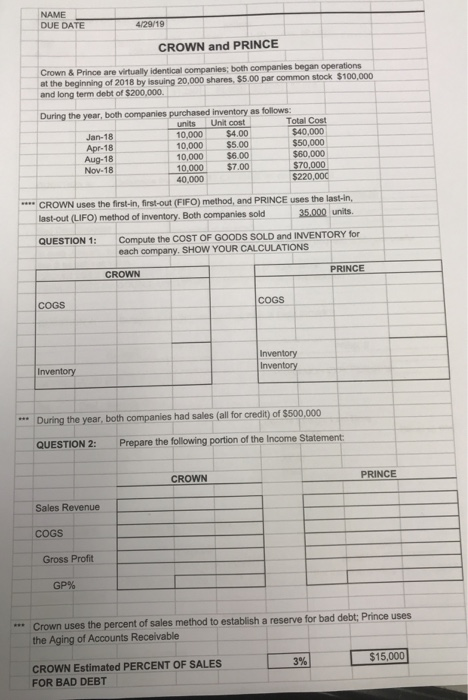

answer question 1-7

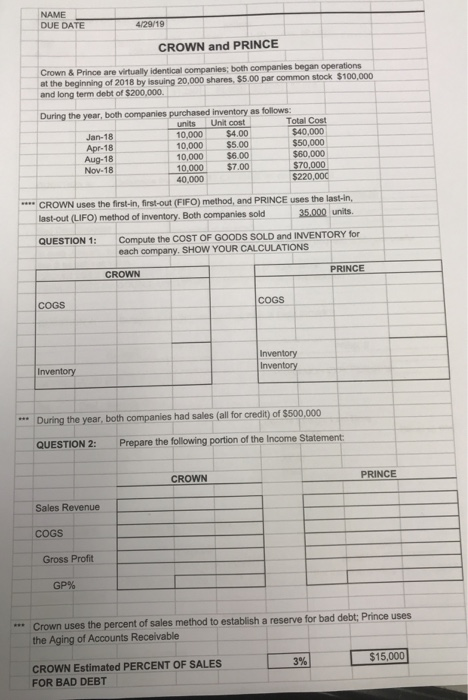

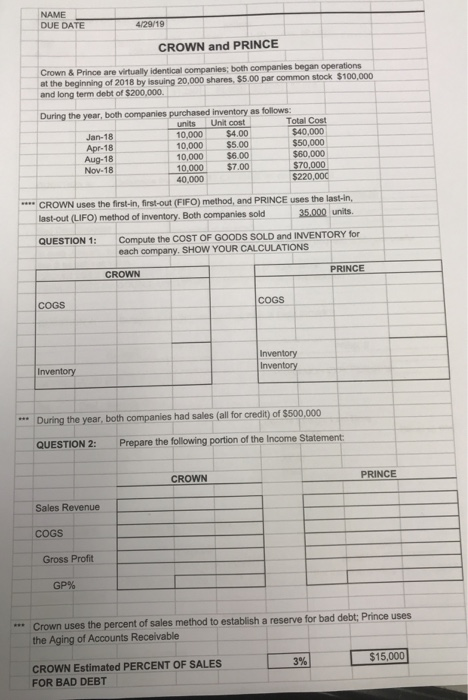

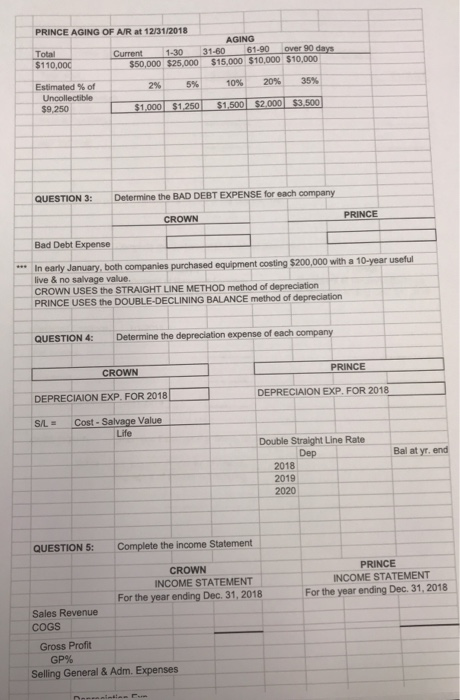

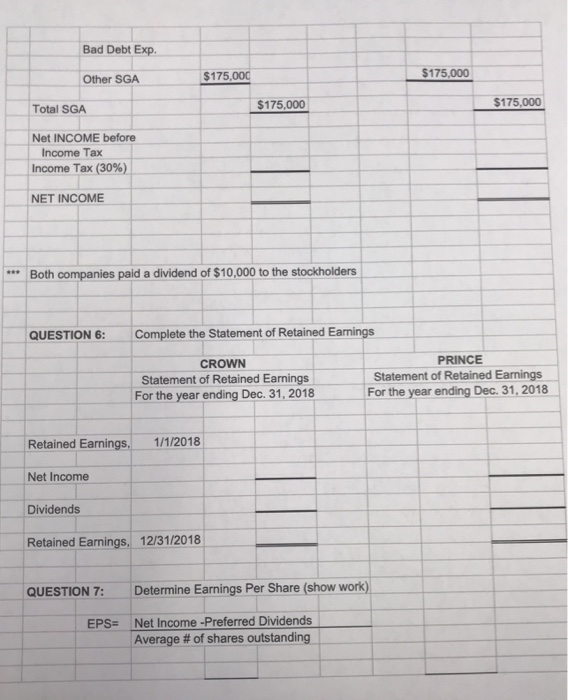

NAME DUE DATE 4/29/19 CROWN and PRINCE Crown& Prince are vitually identical companies; both companies began operations at the beginning of 2018 by issuing 20,000 shares, $5.00 par common stock $100,000 and long term debt of $200,000. During the year, both companies purchased inventory as follows Jan-18 Apr-18 Aug-18 Nov-18 units Unit cost 0,000$4.00 10,000 $5.00 0,000 $6.00 10,000$7.00 40,000 Total Cost $40,000 $50,000 $60,000 $70,000 $220,000 CROWN uses the first-in, first-out (FIFO) method, and PRINCE uses the last-in, 35,000 units. last-out (LIFO) method of inventory. Both companies sold Compute the COST OF GOODS SOLD and INVENTORY for each company. SHOW YOUR CALCULATIONS QUESTION 1: CROWN PRINCE CoGs COGS Inventory Inven During the year, both companies had sales (all tor credit) of $500,000 QUESTION 2: Prepare the following portion of the Income Statement CROWN PRINCE Sales Revenue COGS Gross Proft GP% " Crown uses the percent of sales method to establish a reserve for bad debt: Prince uses the Aging of Accounts Receivable CROWN Estimated PERCENT OF SALES FOR BAD DEBT 15,000] PRINCE AGING OF A/R at 12/31/2018 Total $110 Estimated % of AGING Current 1-30 31-60 61.90 over 90 days $50,000 $25,000 $15,000 $10,000 $10,000 2% 5% 10% 20% 35% $1.0001.250| $1,5002.000 3.500 $9,250 QUESTION 3: Determine the BAD DEBT EXPENSE for each company CROWN PRINCE Bad Debt Expense In early January, both companies purchased equipment costing $200,000 with a 10-year useful live & no salvage value CROWN USES the STRAIGHT LINE METHOD method of depreciation PRINCE USES the DOUBLE-DECLINING BALANCE method of depreciation QUESTION 4: Determine the depreciation expense of each CROWN PRINCE DEPRECIAION EXP.FOR 2018 S/A Cost-Salvage Value DEPRECIAION EXP FOR 2018 Life Double Straight Line Rate Dep Bal at yr. end 2018 2019 2020 Complete the income Statement CROWN For the year ending Dec. 31,2018 QUESTION 5: PRINCE NCOME STATEMENT For the year ending Dec. 31, 2018 INCOME STATEMENT Sales Revenue COGS Gross Profit GP% Selling General & Adm. Expenses Bad Debt Exp $175,000 $175,000 Other SGA$ Total SGA $175,000 $175,000 Net INCOME before ncome Tax Income Tax (30%), NET INCOME Both companies paid a dividend of $10,000 to the stockholders QUESTION 6: Complete the Statement of Retained Earnings CROWN Statement of Retained Earnings For the year ending Dec. 31, 2018 PRINCE Statement of Retained Earnings For the year ending Dec. 31, 2018 Retained Earnings, 1/1/2018 Net Income Dividends Retained Earnings, 12/31/2018 QUESTION 7: Determine Earnings Per Share (show work) EPS Net Income -Preferred Dividends Average # of shares outstanding