty

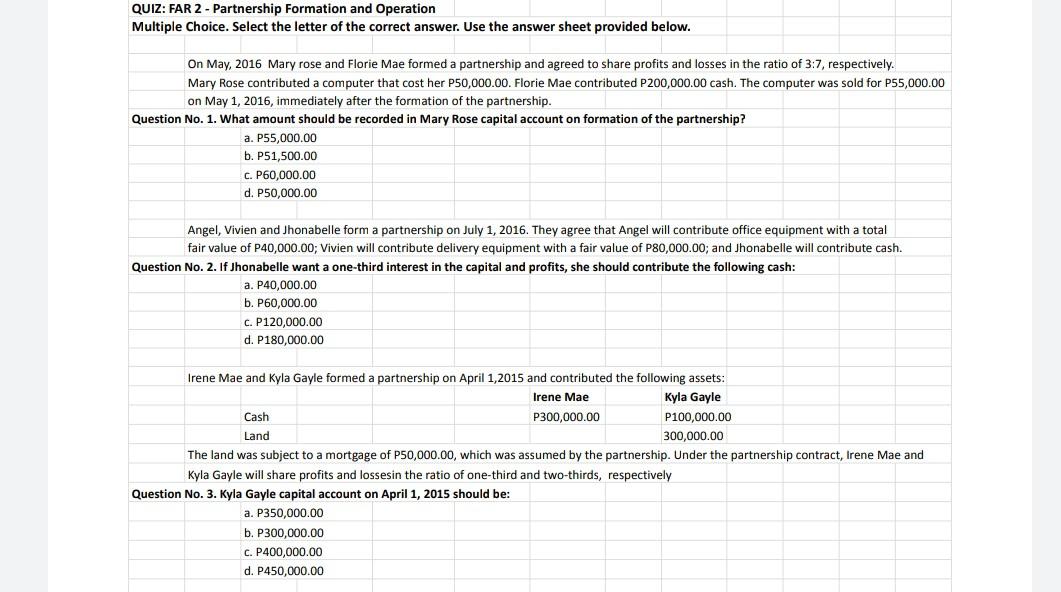

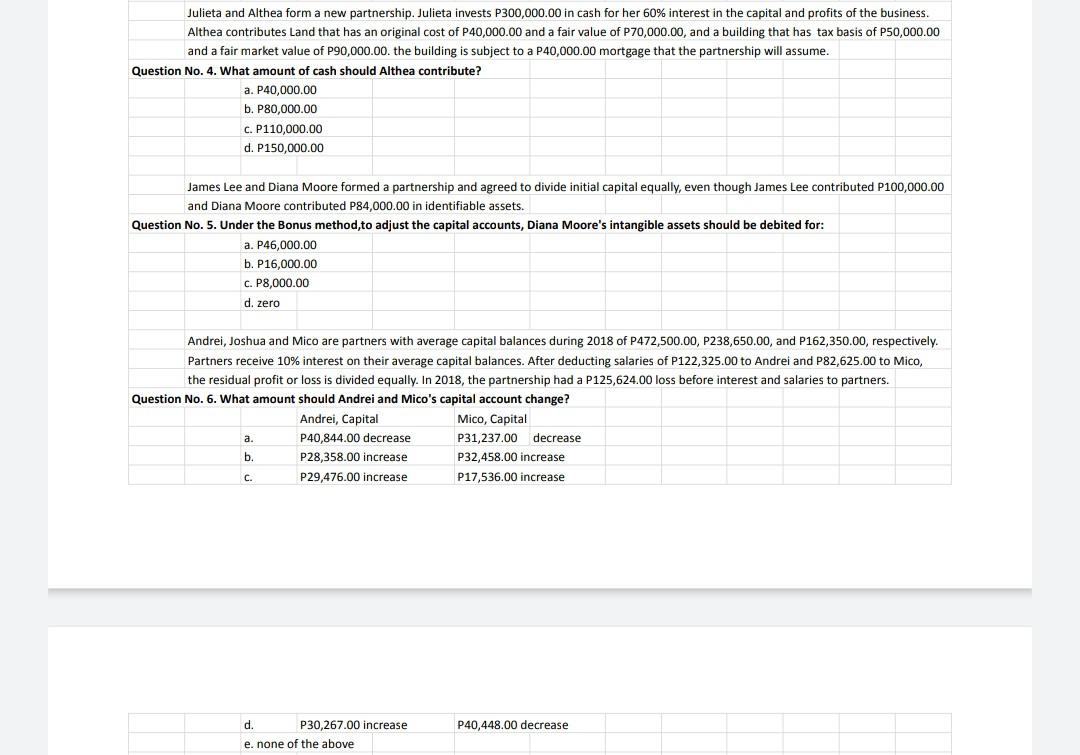

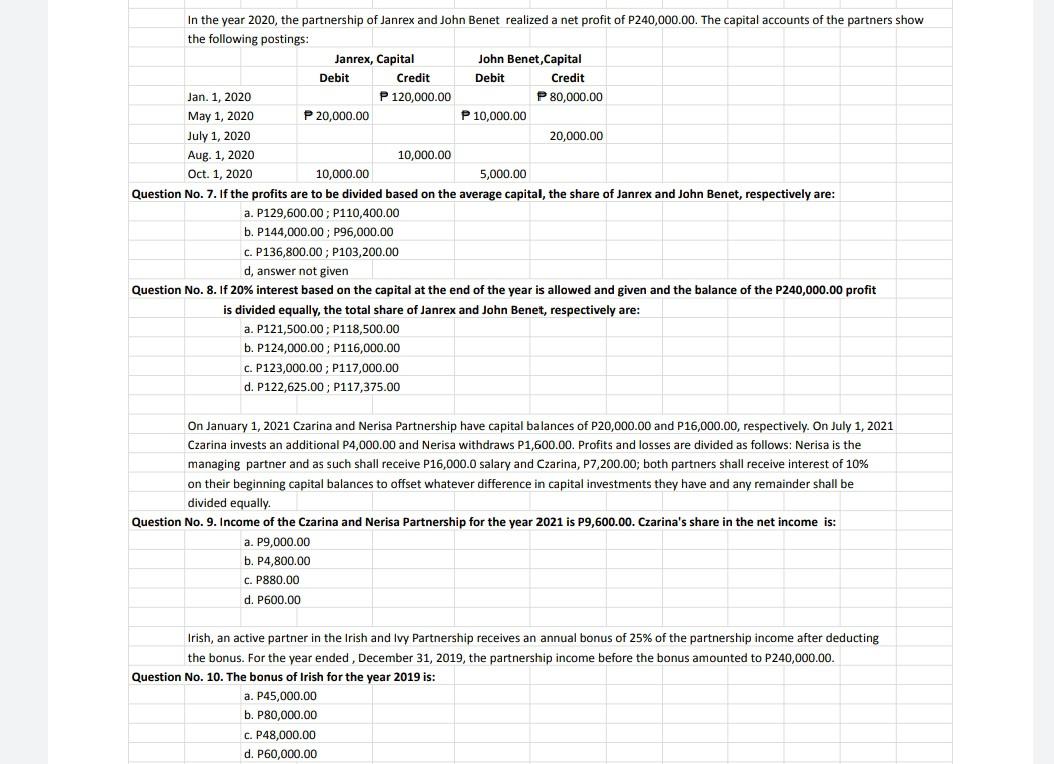

QUIZ: FAR 2 - Partnership Formation and Operation Multiple Choice. Select the letter of the correct answer. Use the answer sheet provided below. On May, 2016 Mary rose and Florie Mae formed a partnership and agreed to share profits and losses in the ratio of 3:7, respectively. Mary Rose contributed a computer that cost her P50,000.00. Florie Mae contributed P200,000.00 cash. The computer was sold for P55,000.00 on May 1, 2016, immediately after the formation of the partnership. Question No. 1. What amount should be recorded in Mary Rose capital account on formation of the partnership? a. P55,000.00 b. P51,500.00 C. P60,000.00 d. P50,000.00 Angel, Vivien and Jhonabelle form a partnership on July 1, 2016. They agree that Angel will contribute office equipment with a total fair value of P40,000.00; Vivien will contribute delivery equipment with a fair value of P80,000.00; and Jhonabelle will contribute cash. Question No. 2. If Jhonabelle want a one-third interest in the capital and profits, she should contribute the following cash: a. P40,000.00 b. P60,000.00 c. P120,000.00 d. P180,000.00 Irene Mae and Kyla Gayle formed a partnership on April 1,2015 and contributed the following assets: Irene Mae Kyla Gayle Cash P300,000.00 P100,000.00 Land 300,000.00 The land was subject to a mortgage of P50,000.00, which was assumed by the partnership. Under the partnership contract, Irene Mae and Kyla Gayle will share profits and lossesin the ratio of one-third and two-thirds, respectively Question No. 3. Kyla Gayle capital account on April 1, 2015 should be: a. P350,000.00 b. P300,000.00 c. P400,000.00 d. P450,000.00 Julieta and Althea form a new partnership. Julieta invests P300,000.00 in cash for her 60% interest in the capital and profits of the business. Althea contributes Land that has an original cost of P40,000.00 and a fair value of P70,000.00, and a building that has tax basis of P50,000.00 and a fair market value of P90,000.00. the building is subject to a P40,000.00 mortgage that the partnership will assume. Question No. 4. What amount of cash should Althea contribute? a. P40,000.00 b. P80,000.00 C. P110,000.00 d. P150,000.00 James Lee and Diana Moore formed a partnership and agreed to divide initial capital equally, even though James Lee contributed P100,000.00 and Diana Moore contributed P84,000.00 in identifiable assets. Question No. 5. Under the Bonus method to adjust the capital accounts, Diana Moore's intangible assets should be debited for: a. P46,000.00 b. P16,000.00 C. P8,000.00 d. zero Andrei, Joshua and Mico are partners with average capital balances during 2018 of P472,500.00, P238,650.00, and P162,350.00, respectively. Partners receive 10% interest on their average capital balances. After deducting salaries of P122,325.00 to Andrei and P82,625.00 to Mico, the residual profit or loss is divided equally. In 2018, the partnership had a P125,624.00 loss before interest and salaries to partners. Question No. 6. What amount should Andrei and Mico's capital account change? Andrei, Capital Mico, Capital a. P40,844.00 decrease P31,237.00 decrease b. P28,358.00 increase P32,458.00 increase C. P29,476.00 increase P17,536.00 increase P40,448.00 decrease d. P30,267.00 increase e. none of the above In the year 2020, the partnership of Janrex and John Benet realized a net profit of P240,000.00. The capital accounts of the partners show the following postings: Janrex, Capital John Benet, Capital Debit Credit Debit Credit Jan. 1, 2020 P 120,000.00 P 80,000.00 May 1, 2020 P20,000.00 P 10,000.00 July 1, 2020 20.000.00 Aug. 1, 2020 10,000.00 Oct. 1, 2020 10,000.00 5,000.00 Question No. 7. If the profits are to be divided based on the average capital, the share of Janrex and John Benet, respectively are: a. P129,600.00; P110,400.00 b. P144,000.00; P96,000.00 C. P136,800.00; P103,200.00 d, answer not given Question No. 8. If 20% interest based on the capital at the end of the year is allowed and given and the balance of the P240,000.00 profit is divided equally, the total share of Janrex and John Benet, respectively are: a. P121,500.00 ; P118,500.00 b. P124,000.00; P116,000.00 c. P123,000.00 ; P117,000.00 d. P122,625.00 ; P117,375.00 On January 1, 2021 Czarina and Nerisa Partnership have capital balances of P20,000.00 and 216,000.00, respectively. On July 1, 2021 Czarina invests an additional P4,000.00 and Nerisa withdraws P1,600.00. Profits and losses are divided as follows: Nerisa is the managing partner and as such shall receive P16,000.0 salary and Czarina, P7,200.00; both partners shall receive interest of 10% on their beginning capital balances to offset whatever difference in capital investments they have and any remainder shall be divided equally Question No. 9. Income of the Czarina and Nerisa Partnership for the year 2021 is P9,600.00. Czarina's share in the net income is: a. P9,000.00 b. P4,800.00 C. P880.00 d. P600.00 Irish, an active partner in the Irish and Ivy Partnership receives an annual bonus of 25% of the partnership income after deducting the bonus. For the year ended , December 31, 2019, the partnership income before the bonus amounted to P240,000.00 Question No. 10. The bonus of Irish for the year 2019 is: a. P45,000.00 b. P80,000.00 C. P48,000.00 d. P60,000.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started