Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER ONLY IF YOU KNOW THE RIGHT ANSWER....SHOW YOU STEPS(WORK) ... 3. On April 24h 2012, AT&T () common stocks were selling at $ 31.72

ANSWER ONLY IF YOU KNOW THE RIGHT ANSWER....SHOW YOU STEPS(WORK) ...

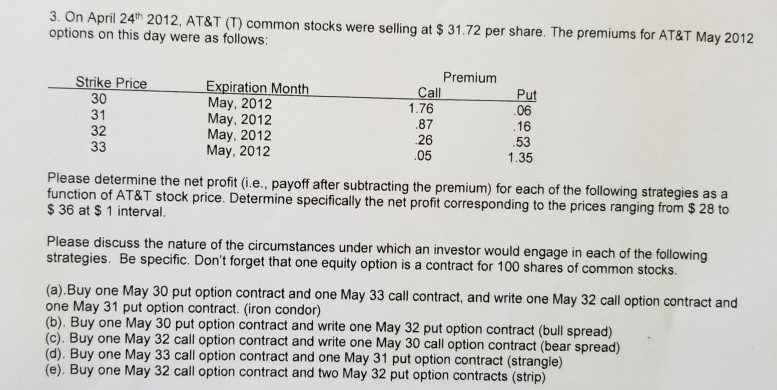

3. On April 24h 2012, AT&T () common stocks were selling at $ 31.72 per share. The premiums for AT&T May 2012 options on this day were as follows: Premium Strike Price Expiration Month May, 2012 May, 2012 May, 2012 May, 2012 30 31 32 1.76 87 .26 .05 16 53 1.35 t profit (i.e., payoff after subtracting the premium) for each of the following strategies as a Please determine the net function of AT&T stock price. Determine specifically the net profit corresponding to the prices ranging from $ 28 to $ 36 at $ 1 interval. Please discuss the nature of the circumstances under which an investor would engage in each of the following strategies. Be specific. Don't forget that one equity option is a contract for 100 shares of common stocks. O put option contract and one May 33 call contract, and write one May 32 call option contract and (a).Buy one May 3 one May 31 put option contract. (iron condor) (b). Buy one May 30 put option contract and write one May 32 put option contract (bull spread) (c). Buy one May 32 call option contract and write one May 30 call option contract (bear spread) (d). Buy one May 33 call option contract and one May 31 put option contract (strangle) (e). Buy one May 32 call option contract and two May 32 put option contracts (strip) 3. On April 24h 2012, AT&T () common stocks were selling at $ 31.72 per share. The premiums for AT&T May 2012 options on this day were as follows: Premium Strike Price Expiration Month May, 2012 May, 2012 May, 2012 May, 2012 30 31 32 1.76 87 .26 .05 16 53 1.35 t profit (i.e., payoff after subtracting the premium) for each of the following strategies as a Please determine the net function of AT&T stock price. Determine specifically the net profit corresponding to the prices ranging from $ 28 to $ 36 at $ 1 interval. Please discuss the nature of the circumstances under which an investor would engage in each of the following strategies. Be specific. Don't forget that one equity option is a contract for 100 shares of common stocks. O put option contract and one May 33 call contract, and write one May 32 call option contract and (a).Buy one May 3 one May 31 put option contract. (iron condor) (b). Buy one May 30 put option contract and write one May 32 put option contract (bull spread) (c). Buy one May 32 call option contract and write one May 30 call option contract (bear spread) (d). Buy one May 33 call option contract and one May 31 put option contract (strangle) (e). Buy one May 32 call option contract and two May 32 put option contracts (strip)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started