A project that involves an initial outlay of 200 000 on a machine is expected to generate

Question:

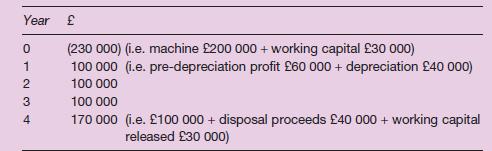

A project that involves an initial outlay of £200 000 on a machine is expected to generate annual profits of £60 000 (after deducting depreciation) each year for four years. Depreciation is calculated on an even (straight line) basis, assuming that the disposal proceeds of the original investment will be £40 000 receivable at the end of year 4. This means that the annual depreciation expense will be £40 000 [(£200 000 − £40 000)/4]. The initial cost is an outflow in year 0

(immediately) and the disposal proceeds are an additional inflow in year 4. The working capital requirement is estimated to be a constant £30 000. The estimated cash flows will be

and it is these figures that should be discounted, using an appropriate rate, to arrive at the NPV.

Step by Step Answer: