Question: Answer the first question (A-H) CASE STUDIES SAMPLE QUESTIONS QI. With reference to the case study Mobile Financial Services for Microfinance Institutions: Case Study of

Answer the first question (A-H)

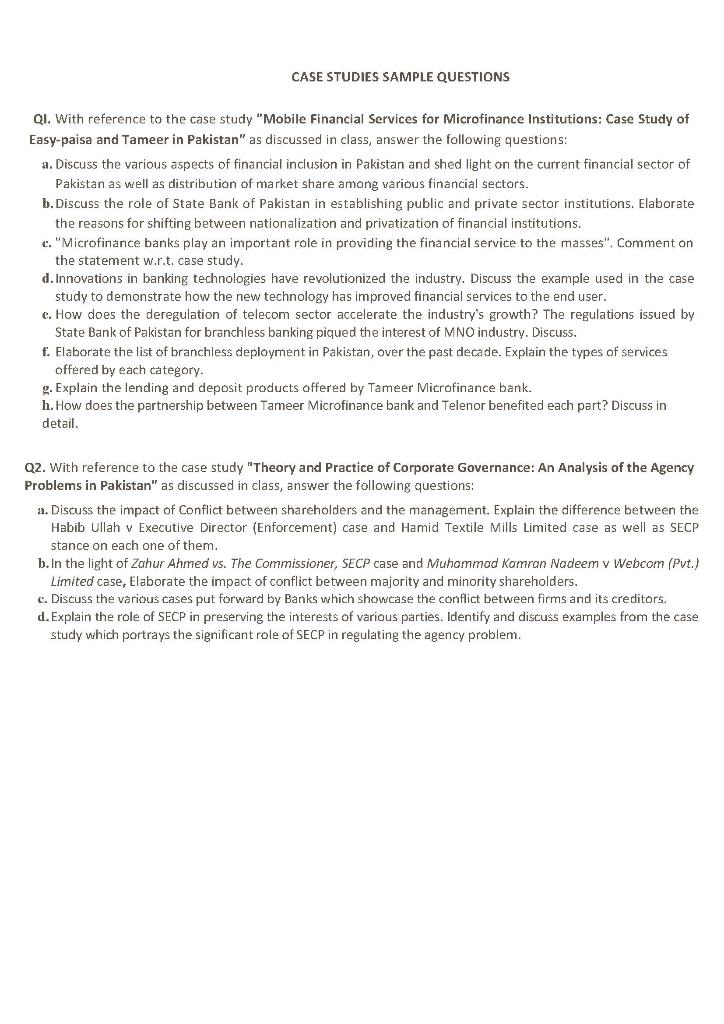

CASE STUDIES SAMPLE QUESTIONS QI. With reference to the case study "Mobile Financial Services for Microfinance Institutions: Case Study of Easy-paisa and Tameer in Pakistan" as discussed in class, answer the following questions: a. Discuss the various aspects of financial inclusion in Pakistan and shed light on the current financial sector of Pakistan as well as distribution of market share among various financial sectors. b. Discuss the role of State Bank of Pakistan in establishing public and private sector institutions. Elaborate the reasons for shifting between nationalization and privatization of financial institutions. c. "Microfinance banks play an important role in providing the financial service to the masses". Comment on the statement w.r.t. case study. d. Innovations in banking technologies have revolutionized the industry. Discuss the example used in the case study to demonstrate how the new technology has improved financial services to the end user. c. How does the deregulation of telecom sector accelerate the industry's growth? The regulations issued by State Bank of Pakistan for branchless banking piqued the interest of MNO industry. Discuss, f. Elaborate the list of branchless deployment in Pakistan, over the past decade. Explain the types of services offered by each category. g. Explain the lending and deposit products offered by Tameer Microfinance bank. h. How does the partnership between Tameer Microfinance bank and Telenor benefited each part? Discuss in detail Q2. With reference to the case study "Theory and Practice of Corporate Governance: An Analysis of the Agency Problems in Pakistan" as discussed in class, answer the following questions: a. Discuss the impact of Conflict between shareholders and the management. Explain the difference between the Habib Ullah v Executive Director (Enforcement) case and Hamid Textile Mills Limited case as well as SECP stance on each one of them. b. In the light of Zahur Ahmed vs. The Commissioner, SECP case and Muhammad Komran Nadeem v Webcom (Pvt.) Limited case, Elaborate the impact of conflict between majority and minority shareholders. c. Discuss the various cases put forward by Banks which showcase the conflict between firms and its creditors. d. Explain the role of SECP in preserving the interests of various parties. Identify and discuss examples from the case study which portrays the significant role of SECP in regulating the agency problem. CASE STUDIES SAMPLE QUESTIONS QI. With reference to the case study "Mobile Financial Services for Microfinance Institutions: Case Study of Easy-paisa and Tameer in Pakistan" as discussed in class, answer the following questions: a. Discuss the various aspects of financial inclusion in Pakistan and shed light on the current financial sector of Pakistan as well as distribution of market share among various financial sectors. b. Discuss the role of State Bank of Pakistan in establishing public and private sector institutions. Elaborate the reasons for shifting between nationalization and privatization of financial institutions. c. "Microfinance banks play an important role in providing the financial service to the masses". Comment on the statement w.r.t. case study. d. Innovations in banking technologies have revolutionized the industry. Discuss the example used in the case study to demonstrate how the new technology has improved financial services to the end user. c. How does the deregulation of telecom sector accelerate the industry's growth? The regulations issued by State Bank of Pakistan for branchless banking piqued the interest of MNO industry. Discuss, f. Elaborate the list of branchless deployment in Pakistan, over the past decade. Explain the types of services offered by each category. g. Explain the lending and deposit products offered by Tameer Microfinance bank. h. How does the partnership between Tameer Microfinance bank and Telenor benefited each part? Discuss in detail Q2. With reference to the case study "Theory and Practice of Corporate Governance: An Analysis of the Agency Problems in Pakistan" as discussed in class, answer the following questions: a. Discuss the impact of Conflict between shareholders and the management. Explain the difference between the Habib Ullah v Executive Director (Enforcement) case and Hamid Textile Mills Limited case as well as SECP stance on each one of them. b. In the light of Zahur Ahmed vs. The Commissioner, SECP case and Muhammad Komran Nadeem v Webcom (Pvt.) Limited case, Elaborate the impact of conflict between majority and minority shareholders. c. Discuss the various cases put forward by Banks which showcase the conflict between firms and its creditors. d. Explain the role of SECP in preserving the interests of various parties. Identify and discuss examples from the case study which portrays the significant role of SECP in regulating the agency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts