Answered step by step

Verified Expert Solution

Question

1 Approved Answer

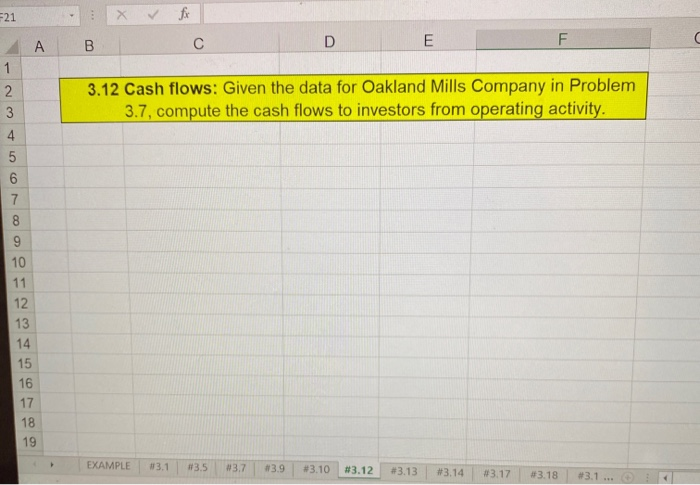

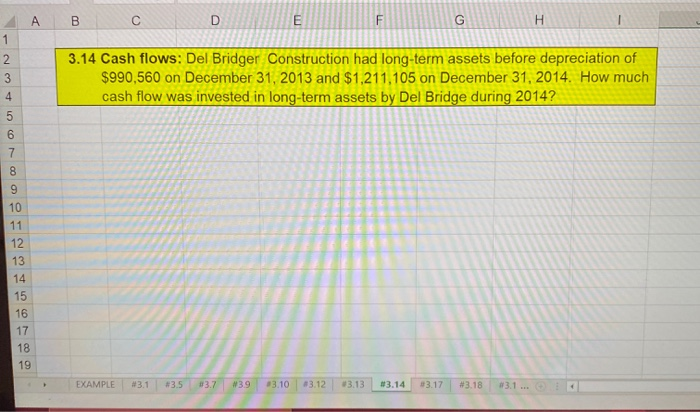

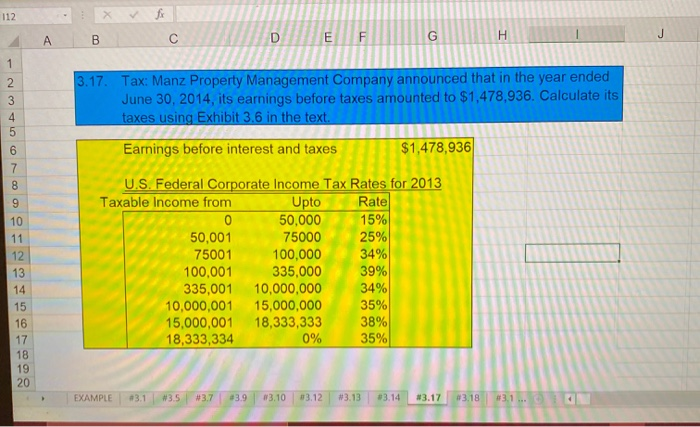

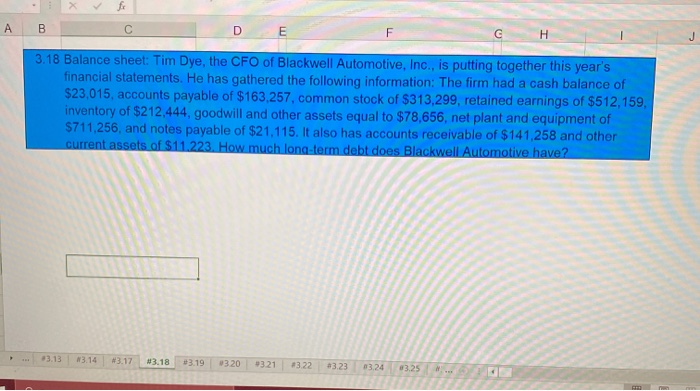

answer the following excel problems using the provided example. use formulas to show work please these are the tabs missing thats all the problems Stay

answer the following excel problems using the provided example. use formulas to show work please

these are the tabs missing

thats all the problems

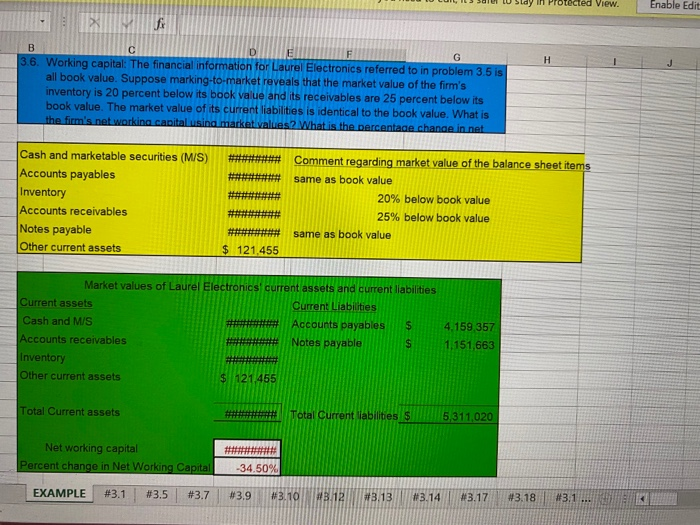

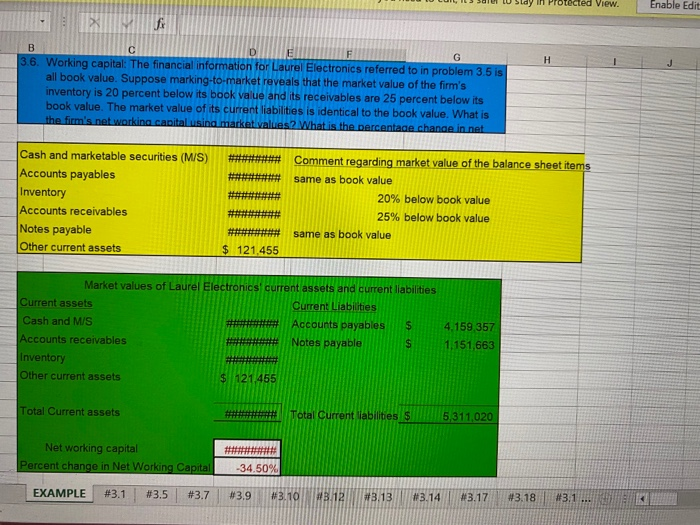

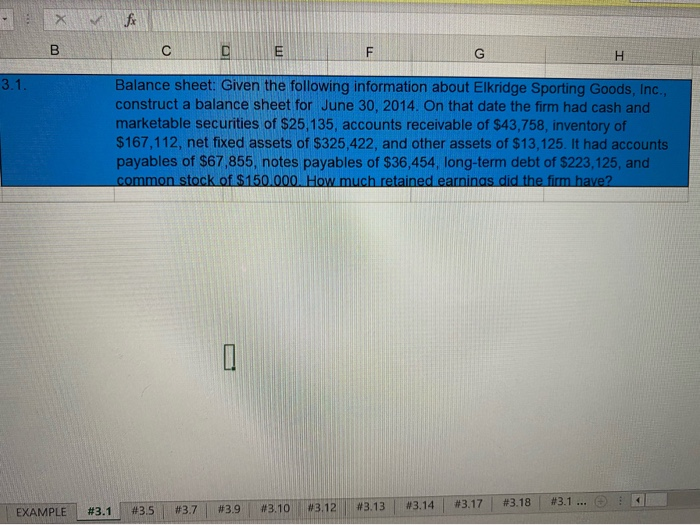

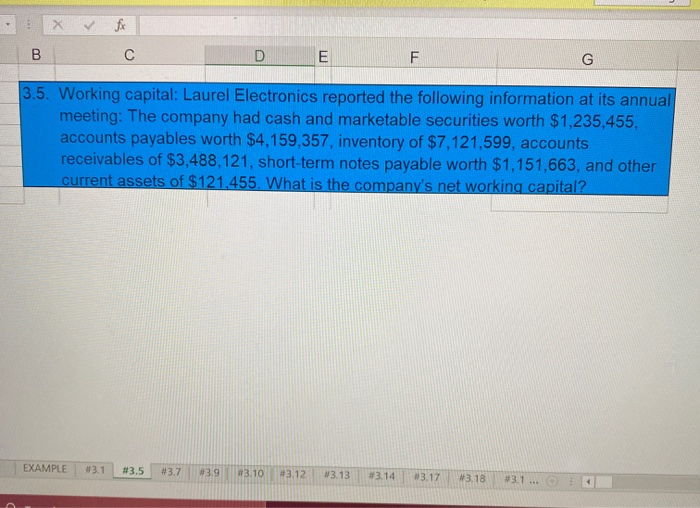

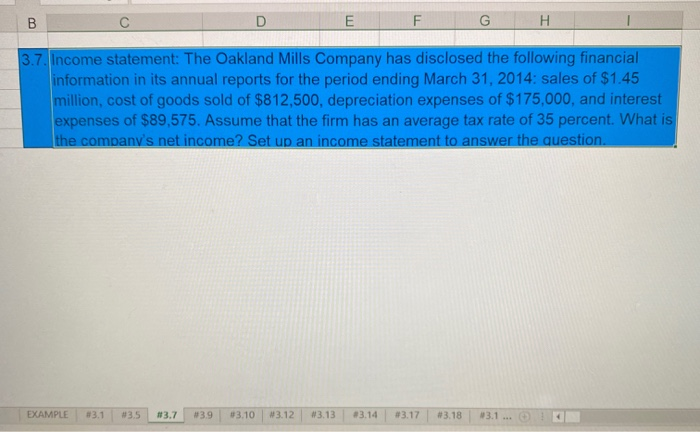

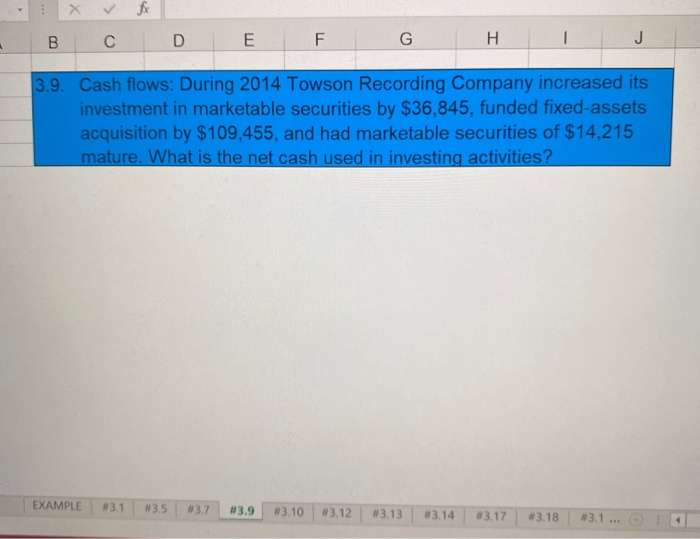

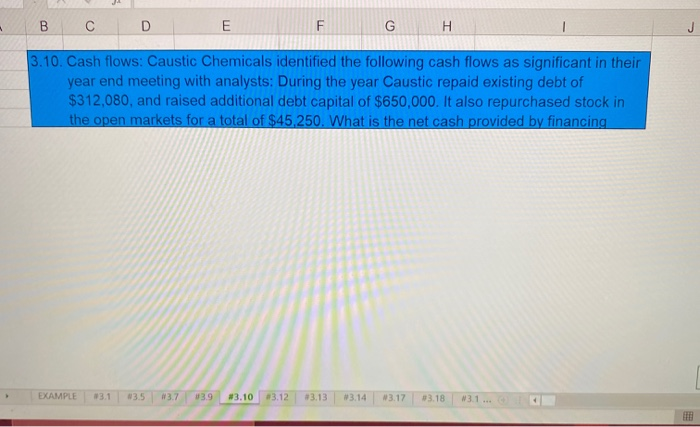

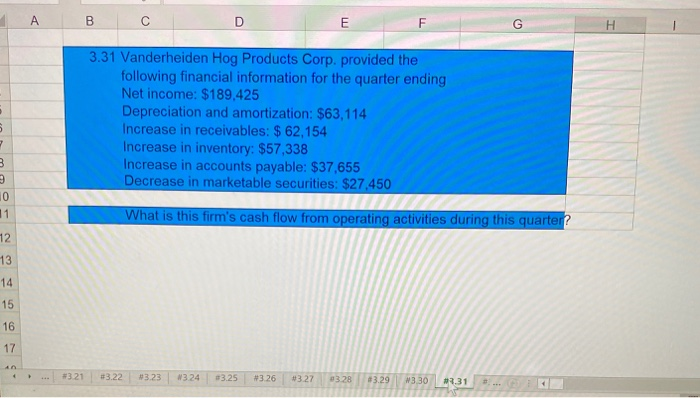

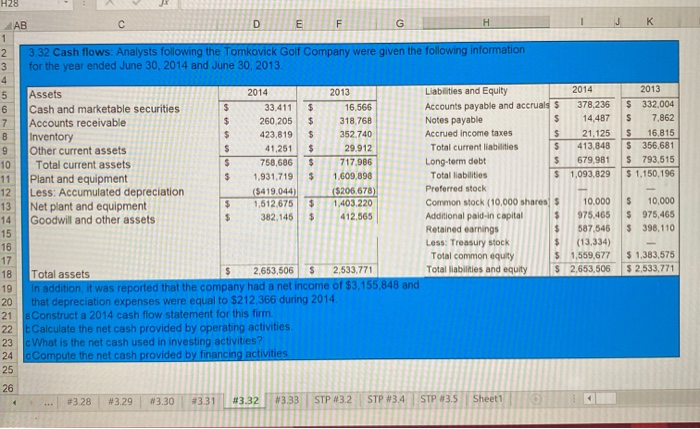

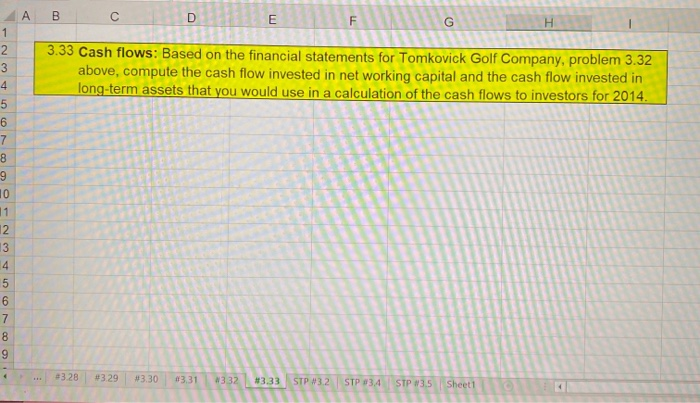

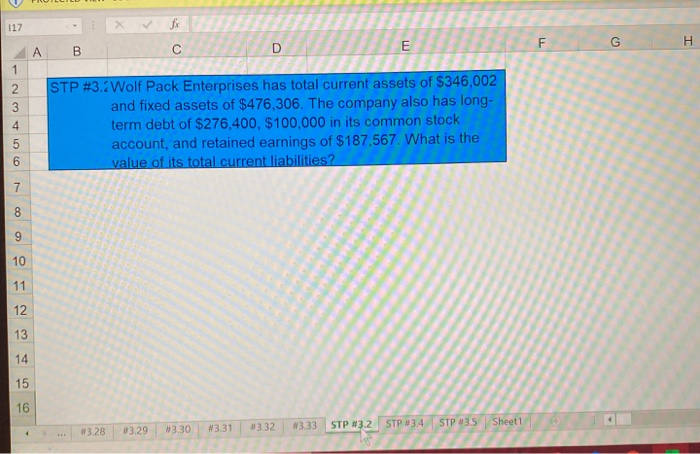

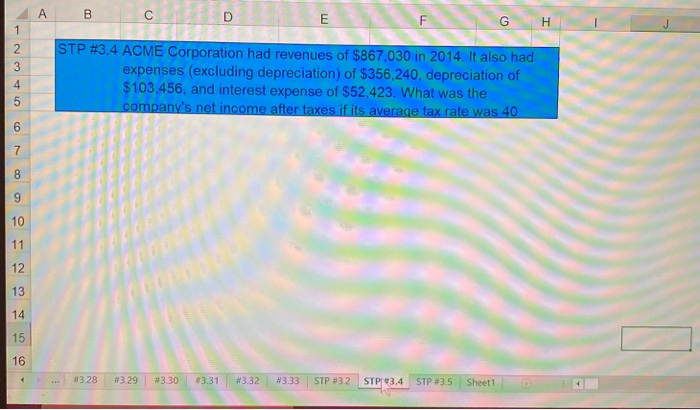

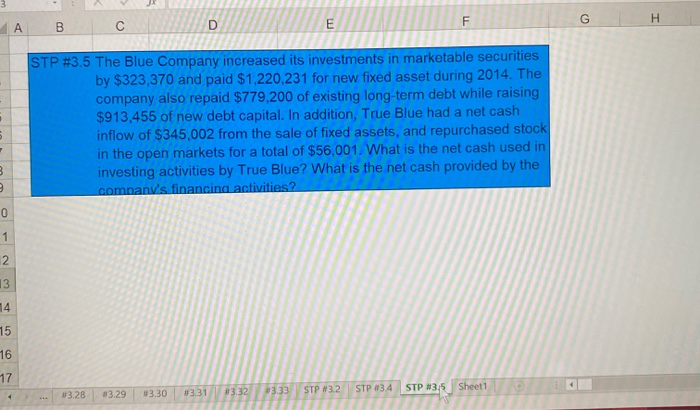

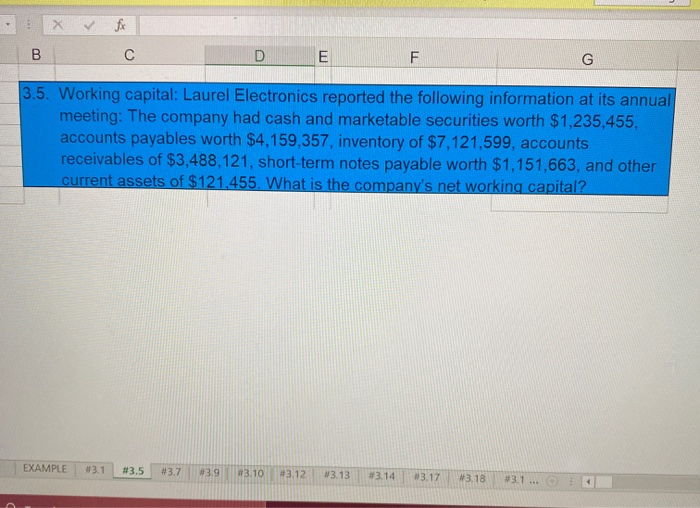

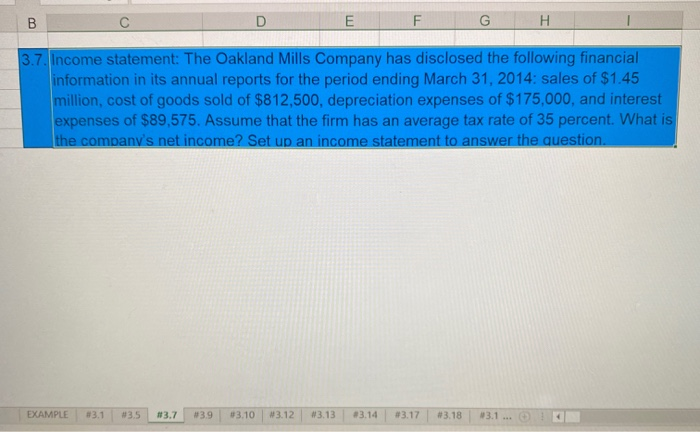

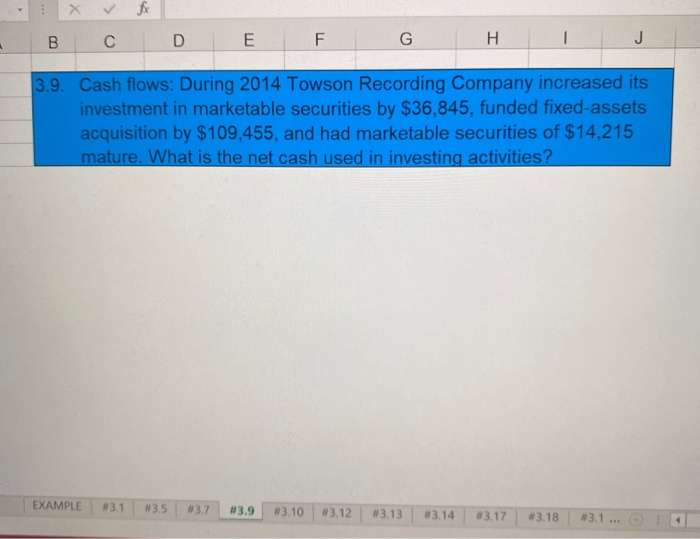

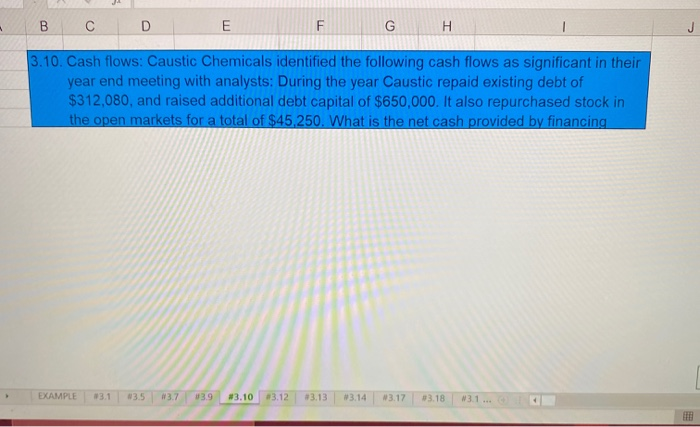

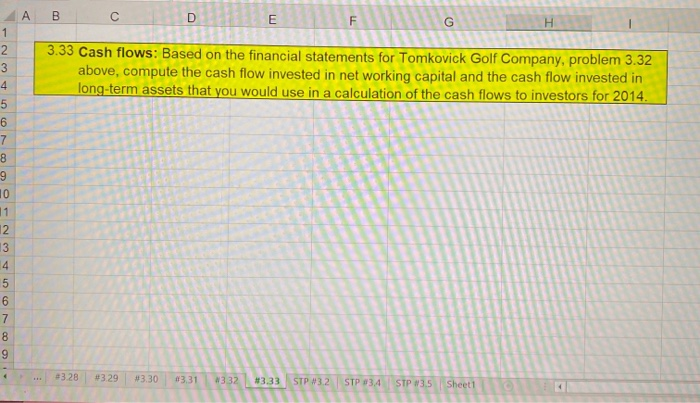

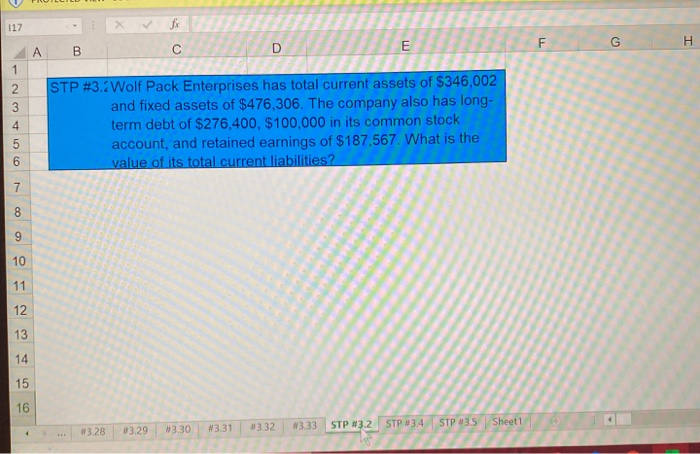

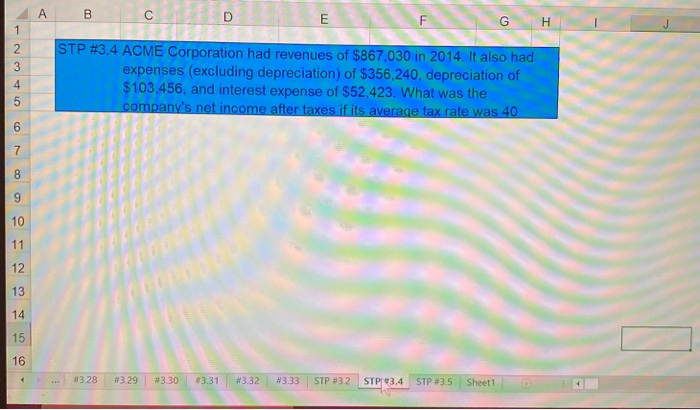

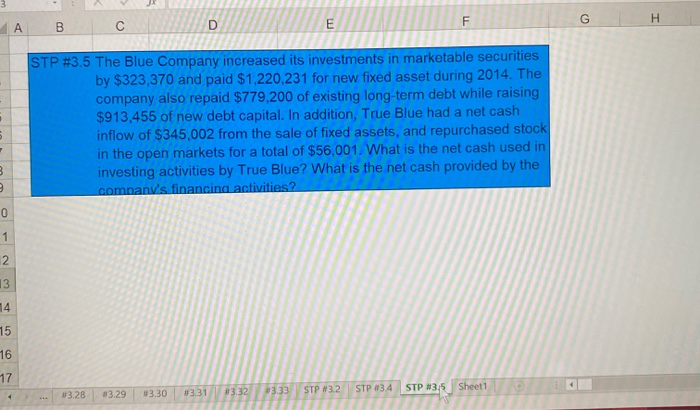

Stay in protected View. Enable Edit F H B D E G 3.6. Working capital: The financial information for Laurel Electronics referred to in problem 3.5 is all book value. Suppose marking-to-market reveals that the market value of the firm's inventory is 20 percent below its book value and its receivables are 25 percent below its book value. The market value of its current liabilities is identical to the book value. What is the firm's not working capital using market values? What is the percentage change in net Cash and marketable securities (M/S) Accounts payables Inventory Accounts receivables Notes payable Other current assets Comment regarding market value of the balance sheet items same as book value 20% below book value 25% below book value same as book value $ 121.455 Market values of Laurel Electronics current assets and current liabilities Current assets Current Liabilities Cash and M/S Accounts payables $ Accounts receivables HT Notes payable $ Inventory Other current assets $ 121,455 4.159 357 1,151,663 Total Current assets Total Current abilities $ 5,311,020 Net working capital Percent change in Net Working Capital -34.50% EXAMPLE #3.1 #3.5 #3.7 #3.9 #3.10 3.12 #3.13 #3.14 #3.17 #3.18 #3.1... x x E F G H 3.1. Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125. It had accounts payables of $67,855, notes payables of $36,454, long-term debt of $223,125, and common stock of $150.000. How much retained earninas did the firm have? EXAMPLE #3.18 #3.1 #3.1 ... #3.5 #3.7 #3.17 #3.9 #3.13 W3.10 #3.12 #3.14 B D E F G 3.13 Cash flows: Hillman Corporation reported current assets of $3,495,055 for the year ending December 31, 2014 and current assets of $3,103,839 for the year ending December 31, 2013. Current liabiliites for the firm were $2,867,225 and $2.760,124 at the end of 2014 and 2013, respectively. Compute the cash flow invested in net working capital at Hillman Corporation during 2014 EXAMPLE #3.1 #3.5 #3.7 #3.9 3.10 #3.12 #3.14 3.18 D E F G 3.24 Income statement: For its most recent fiscal year, Carmichael Hobby Shop recorded EBITDA of $512,725.20, EBIT of $362,450.20, zero interest expense, and cash flow to investors from operating activitiy of $348,461.25. Assuming there are no non-cash revenues recorded on the income statement, what is the firm's net income after taxes? 23.12 23.13 #3.17 #3.19 #3.20 23.21 63.22 323 33.24 B C D E F 3.26 Cash flows: Refer to the information given in problem 3.21. What is the cash flow for Nimitz Rental? #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 E F G - J 3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retained earnings of $323,325. During the year ended March 31, 2014, the company produced net income after taxes of $713,445 and paid out 45 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 A B C E F G 3.30 Menomonie Casino Company earned $23,458,933 before interest and taxes for the fiscal year ending March 31, 2014. If the casino had interest expenses of $1,645,123, calculate its tax burden using Exhibit 3.6. What are the marginal and the average tax rates for this company? EBIT Interest expenses 1,645,123 Tax schedule U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 $ 50,000 15% 50,001 $ 75,000 25% 75001 $ 100,000 34% 100,001 $ 335,000 39% 335,001 $ 10,000,000 34% 10,000,001 $ 15,000,000 35% 15,000,001 $ 18,333,333 38% 18,333,334 $ 35% 3 0 1 2 -3 #3.21 3.22 13.23 W3.24 3.25 W3.26 W3.27 W3.28 #3.29 #3.30 #3.31 C D E F G 3.5. Working capital: Laurel Electronics reported the following information at its annual meeting: The company had cash and marketable securities worth $1,235,455, accounts payables worth $4,159,357, inventory of $7,121,599, accounts receivables of $3,488,121, short-term notes payable worth $1,151,663, and other current assets of $121,455. What is the company's net working capital? EXAMPLE #3.1 #3.5 #3.7 #3.9 3.10 #3.12 W3.13 #3.14 W3.17 #3.18 #3.1... B C D E F H 3.7. Income statement: The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2014: sales of $1.45 million, cost of goods sold of $812,500, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question EXAMPLE 33.1 13.5 #3.7 #3.9 #3.10 3.12 W3.13 #3.14 #3.17 #3.18 23.1 - C D E F G H J 3.9. Cash flows: During 2014 Towson Recording Company increased its investment in marketable securities by $36,845, funded fixed-assets acquisition by $109,455, and had marketable securities of $14,215 mature. What is the net cash used in investing activities? EXAMPLE #3.1 #3.5 #3.9 #3.10 #3.12 #3.13 #3.14 #3.17 #3.18 #3.1 D E F G J 3.10. Cash flows: Caustic Chemicals identified the following cash flows as significant in their year end meeting with analysts: During the year Caustic repaid existing debt of $312,080, and raised additional debt capital of $650,000. It also repurchased stock in the open markets for a total of $45,250. What is the net cash provided by financing EXAMPLE 3.1 3.5 W3.7 3.9 #3.10 3.12 23.13 #3.14 3.17 33.18 FRE E21 X & fx A B C D E F 1 3.12 Cash flows: Given the data for Oakland Mills Company in Problem 3.7, compute the cash flows to investors from operating activity. 2 3 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 EXAMPLE 13.1 #3.5 3.7 #3.9 #3.10 #3.12 #3.13 #3.14 #3.17 #3.18 #3.1... A 00 D E F G H 1 2 3 4 3.14 Cash flows: Del Bridger Construction had long-term assets before depreciation of $990,560 on December 31, 2013 and $1,211,105 on December 31, 2014. How much cash flow was invested in long-term assets by Del Bridge during 2014? 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 EXAMPLE #3.1 #3.5 83.7 13.9 23.10 #3.12 3.13 3.14 #3.17 #3.18 112 B D E F G H 1 2 3 4 5 6 3.17. Tax: Manz Property Management Company announced that in the year ended June 30, 2014, its earnings before taxes amounted to $1,478,936. Calculate its taxes using Exhibit 3.6 in the text. Earnings before interest and taxes $1,478,936 8 9 10 11 12 13 14 15 16 17 18 19 20 U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 50,000 15% 50,001 75000 25% 75001 100,000 34% 100,001 335,000 39% 335,001 10,000,000 34% 10,000,001 15,000,000 35% 15,000,001 18,333,333 38% 18,333,334 0% 35% EXAMPLE #3.1 #3.5 #3.7 *3.9 13.10 03.12 #3.13 #3.14 #3.17 #3.18 > B C D E F G H 3.18 Balance sheet: Tim Dye, the CFO of Blackwell Automotive, Inc., is putting together this year's financial statements. He has gathered the following information: The firm had a cash balance of $23,015, accounts payable of $163,257, common stock of $313,299, retained earnings of $512,159, inventory of $212,444, goodwill and other assets equal to $78,656, net plant and equipment of $711,256, and notes payable of $21.115. It also has accounts receivable of $141,258 and other current assets of $11.223. How much long-term debt does Blackwell Automotive have? 33.13 #3.14 #3.17 #3.18 #3.19 320 1321 #3.22 83.23 03.24 83.25 A B C D E F G H 3.19 Working capital: Mukhopadhya Network Associates has a current ratio of 1.60, where the current ratio is defined as follows: Current ratio = Current assets/Current liabilities. The firm's current assets are equal to $1,233,265, its accounts payables are $419,357, and its notes payables are $351,663. Its inventory is currently at $721,599. The company plans to raise funds in the short-term debt market and invest the entire amount in additional inventory. How much can notes pavable increase without the current ratio falling below 2 3 4 5 16 * 3.13 23.14 03.17 3.18 3.19 0320 2321 3.22 0323 23 24 325 w f B D E F G . 3.20 Market value: Reservoir Bottling Co. reported the following information at the end of the year. Total current assets are worth $237,513 at book value and $219,344 at market value. In addition, plant and equipment with a market of $343,222, and a book value of $362,145. The company's total current liabilities are valued at market for $134,889 and has a book value of $129,175. Both the book value and the market value of its long-term debt is $144,000. If the company's total assets are equal to a market value of $562,566 and a book value of $599.658, what is the difference in the book value and market value of its stockholders' equity? 3.13 83.14 03.17 3.19 13.20 W3.21 13.22 3323 43.24 *325 .. B c D E G H 2 3 4 5 6 7 8 3.21 Income statement: Nimitz Rental Company provided the following information to its auditors. For the year ended March 31, 2014, the company had revenues of $878,412, general and administrative expenses of $352,666, depreciation expenses of $131,455, leasing expenses of $108,195, and interest expenses equal to $78,122. If the company's average tax rate is 34 percent, what is its net income after taxes? 9 10 11 12 13 14 15 7 #3.13 #3.14 #3.17 #3.18 #3.19 03.20 W3.2 3.22 #3.23 #3.24 43.25 ... BAKIR H18 B D E F 3.22 2 3 4 5 6 Income statement: Sosa Corporation recently reported an EBITDA of $31.3 million and net income of $9.7 million. The company had $6.8 million in interest expense, and its average corporate tax rate was 35 percent. What was its depreciation and amortization expense? 7 8 9 10 11 12 13 14 15 16 23.13 #3.14 #3.17 #3.18 #3.19 #3.20 #3.21 #3.22 3.23 3.24 #3.25 E8 fx B D E F G 1 3.23 2 3 4 5 6 Income statement: Fraser Corporation has announced that its net income for the year ended June 30, 2014, was $1,353,412. The company had EBITDA of $4,967,855, and its depreciation and amortization expense was equal to $1.112.685. The company's average tax rate is 34 percent. 7 8 9 10 11 12 13 14 15 16 #3.13 03.14 #3.17 #3.18 #3.19 #3.20 W3.21 #3.22 #3.23 #3.24 #3.25 # > fo int B D E F G H 3.25 Retained earnings: Columbia Construction Company earned $451,888 during the year ended June 30, 2014. After paying out $225,794 in dividends, the balance went into retained earnings. If the firm's total retained earnings were $846,972, what was the retained earnings on its balance sheet on July 1. 2013? 1 2 3 4 5 16 321 #3.22 3.23 #324 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 3.31 G D E F 00 3.27 Tax: Mount Hebron Electrical Company's financial statements indicated that the company had earnings before interest and taxes of $718,323. The interest rate on its $850,000 debt was 8.95 percent. Calculate the taxes the company is likely to owe. What are the marginal and average tax rates for this company? w3.24 3.21 W3.28 03.31 #3.22 #3.25 13.29 W3.26 3.27 3.23 W3.30 The Centennial Chemical Corp. announced that, for the period ending March 31, 2014, it had earned income after taxes wa A B C D E F 3.28 The Centennial Chemical Corp. announced that, for the period ending March 31, 2014, it had earned income after taxes worth $5,330,275 on revenues of $13, 144,680. The company's costs (excluding depreciation and amortization) amounted to 61 percent of sales and it had interest expenses of $392.168. What is the firm's depreciation and amortization expense if its average tax rate is 34 percent? #3.21 #322 #3.23 #3.24 #3.25 #3.26 13.27 #3.2 3.29 #3.30 #3.31 A B D E F G H 3.31 Vanderheiden Hog Products Corp. provided the following financial information for the quarter ending Net income: $189,425 Depreciation and amortization: $63,114 Increase in receivables: $ 62,154 Increase in inventory: $57,338 Increase in accounts payable: $37,655 Decrease in marketable securities: $27,450 5 7 3 TE 10 11 What is this firm's cash flow from operating activities during this quarter? 42 13 14 15 16 17 4 #3.21 #3.22 1323 W3.24 #3.25 #3.26 4327 3328 #3.29 330 #2.31 H28 - J 2013 $ 332,004 s 7,862 $ 16,815 $ 356,681 $ 793,515 $ 1,150.196 AB D E F G H 1 2 3.32 Cash flows: Analysts following the Tomkovick Golf Company were given the following information 3 for the year ended June 30, 2014 and June 30, 2013 4 5 Assets 2014 2013 Liabilities and Equity 2014 6 Cash and marketable securities $ 33,411 $ 16,566 Accounts payable and accruals $ 378,236 7 Accounts receivable $ 260,205 $ 318.768 Notes payable $ 14,487 8 Inventory $ 423,819 $ 352.740 Accrued income taxes $ 21.125 9 Other current assets $ 41,251 $ 29.912 Total current liabilities $ 413.848 10 Total current assets $ 758,686 $ 717.986 Long-term debt $ 679,981 11 Plant and equipment $ 1,931,719 $ 1.609,898 Total liabilities $ 1,093.829 12 Less: Accumulated depreciation ($419.044) (5206,678) Preferred stock 13 Net plant and equipment $ 1,512,675 5 1,403,220 Common stock (10,000 shares 10.000 14 Goodwill and other assets $ 382.145 412.565 Additional paid-in capital $ 975.465 15 Retained earnings 587,546 16 Less: Treasury stock $ (13,334) 17 Total common equity $ 1,559,677 18 Total assets $ 2,653,506 $ 2,533.771 Total liabilities and equity $ 2,653,506 19 In addition, it was reported that the company had a net income of $3,155,848 and 20 that depreciation expenses were equal to $212,366 during 2014 21 Construct a 2014 cash flow statement for this firm 22 Calculate the net cash provided by operating activities 23 What is the net cash used in investing activities? 24 Compute the net cash provided by financing activities 25 $ 10,000 $ 975,465 $ 398,110 $ 1,383,575 $ 2.533.771 26 #3.28 #3.29 #3.30 #3.31 #3.32 #3.33 STP 3.2 STP W34 STP 83.5 Sheet1 A B c D E F G 1 2 3 4 5 3.33 Cash flows: Based on the financial statements for Tomkovick Golf Company, problem 3.32 above, compute the cash flow invested in net working capital and the cash flow invested in long-term assets that you would use in a calculation of the cash flows to investors for 2014. 6 8 9 10 11 12 13 4 5 6 7 8 9 *** 23.28 #329 #3.30 3.31 W332 #3.33 STP W3.2 STP83.4 STP 3.5 Sheet1 117 fx E F G H A C D B 1 2 3 4 5 6 STP #3. Wolf Pack Enterprises has total current assets of $346,002 and fixed assets of $476,306. The company also has long- term debt of $276,400, $100,000 in its common stock account, and retained earnings of $187.567. What is the value of its total current liabilities? 7 8 9 10 11 12 13 14 15 16 33 33 STP #3.2 STP W3.5 W3.30 0332 3.28 #3.31 STP 3.4 Sheet1 3.29 A B 0 E G 1 STP #3.4 ACME Corporation had revenues of $867,030 in 2014. It also had expenses (excluding depreciation) of $356,240, depreciation of $103.456, and interest expense of $52,423. What was the company's net income after taxes if its average tax rate was 40 4 OD 7 8 9 10 11 12 13 14 15 16 03.28 #3.29 #3.30 63.31 #3.32 #3.33 STP #32 STP 13.4 STP #3.5 Sheet1 G H F B D E STP #3.5 The Blue Company increased its investments in marketable securities by $323,370 and paid $1,220,231 for new fixed asset during 2014. The company also repaid $779,200 of existing long-term debt while raising $913,455 of new debt capital. In addition, True Blue had a net cash inflow of $345,002 from the sale of fixed assets, and repurchased stock in the open markets for a total of $56,001. What is the net cash used in investing activities by True Blue? What is the net cash provided by the company's financing activities? 3 m 0 1 2 13 14 15 16 17 13.28 83.29 #3.31 Sheet1 43.30 23.33 STP 3.4 STP #3:5 83.32 STP #32 Stay in protected View. Enable Edit F H B D E G 3.6. Working capital: The financial information for Laurel Electronics referred to in problem 3.5 is all book value. Suppose marking-to-market reveals that the market value of the firm's inventory is 20 percent below its book value and its receivables are 25 percent below its book value. The market value of its current liabilities is identical to the book value. What is the firm's not working capital using market values? What is the percentage change in net Cash and marketable securities (M/S) Accounts payables Inventory Accounts receivables Notes payable Other current assets Comment regarding market value of the balance sheet items same as book value 20% below book value 25% below book value same as book value $ 121.455 Market values of Laurel Electronics current assets and current liabilities Current assets Current Liabilities Cash and M/S Accounts payables $ Accounts receivables HT Notes payable $ Inventory Other current assets $ 121,455 4.159 357 1,151,663 Total Current assets Total Current abilities $ 5,311,020 Net working capital Percent change in Net Working Capital -34.50% EXAMPLE #3.1 #3.5 #3.7 #3.9 #3.10 3.12 #3.13 #3.14 #3.17 #3.18 #3.1... x x E F G H 3.1. Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125. It had accounts payables of $67,855, notes payables of $36,454, long-term debt of $223,125, and common stock of $150.000. How much retained earninas did the firm have? EXAMPLE #3.18 #3.1 #3.1 ... #3.5 #3.7 #3.17 #3.9 #3.13 W3.10 #3.12 #3.14 B D E F G 3.13 Cash flows: Hillman Corporation reported current assets of $3,495,055 for the year ending December 31, 2014 and current assets of $3,103,839 for the year ending December 31, 2013. Current liabiliites for the firm were $2,867,225 and $2.760,124 at the end of 2014 and 2013, respectively. Compute the cash flow invested in net working capital at Hillman Corporation during 2014 EXAMPLE #3.1 #3.5 #3.7 #3.9 3.10 #3.12 #3.14 3.18 D E F G 3.24 Income statement: For its most recent fiscal year, Carmichael Hobby Shop recorded EBITDA of $512,725.20, EBIT of $362,450.20, zero interest expense, and cash flow to investors from operating activitiy of $348,461.25. Assuming there are no non-cash revenues recorded on the income statement, what is the firm's net income after taxes? 23.12 23.13 #3.17 #3.19 #3.20 23.21 63.22 323 33.24 B C D E F 3.26 Cash flows: Refer to the information given in problem 3.21. What is the cash flow for Nimitz Rental? #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 E F G - J 3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retained earnings of $323,325. During the year ended March 31, 2014, the company produced net income after taxes of $713,445 and paid out 45 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 A B C E F G 3.30 Menomonie Casino Company earned $23,458,933 before interest and taxes for the fiscal year ending March 31, 2014. If the casino had interest expenses of $1,645,123, calculate its tax burden using Exhibit 3.6. What are the marginal and the average tax rates for this company? EBIT Interest expenses 1,645,123 Tax schedule U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 $ 50,000 15% 50,001 $ 75,000 25% 75001 $ 100,000 34% 100,001 $ 335,000 39% 335,001 $ 10,000,000 34% 10,000,001 $ 15,000,000 35% 15,000,001 $ 18,333,333 38% 18,333,334 $ 35% 3 0 1 2 -3 #3.21 3.22 13.23 W3.24 3.25 W3.26 W3.27 W3.28 #3.29 #3.30 #3.31 C D E F G 3.5. Working capital: Laurel Electronics reported the following information at its annual meeting: The company had cash and marketable securities worth $1,235,455, accounts payables worth $4,159,357, inventory of $7,121,599, accounts receivables of $3,488,121, short-term notes payable worth $1,151,663, and other current assets of $121,455. What is the company's net working capital? EXAMPLE #3.1 #3.5 #3.7 #3.9 3.10 #3.12 W3.13 #3.14 W3.17 #3.18 #3.1... B C D E F H 3.7. Income statement: The Oakland Mills Company has disclosed the following financial information in its annual reports for the period ending March 31, 2014: sales of $1.45 million, cost of goods sold of $812,500, depreciation expenses of $175,000, and interest expenses of $89,575. Assume that the firm has an average tax rate of 35 percent. What is the company's net income? Set up an income statement to answer the question EXAMPLE 33.1 13.5 #3.7 #3.9 #3.10 3.12 W3.13 #3.14 #3.17 #3.18 23.1 - C D E F G H J 3.9. Cash flows: During 2014 Towson Recording Company increased its investment in marketable securities by $36,845, funded fixed-assets acquisition by $109,455, and had marketable securities of $14,215 mature. What is the net cash used in investing activities? EXAMPLE #3.1 #3.5 #3.9 #3.10 #3.12 #3.13 #3.14 #3.17 #3.18 #3.1 D E F G J 3.10. Cash flows: Caustic Chemicals identified the following cash flows as significant in their year end meeting with analysts: During the year Caustic repaid existing debt of $312,080, and raised additional debt capital of $650,000. It also repurchased stock in the open markets for a total of $45,250. What is the net cash provided by financing EXAMPLE 3.1 3.5 W3.7 3.9 #3.10 3.12 23.13 #3.14 3.17 33.18 FRE E21 X & fx A B C D E F 1 3.12 Cash flows: Given the data for Oakland Mills Company in Problem 3.7, compute the cash flows to investors from operating activity. 2 3 4 5 6 7 8 10 11 12 13 14 15 16 17 18 19 EXAMPLE 13.1 #3.5 3.7 #3.9 #3.10 #3.12 #3.13 #3.14 #3.17 #3.18 #3.1... A 00 D E F G H 1 2 3 4 3.14 Cash flows: Del Bridger Construction had long-term assets before depreciation of $990,560 on December 31, 2013 and $1,211,105 on December 31, 2014. How much cash flow was invested in long-term assets by Del Bridge during 2014? 