Answer the entire problem, please!!!

There are various steps. This is my 3rd time submitting the same question.

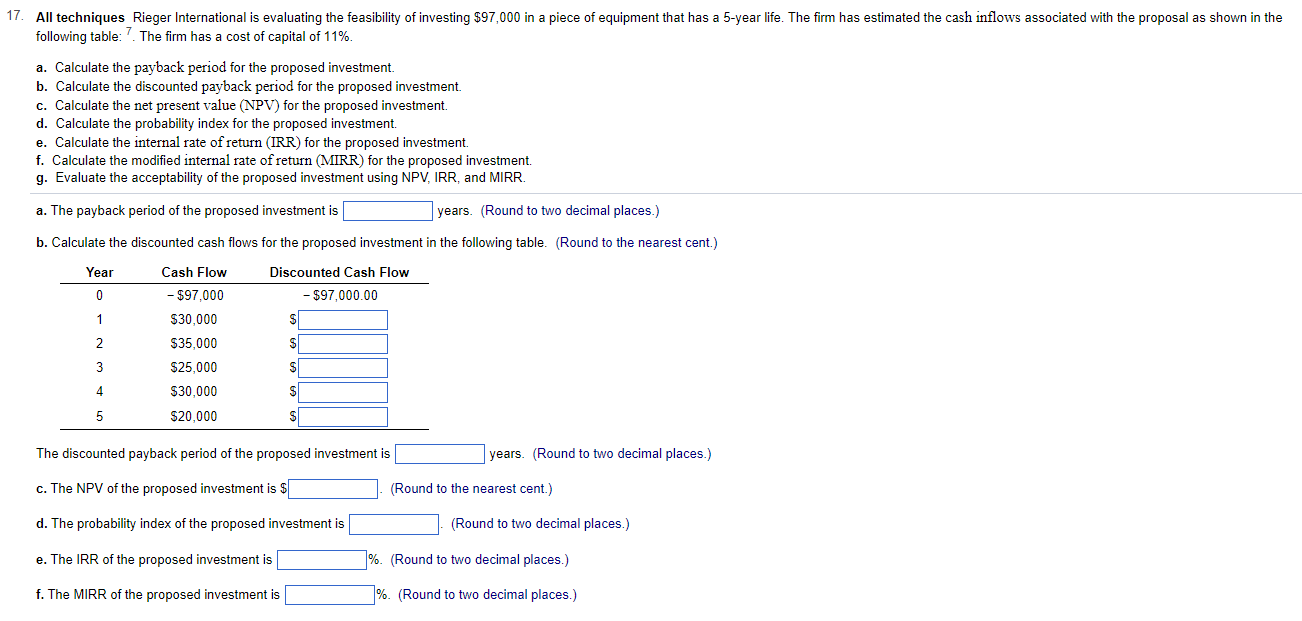

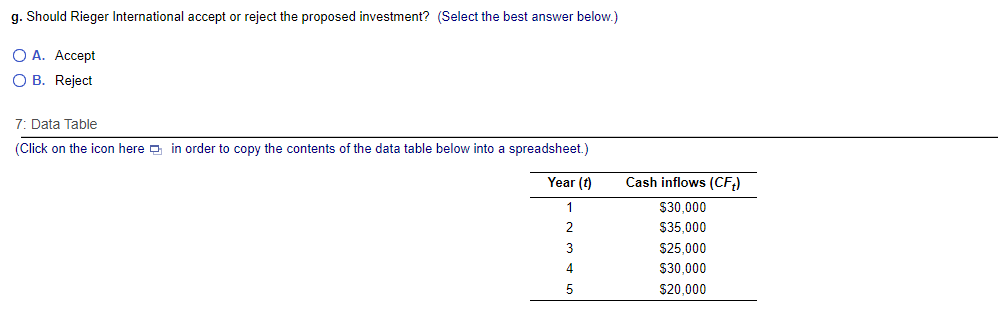

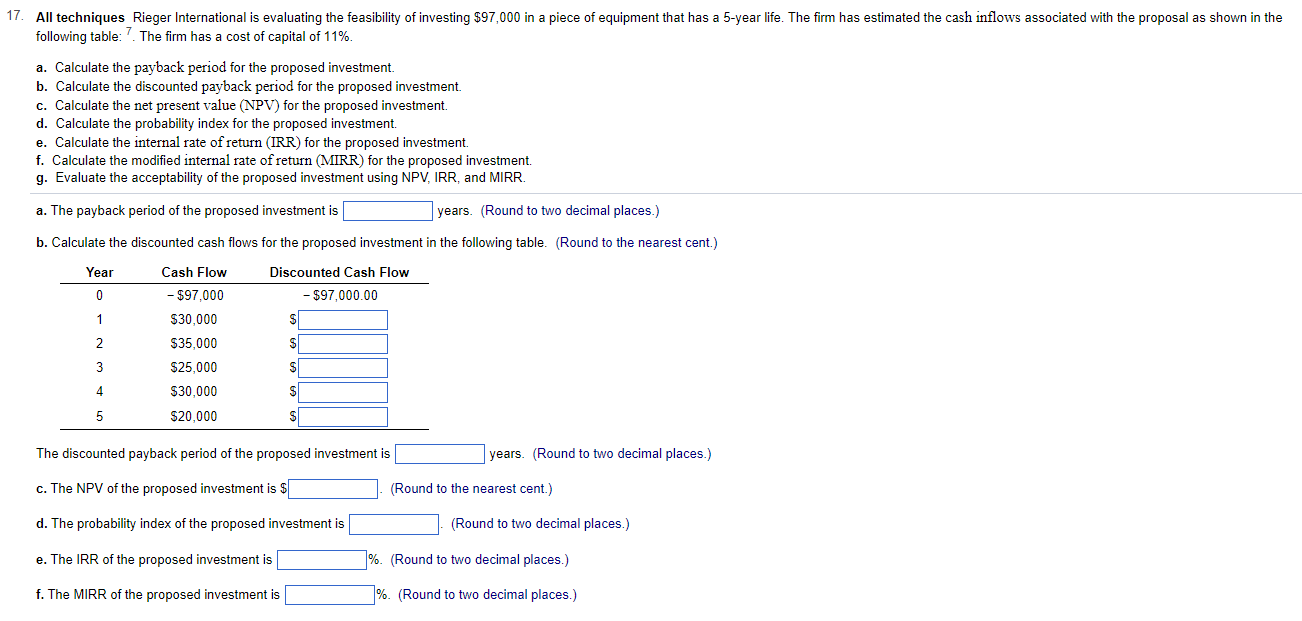

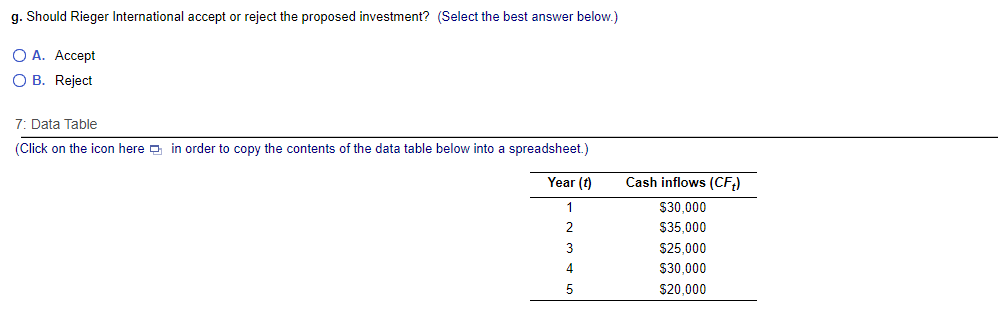

following table: 7. The firm has a cost of capital of 11%. a. Calculate the payback period for the proposed investment. b. Calculate the discounted payback period for the proposed investment. c. Calculate the net present value (NPV) for the proposed investment. d. Calculate the probability index for the proposed investment. e. Calculate the internal rate of return (IRR) for the proposed investment. f. Calculate the modified internal rate of return (MIRR) for the proposed investment. g. Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR. a. The payback period of the proposed investment is years. (Round to two decimal places.) b. Calculate the discounted cash flows for the proposed investment in the following table. (Round to the nearest cent.) The discounted payback period of the proposed investment is years. (Round to two decimal places.) c. The NPV of the proposed investment is $ d. The probability index of the proposed investment is e. The IRR of the proposed investment is f. The MIRR of the proposed investment is (Round to the nearest cent.) (Round to two decimal places.) \%. (Round to two decimal places.) %. (Round to two decimal places.) g. Should Rieger International accept or reject the proposed investment? (Select the best answer below.) A. Accept B. Reject 7: Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) following table: 7. The firm has a cost of capital of 11%. a. Calculate the payback period for the proposed investment. b. Calculate the discounted payback period for the proposed investment. c. Calculate the net present value (NPV) for the proposed investment. d. Calculate the probability index for the proposed investment. e. Calculate the internal rate of return (IRR) for the proposed investment. f. Calculate the modified internal rate of return (MIRR) for the proposed investment. g. Evaluate the acceptability of the proposed investment using NPV, IRR, and MIRR. a. The payback period of the proposed investment is years. (Round to two decimal places.) b. Calculate the discounted cash flows for the proposed investment in the following table. (Round to the nearest cent.) The discounted payback period of the proposed investment is years. (Round to two decimal places.) c. The NPV of the proposed investment is $ d. The probability index of the proposed investment is e. The IRR of the proposed investment is f. The MIRR of the proposed investment is (Round to the nearest cent.) (Round to two decimal places.) \%. (Round to two decimal places.) %. (Round to two decimal places.) g. Should Rieger International accept or reject the proposed investment? (Select the best answer below.) A. Accept B. Reject 7: Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)