Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer questions in its entirety and show full working. Consider two players, Isha and Ana, each separately playing an infinitely repeated prisoner's dilemma game against

Answer questions in its entirety and show full working.

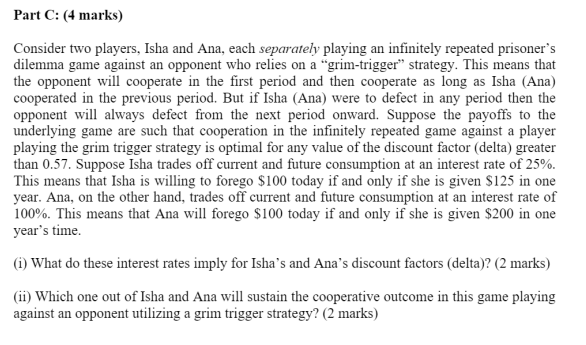

Consider two players, Isha and Ana, each separately playing an infinitely repeated prisoner's dilemma game against an opponent who relies on a "grim-trigger" strategy. This means that the opponent will cooperate in the first period and then cooperate as long as Isha (Ana) cooperated in the previous period. But if Isha (Ana) were to defect in any period then the opponent will always defect from the next period onward. Suppose the payoffs to the underlying game are such that cooperation in the infinitely repeated game against a player playing the grim trigger strategy is optimal for any value of the discount factor (delta) greater than 0.57. Suppose Isha trades off current and future consumption at an interest rate of 25%. This means that Isha is willing to forego $100 today if and only if she is given $125 in one year. Ana, on the other hand, trades off current and future consumption at an interest rate of 100%. This means that Ana will forego $100 today if and only if she is given $200 in one year's time. (i) What do these interest rates imply for Isha's and Ana's discount factors (delta)? (2 marks) (ii) Which one out of Isha and Ana will sustain the cooperative outcome in this game playing against an opponent utilizing a grim trigger strategy? (2 marks) Consider two players, Isha and Ana, each separately playing an infinitely repeated prisoner's dilemma game against an opponent who relies on a "grim-trigger" strategy. This means that the opponent will cooperate in the first period and then cooperate as long as Isha (Ana) cooperated in the previous period. But if Isha (Ana) were to defect in any period then the opponent will always defect from the next period onward. Suppose the payoffs to the underlying game are such that cooperation in the infinitely repeated game against a player playing the grim trigger strategy is optimal for any value of the discount factor (delta) greater than 0.57. Suppose Isha trades off current and future consumption at an interest rate of 25%. This means that Isha is willing to forego $100 today if and only if she is given $125 in one year. Ana, on the other hand, trades off current and future consumption at an interest rate of 100%. This means that Ana will forego $100 today if and only if she is given $200 in one year's time. (i) What do these interest rates imply for Isha's and Ana's discount factors (delta)? (2 marks) (ii) Which one out of Isha and Ana will sustain the cooperative outcome in this game playing against an opponent utilizing a grim trigger strategy? (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started