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 EXAMPLE #3.1 #3.5 83.7 13.9 23.10 #3.12 3.13 3.14 #3.17 #3.18 112 B D E F G H 1 2 3 4 5 6 3.17. Tax: Manz Property Management Company announced that in the year ended June 30, 2014, its earnings before taxes amounted to $1,478,936. Calculate its taxes using Exhibit 3.6 in the text. Earnings before interest and taxes $1,478,936 8 9 10 11 12 13 14 15 16 17 18 19 20 U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 50,000 15% 50,001 75000 25% 75001 100,000 34% 100,001 335,000 39% 335,001 10,000,000 34% 10,000,001 15,000,000 35% 15,000,001 18,333,333 38% 18,333,334 0% 35% EXAMPLE #3.1 #3.5 #3.7 *3.9 13.10 03.12 #3.13 #3.14 #3.17 #3.18 > B C D E F G H 3.18 Balance sheet: Tim Dye, the CFO of Blackwell Automotive, Inc., is putting together this year's financial statements. He has gathered the following information: The firm had a cash balance of $23,015, accounts payable of $163,257, common stock of $313,299, retained earnings of $512,159, inventory of $212,444, goodwill and other assets equal to $78,656, net plant and equipment of $711,256, and notes payable of $21.115. It also has accounts receivable of $141,258 and other current assets of $11.223. How much long-term debt does Blackwell Automotive have? 33.13 #3.14 #3.17 #3.18 #3.19 320 1321 #3.22 83.23 03.24 83.25 A B C D E F G H 3.19 Working capital: Mukhopadhya Network Associates has a current ratio of 1.60, where the current ratio is defined as follows: Current ratio = Current assets/Current liabilities. The firm's current assets are equal to $1,233,265, its accounts payables are $419,357, and its notes payables are $351,663. Its inventory is currently at $721,599. The company plans to raise funds in the short-term debt market and invest the entire amount in additional inventory. How much can notes pavable increase without the current ratio falling below 2 3 4 5 16 * 3.13 23.14 03.17 3.18 3.19 0320 2321 3.22 0323 23 24 325 w f B D E F G . 3.20 Market value: Reservoir Bottling Co. reported the following information at the end of the year. Total current assets are worth $237,513 at book value and $219,344 at market value. In addition, plant and equipment with a market of $343,222, and a book value of $362,145. The company's total current liabilities are valued at market for $134,889 and has a book value of $129,175. Both the book value and the market value of its long-term debt is $144,000. If the company's total assets are equal to a market value of $562,566 and a book value of $599.658, what is the difference in the book value and market value of its stockholders' equity? 3.13 83.14 03.17 3.19 13.20 W3.21 13.22 3323 43.24 *325 .. B c D E G H 2 3 4 5 6 7 8 3.21 Income statement: Nimitz Rental Company provided the following information to its auditors. For the year ended March 31, 2014, the company had revenues of $878,412, general and administrative expenses of $352,666, depreciation expenses of $131,455, leasing expenses of $108,195, and interest expenses equal to $78,122. If the company's average tax rate is 34 percent, what is its net income after taxes? 9 10 11 12 13 14 15 7 #3.13 #3.14 #3.17 #3.18 #3.19 03.20 W3.2 3.22 #3.23 #3.24 43.25 ... BAKIR H18 B D E F 3.22 2 3 4 5 6 Income statement: Sosa Corporation recently reported an EBITDA of $31.3 million and net income of $9.7 million. The company had $6.8 million in interest expense, and its average corporate tax rate was 35 percent. What was its depreciation and amortization expense? 7 8 9 10 11 12 13 14 15 16 23.13 #3.14 #3.17 #3.18 #3.19 #3.20 #3.21 #3.22 3.23 3.24 #3.25 E8 fx B D E F G 1 3.23 2 3 4 5 6 Income statement: Fraser Corporation has announced that its net income for the year ended June 30, 2014, was $1,353,412. The company had EBITDA of $4,967,855, and its depreciation and amortization expense was equal to $1.112.685. The company's average tax rate is 34 percent. 7 8 9 10 11 12 13 14 15 16 #3.13 03.14 #3.17 #3.18 #3.19 #3.20 W3.21 #3.22 #3.23 #3.24 #3.25 # > fo int B D E F G H 3.25 Retained earnings: Columbia Construction Company earned $451,888 during the year ended June 30, 2014. After paying out $225,794 in dividends, the balance went into retained earnings. If the firm's total retained earnings were $846,972, what was the retained earnings on its balance sheet on July 1. 2013? 1 2 3 4 5 16 321 #3.22 3.23 #324 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 3.31 G D E F 00 3.27 Tax: Mount Hebron Electrical Company's financial statements indicated that the company had earnings before interest and taxes of $718,323. The interest rate on its $850,000 debt was 8.95 percent. Calculate the taxes the company is likely to owe. What are the marginal and average tax rates for this company? w3.24 3.21 W3.28 03.31 #3.22 #3.25 13.29 W3.26 3.27 3.23 W3.30 The Centennial Chemical Corp. announced that, for the period ending March 31, 2014, it had earned income after taxes wa A B C D E F 3.28 The Centennial Chemical Corp. announced that, for the period ending March 31, 2014, it had