Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer part A, also please let me know if part 2&3 are correct! would appreciate, will give thumbs up! 8. Ashley sells her interest in

answer part A, also please let me know if part 2&3 are correct! would appreciate, will give thumbs up!

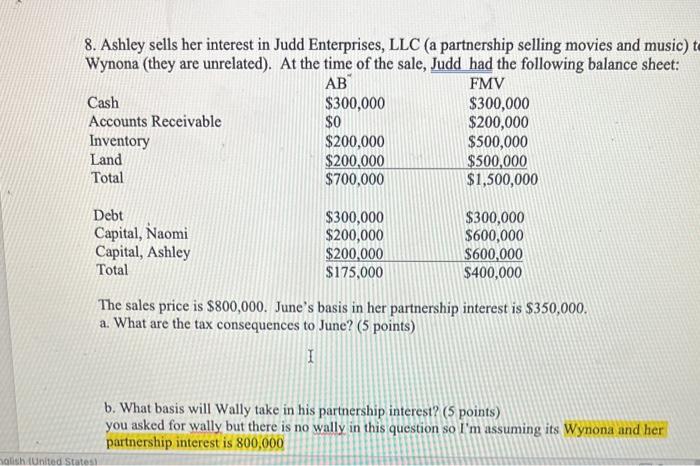

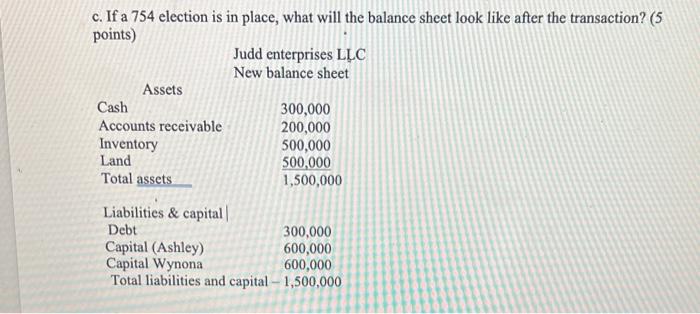

8. Ashley sells her interest in Judd Enterprises, LLC (a partnership selling movies and music) Wynona (they are unrelated). At the time of the sale, Judd had the following balance sheet: The sales price is $800,000. June's basis in her partnership interest is $350,000. a. What are the tax consequences to June? ( 5 points) b. What basis will Wally take in his partnership interest? ( 5 points) you asked for wally but there is no wally in this question so I' m assuming its. partnership interest is 800,000 c. If a 754 election is in place, what will the balance sheet look like after the transaction? (5 noints)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started