A project to manufacture widgets, if undertaken, will start on 1 January with the purchase of (and

Question:

A project to manufacture widgets, if undertaken, will start on 1 January with the purchase of

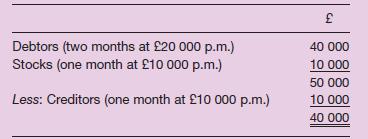

(and payment for) a widget-making machine. Materials for use in the manufacture of widgets will be bought in January and paid for in February, and these will be used in production in February. February’s production will be sold in that month, on credit, and customers will pay in April. If the monthly purchase of raw materials is £10 000 and the monthly sales revenue from widgets £20 000, then once the project gets under way the working capital investment at any given moment will be

(This assumes that the level of activity, the stockholding and the credit periods remain constant.) So to take account of the difference between operating accounting flows and cash flows we could treat the £40 000, which is the magnitude of the difference between accounting and cash flows, as an initial investment of the project.

We should also need to treat it as a receipt at the end of this project. This is logical because, during the last few months of the project, more cash would be received from sales revenue than sales revenue made; debtors will continue to pay after the end of the project for two months. Stocks will not be bought during the last month of production, though creditors for stocks bought the previous month will need to be paid during that last month.

Provided that this recognition of the timing difference (the £40 000), is correctly adjusted for, operating accounting flows can be used as a surrogate for the (more strictly correct)

cash flows.

Step by Step Answer: