Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer please thanks. Part 2 - Assignment: As a class, you will review Part 1 to ensure all groups arrived at the same 'Total Cost

answer please thanks.

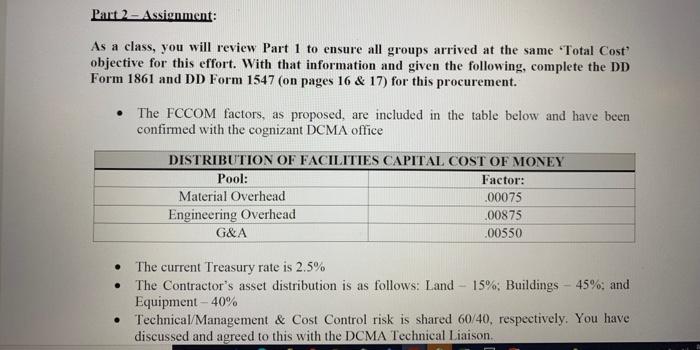

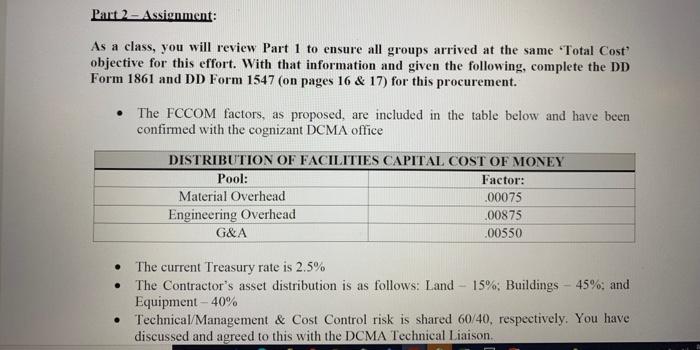

Part 2 - Assignment: As a class, you will review Part 1 to ensure all groups arrived at the same 'Total Cost objective for this effort. With that information and given the following, complete the DD Form 1861 and DD Form 1547 (on pages 16 & 17) for this procurement. The FCCOM factors, as proposed, are included in the table below and have been confirmed with the cognizant DCMA office DISTRIBUTION OF FACILITIES CAPITAL COST OF MONEY Pool: Factor: Material Overhead .00075 Engineering Overhead .00875 G&A .00550 . The current Treasury rate is 2.5% The Contractor's asset distribution is as follows: Land 15%; Buildings - 45%; and Equipment - 40% Technical/Management & Cost Control risk is shared 60/40, respectively. You have discussed and agreed to this with the DCMA Technical Liaison Part 2 - Assignment: As a class, you will review Part 1 to ensure all groups arrived at the same 'Total Cost objective for this effort. With that information and given the following, complete the DD Form 1861 and DD Form 1547 (on pages 16 & 17) for this procurement. The FCCOM factors, as proposed, are included in the table below and have been confirmed with the cognizant DCMA office DISTRIBUTION OF FACILITIES CAPITAL COST OF MONEY Pool: Factor: Material Overhead .00075 Engineering Overhead .00875 G&A .00550 . The current Treasury rate is 2.5% The Contractor's asset distribution is as follows: Land 15%; Buildings - 45%; and Equipment - 40% Technical/Management & Cost Control risk is shared 60/40, respectively. You have discussed and agreed to this with the DCMA Technical Liaison

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started