Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please Big Corporation acquired and placed in service the following 100% business-use assets. Big did not claim Sec. 179 or bonus depreciation expensing on

answer please

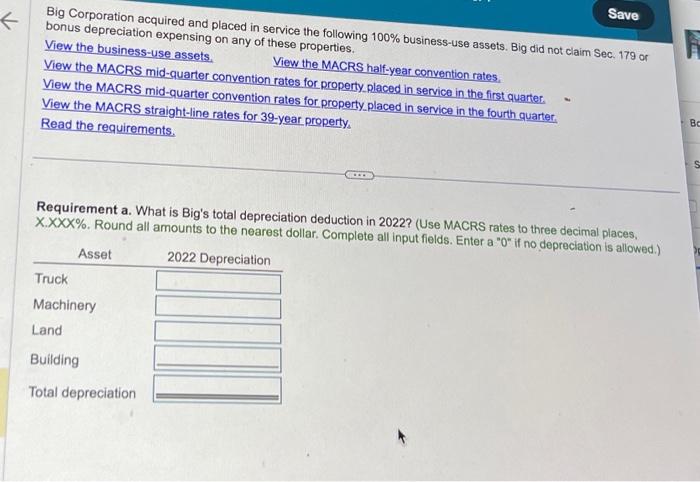

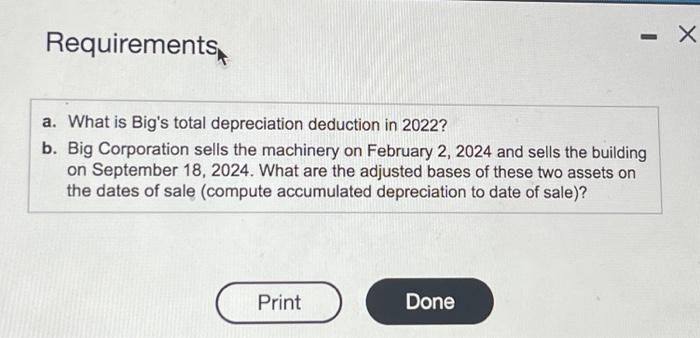

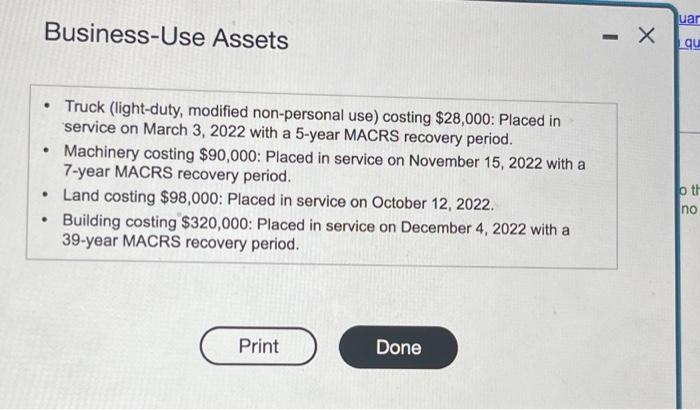

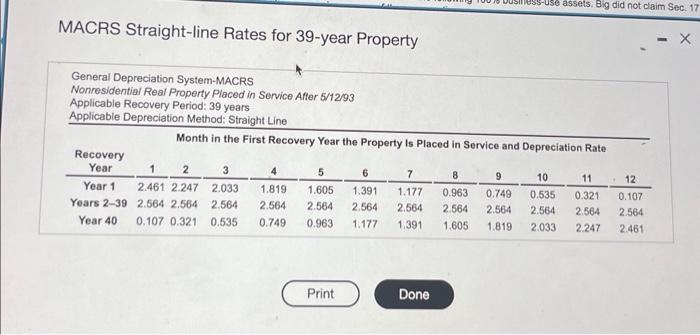

Big Corporation acquired and placed in service the following 100% business-use assets. Big did not claim Sec. 179 or bonus depreciation expensing on any of these properties. View the business-use assets. View the MACRS half-year convention rates, View the MACRS mid-quarter convention rates for property placed in service in the first quarter. View the MACRS mid-quarter convention rates for property.placed in service in the fourth quarter. View the MACRS straight-line rates for 39 -year property, Read the requirements. Requirement a. What is Big's total depreciation deduction in 2022 ? (Use MACRS rates to three decimal places, X. XXX\%. Round all amounts to the nearest dollar. Complete all input fields. Enter a "0" if no deoreciation places, Requirements a. What is Big's total depreciation deduction in 2022? b. Big Corporation sells the machinery on February 2, 2024 and sells the building on September 18,2024 . What are the adjusted bases of these two assets on the dates of sale (compute accumulated depreciation to date of sale)? Business-Use Assets - Truck (light-duty, modified non-personal use) costing \$28,000: Placed in service on March 3, 2022 with a 5-year MACRS recovery period. - Machinery costing $90,000 : Placed in service on November 15,2022 with a 7-year MACRS recovery period. - Land costing $98,000 : Placed in service on October 12, 2022. - Building costing $320,000 : Placed in service on December 4,2022 with a 39-year MACRS recovery period. MACRS Straight-line Rates for 39-year Property General Depreciation System-MACRS Nonresidential Real Property Placed in Service Affer 5/12/93 Applicable Recovery Period: 39 years Applicable Depreciation Method: Straight Line Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started