Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER ONLY QUESTION 5 PLEASE 258 Revision Question 4 Discuss the accounting treatment in the book of owner on repossession date. Revision Question 5 On

ANSWER ONLY QUESTION 5 PLEASE

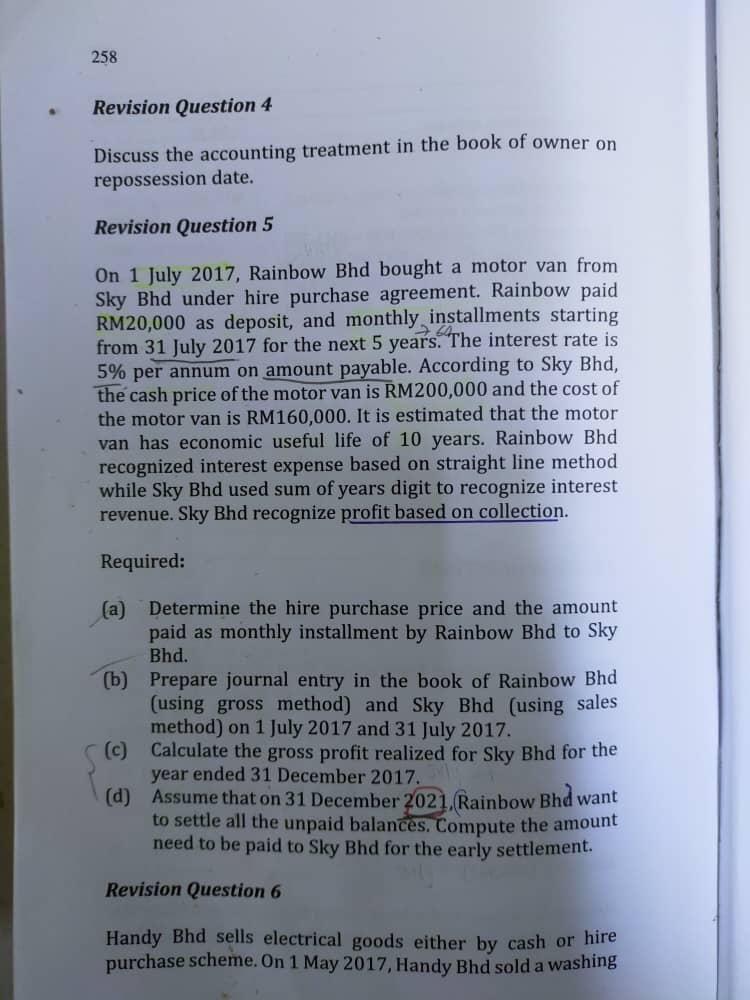

258 Revision Question 4 Discuss the accounting treatment in the book of owner on repossession date. Revision Question 5 On 1 July 2017, Rainbow Bhd bought a motor van from Sky Bhd under hire purchase agreement. Rainbow paid RM20,000 as deposit, and monthly installments starting from 31 July 2017 for the next 5 years. The interest rate is 5% per annum on amount payable. According to Sky Bhd, the cash price of the motor van is RM200,000 and the cost of the motor van is RM160,000. It is estimated that the motor van has economic useful life of 10 years. Rainbow Bhd recognized interest expense based on straight line method while Sky Bhd used sum of years digit to recognize interest revenue. Sky Bhd recognize profit based on collection. Required: (a) Determine the hire purchase price and the amount paid as monthly installment by Rainbow Bhd to Sky Bhd. (b) Prepare journal entry in the book of Rainbow Bhd (using gross method) and Sky Bhd (using sales method) on 1 July 2017 and 31 July 2017 (c) Calculate the gross profit realized for Sky Bhd for the year ended 31 December 2017. (d) Assume that on 31 December 2021. Rainbow Bhd want to settle all the unpaid balances. Compute the amount need to be paid to Sky Bhd for the early settlement. Revision Question 6 Handy Bhd sells electrical goods either by cash or hire purchase scheme. On 1 May 2017, Handy Bhd sold a washingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started