Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please Sitra On May 1, 2021, Manama Co. acquired all of the voting shares of Sitra Co. by issuing 15,000 shares of $2 par

answer please

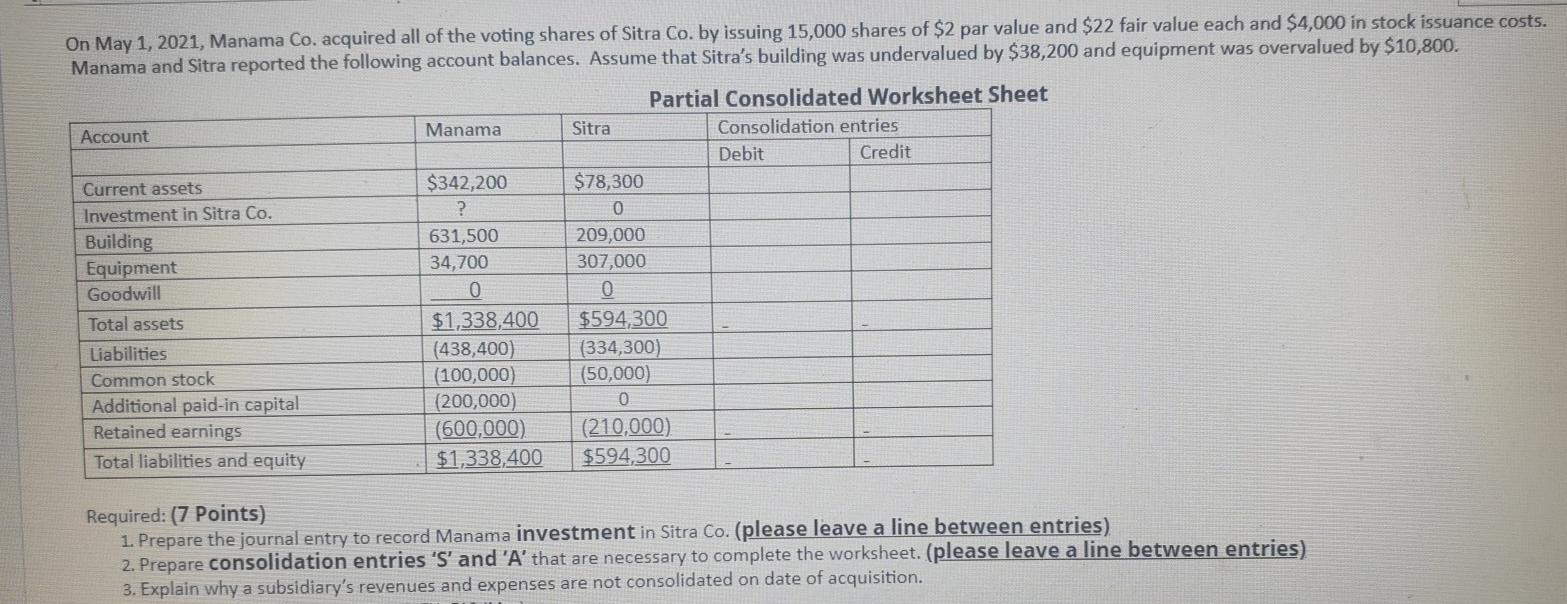

Sitra On May 1, 2021, Manama Co. acquired all of the voting shares of Sitra Co. by issuing 15,000 shares of $2 par value and $22 fair value each and $4,000 in stock issuance costs. Manama and Sitra reported the following account balances. Assume that Sitra's building was undervalued by $38,200 and equipment was overvalued by $10,800. Partial Consolidated Worksheet Sheet Account Manama Consolidation entries Debit Credit Current assets $342,200 $78,300 Investment in Sitra Co. ? 0 Building 631,500 209,000 Equipment 34,700 307,000 Goodwill 0 0 Total assets $1,338,400 $594,300 Liabilities (438,400) (334,300) Common stock (100,000) (50,000) Additional paid-in capital (200,000) 0 Retained earnings (600,000) (210,000) Total liabilities and equity $1,338,400 $594,300 Required: (7 Points) 1. Prepare the journal entry to record Manama investment in Sitra Co. (please leave a line between entries) 2. Prepare consolidation entries 'S' and 'A' that are necessary to complete the worksheet. (please leave a line between entries) 3. Explain why a subsidiary's revenues and expenses are not consolidated on date of acquisitionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started