Answered step by step

Verified Expert Solution

Question

1 Approved Answer

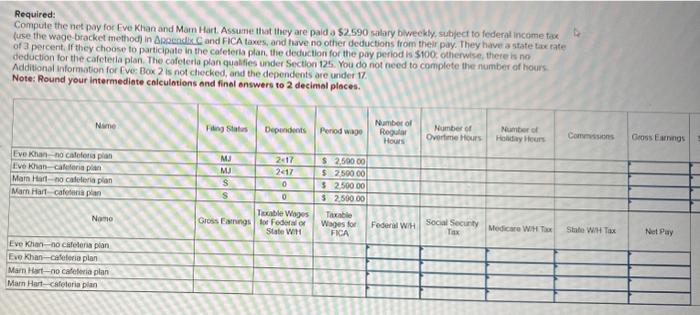

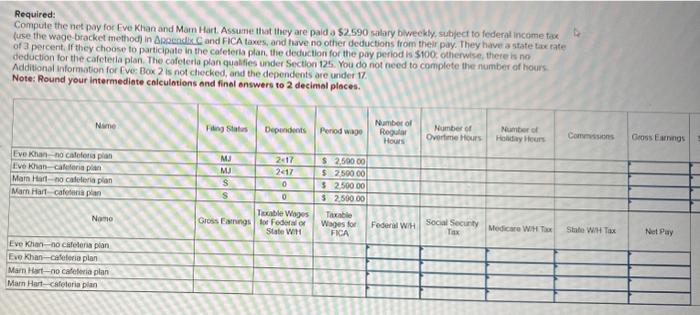

Answer please Required: Compute the net pay for Eve Khan and Mam Hart. Assume ihat lhey are paid a $2.590 salary biveckly, subject to federat

Answer please

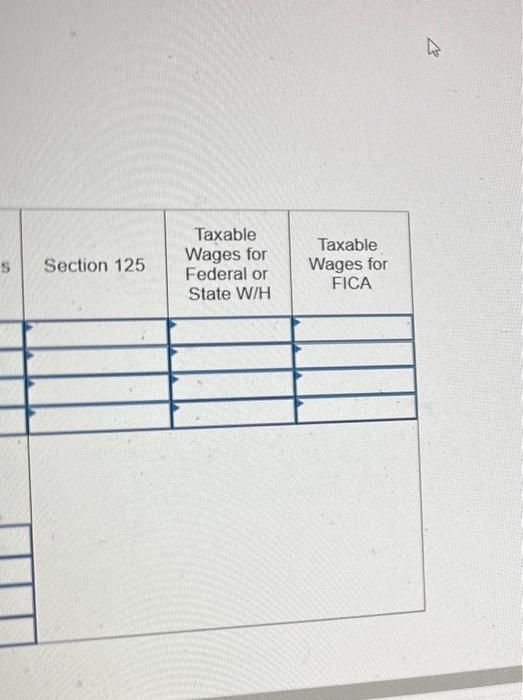

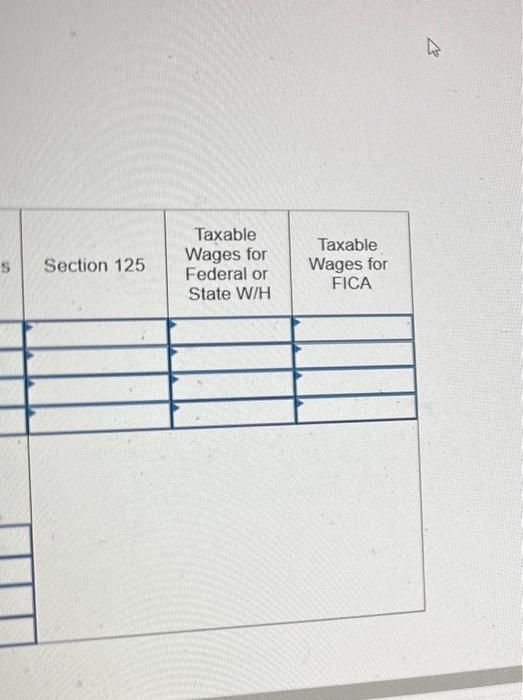

Required: Compute the net pay for Eve Khan and Mam Hart. Assume ihat lhey are paid a $2.590 salary biveckly, subject to federat inceme tase (use the wage bracket tmethod) in APaendix C and FICA taxes, and have no other deductions from their pay. They have a state tax rate of 3 percent. If they choose to participate in the catetens plan, the deduction for the pay period is $100, ohierwise, there is no deduction for the cafetetla plan. The cofeteria plan qualites under Section 126 , You do not need to complete the number of hours. Additional informotion for Fve: Box 2 is not checked, and the dependents are under 17 Note: Round your intermediate colculotions and final answers to 2 decimal places. s Section 125 \begin{tabular}{c|c|c|} \hline & TaxableWagesforFederalorStateW/H & TaxableWagesforFICA \\ \hline & & \\ \hline \end{tabular} Required: Compute the net pay for Eve Khan and Mam Hart. Assume ihat lhey are paid a $2.590 salary biveckly, subject to federat inceme tase (use the wage bracket tmethod) in APaendix C and FICA taxes, and have no other deductions from their pay. They have a state tax rate of 3 percent. If they choose to participate in the catetens plan, the deduction for the pay period is $100, ohierwise, there is no deduction for the cafetetla plan. The cofeteria plan qualites under Section 126 , You do not need to complete the number of hours. Additional informotion for Fve: Box 2 is not checked, and the dependents are under 17 Note: Round your intermediate colculotions and final answers to 2 decimal places. s Section 125 \begin{tabular}{c|c|c|} \hline & TaxableWagesforFederalorStateW/H & TaxableWagesforFICA \\ \hline & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started