Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer quickly and correctly! Determine the effect of the following scenario on the Cash Flow Yield Ratio: A company takes out a long-term loan from

Answer quickly and correctly!

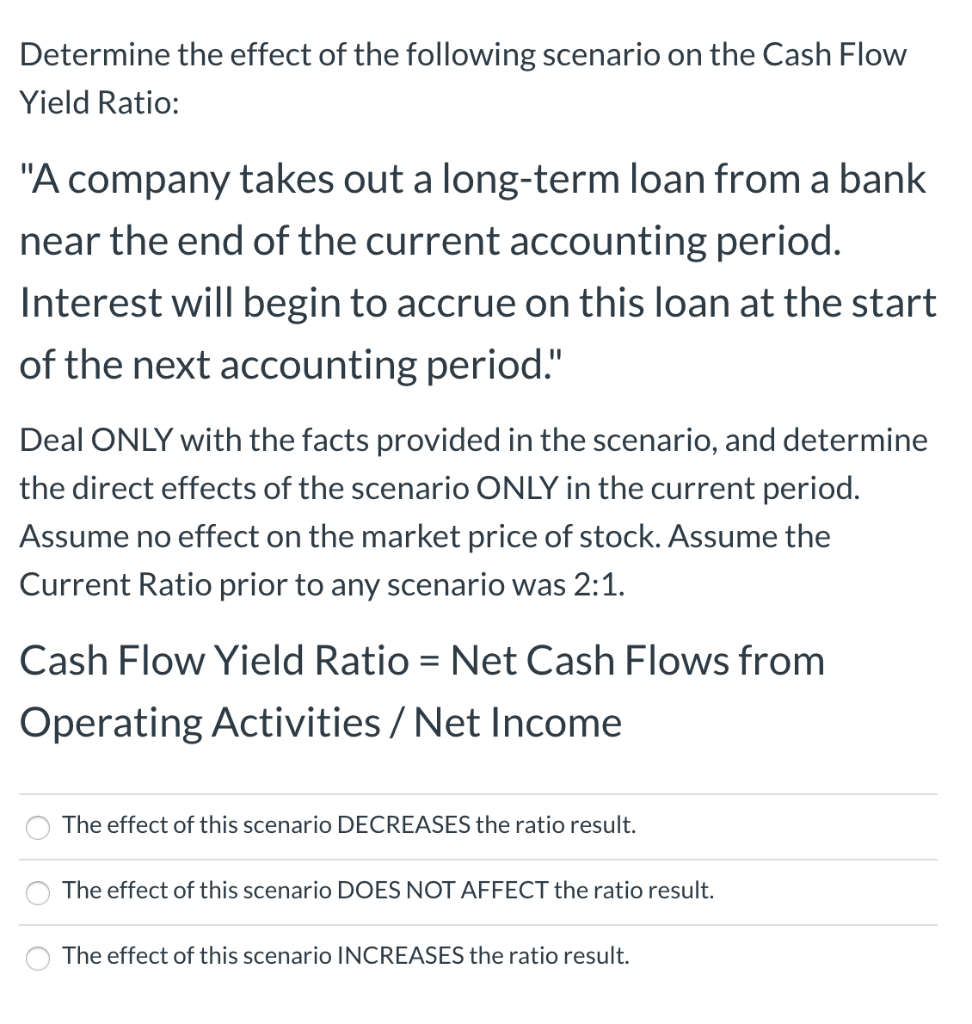

Determine the effect of the following scenario on the Cash Flow Yield Ratio: "A company takes out a long-term loan from a bank near the end of the current accounting period. Interest will begin to accrue on this loan at the start of the next accounting period." Deal ONLY with the facts provided in the scenario, and determine the direct effects of the scenario ONLY in the current period. Assume no effect on the market price of stock. Assume the Current Ratio prior to any scenario was 2:1. Cash Flow Yield Ratio = Net Cash Flows from Operating Activities / Net Income O The effect of this scenario DECREASES the ratio result. O The effect of this scenario DOES NOT AFFECT the ratio result. The effect of this scenario INCREASES the ratio result

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started