Answer questions in its entirety and show full working.

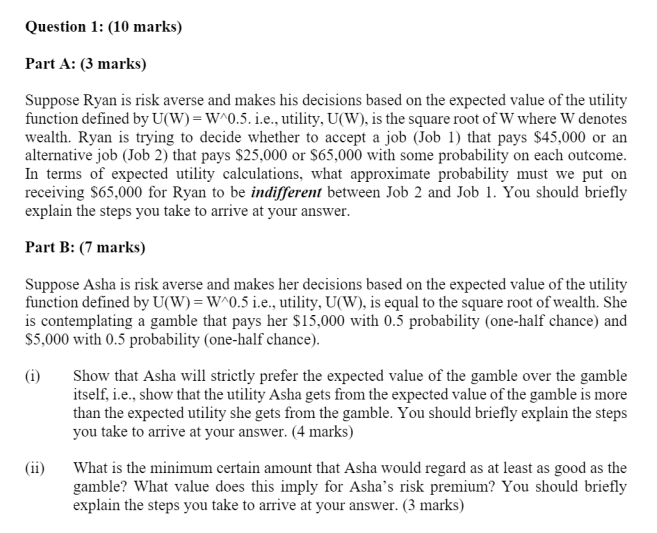

Suppose Ryan is risk averse and makes his decisions based on the expected value of the utility function defined by U(W)=W0.5. i.e., utility, U(W), is the square root of W where W denotes wealth. Ryan is trying to decide whether to accept a job (Job 1) that pays $45,000 or an alternative job (Job 2) that pays $25,000 or $65,000 with some probability on each outcome. In terms of expected utility calculations, what approximate probability must we put on receiving $65,000 for Ryan to be indifferent between Job 2 and Job 1. You should briefly explain the steps you take to arrive at your answer. Part B: (7 marks) Suppose Asha is risk averse and makes her decisions based on the expected value of the utility function defined by U(W)=W0.5 i.e., utility, U(W), is equal to the square root of wealth. She is contemplating a gamble that pays her $15,000 with 0.5 probability (one-half chance) and $5,000 with 0.5 probability (one-half chance). (i) Show that Asha will strictly prefer the expected value of the gamble over the gamble itself, i.e., show that the utility Asha gets from the expected value of the gamble is more than the expected utility she gets from the gamble. You should briefly explain the steps you take to arrive at your answer. (4 marks) (ii) What is the minimum certain amount that Asha would regard as at least as good as the gamble? What value does this imply for Asha's risk premium? You should briefly explain the steps you take to arrive at your answer. ( 3 marks) Suppose Ryan is risk averse and makes his decisions based on the expected value of the utility function defined by U(W)=W0.5. i.e., utility, U(W), is the square root of W where W denotes wealth. Ryan is trying to decide whether to accept a job (Job 1) that pays $45,000 or an alternative job (Job 2) that pays $25,000 or $65,000 with some probability on each outcome. In terms of expected utility calculations, what approximate probability must we put on receiving $65,000 for Ryan to be indifferent between Job 2 and Job 1. You should briefly explain the steps you take to arrive at your answer. Part B: (7 marks) Suppose Asha is risk averse and makes her decisions based on the expected value of the utility function defined by U(W)=W0.5 i.e., utility, U(W), is equal to the square root of wealth. She is contemplating a gamble that pays her $15,000 with 0.5 probability (one-half chance) and $5,000 with 0.5 probability (one-half chance). (i) Show that Asha will strictly prefer the expected value of the gamble over the gamble itself, i.e., show that the utility Asha gets from the expected value of the gamble is more than the expected utility she gets from the gamble. You should briefly explain the steps you take to arrive at your answer. (4 marks) (ii) What is the minimum certain amount that Asha would regard as at least as good as the gamble? What value does this imply for Asha's risk premium? You should briefly explain the steps you take to arrive at your answer. ( 3 marks)