earned income after taxes worth $5,330,275 on revenues of $13, 144,680. The company's costs (excluding depreciation and amortization) amounted to 61 percent of sales and it had interest expenses of $392.168. What is the firm's depreciation and amortization expense if its average tax rate is 34 percent? #3.21 #322 #3.23 #3.24 #3.25 #3.26 13.27 #3.2 3.29 #3.30 #3.31 A B D E F G H 3.31 Vanderheiden Hog Products Corp. provided the following financial information for the quarter ending Net income: $189,425 Depreciation and amortization: $63,114 Increase in receivables: $ 62,154 Increase in inventory: $57,338 Increase in accounts payable: $37,655 Decrease in marketable securities: $27,450 5 7 3 TE 10 11 What is this firm's cash flow from operating activities during this quarter? 42 13 14 15 16 17 4 #3.21 #3.22 1323 W3.24 #3.25 #3.26 4327 3328 #3.29 330 #2.31 H28 - J 2013 $ 332,004 s 7,862 $ 16,815 $ 356,681 $ 793,515 $ 1,150.196 AB D E F G H 1 2 3.32 Cash flows: Analysts following the Tomkovick Golf Company were given the following information 3 for the year ended June 30, 2014 and June 30, 2013 4 5 Assets 2014 2013 Liabilities and Equity 2014 6 Cash and marketable securities $ 33,411 $ 16,566 Accounts payable and accruals $ 378,236 7 Accounts receivable $ 260,205 $ 318.768 Notes payable $ 14,487 8 Inventory $ 423,819 $ 352.740 Accrued income taxes $ 21.125 9 Other current assets $ 41,251 $ 29.912 Total current liabilities $ 413.848 10 Total current assets $ 758,686 $ 717.986 Long-term debt $ 679,981 11 Plant and equipment $ 1,931,719 $ 1.609,898 Total liabilities $ 1,093.829 12 Less: Accumulated depreciation ($419.044) (5206,678) Preferred stock 13 Net plant and equipment $ 1,512,675 5 1,403,220 Common stock (10,000 shares 10.000 14 Goodwill and other assets $ 382.145 412.565 Additional paid-in capital $ 975.465 15 Retained earnings 587,546 16 Less: Treasury stock $ (13,334) 17 Total common equity $ 1,559,677 18 Total assets $ 2,653,506 $ 2,533.771 Total liabilities and equity $ 2,653,506 19 In addition, it was reported that the company had a net income of $3,155,848 and 20 that depreciation expenses were equal to $212,366 during 2014 21 Construct a 2014 cash flow statement for this firm 22 Calculate the net cash provided by operating activities 23 What is the net cash used in investing activities? 24 Compute the net cash provided by financing activities 25 $ 10,000 $ 975,465 $ 398,110 $ 1,383,575 $ 2.533.771 26 #3.28 #3.29 #3.30 #3.31 #3.32 #3.33 STP 3.2 STP W34 STP 83.5 Sheet1 A B c D E F G 1 2 3 4 5 3.33 Cash flows: Based on the financial statements for Tomkovick Golf Company, problem 3.32 above, compute the cash flow invested in net working capital and the cash flow invested in long-term assets that you would use in a calculation of the cash flows to investors for 2014. 6 8 9 10 11 12 13 4 5 6 7 8 9 *** 23.28 #329 #3.30 3.31 W332 #3.33 STP W3.2 STP83.4 STP 3.5 Sheet1 117 fx E F G H A C D B 1 2 3 4 5 6 STP #3. Wolf Pack Enterprises has total current assets of $346,002 and fixed assets of $476,306. The company also has long- term debt of $276,400, $100,000 in its common stock account, and retained earnings of $187.567. What is the value of its total current liabilities? 7 8 9 10 11 12 13 14 15 16 33 33 STP #3.2 STP W3.5 W3.30 0332 3.28 #3.31 STP 3.4 Sheet1 3.29 A B 0 E G 1 STP #3.4 ACME Corporation had revenues of $867,030 in 2014. It also had expenses (excluding depreciation) of $356,240, depreciation of $103.456, and interest expense of $52,423. What was the company's net income after taxes if its average tax rate was 40 4 OD 7 8 9 10 11 12 13 14 15 16 03.28 #3.29 #3.30 63.31 #3.32 #3.33 STP #32 STP 13.4 STP #3.5 Sheet1 G H F B D E STP #3.5 The Blue Company increased its investments in marketable securities by $323,370 and paid $1,220,231 for new fixed asset during 2014. The company also repaid $779,200 of existing long-term debt while raising $913,455 of new debt capital. In addition, True Blue had a net cash inflow of $345,002 from the sale of fixed assets, and repurchased stock in the open markets for a total of $56,001. What is the net cash used in investing activities by True Blue? What is the net cash provided by the company's financing activities? 3 m 0 1 2 13 14 15 16 17 13.28 83.29 #3.31 Sheet1 43.30 23.33 STP 3.4 STP #3:5 83.32 STP #32 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

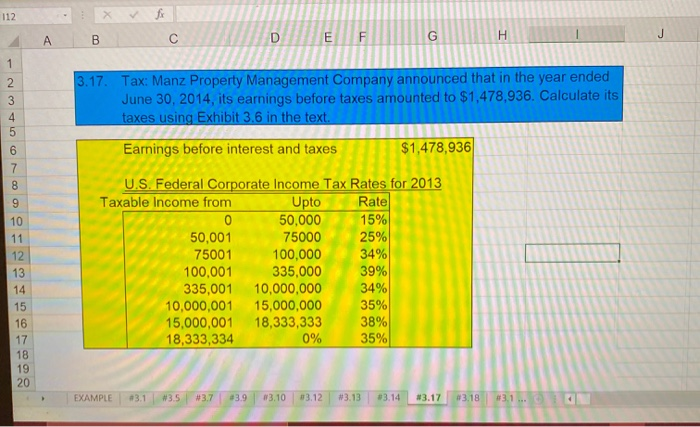

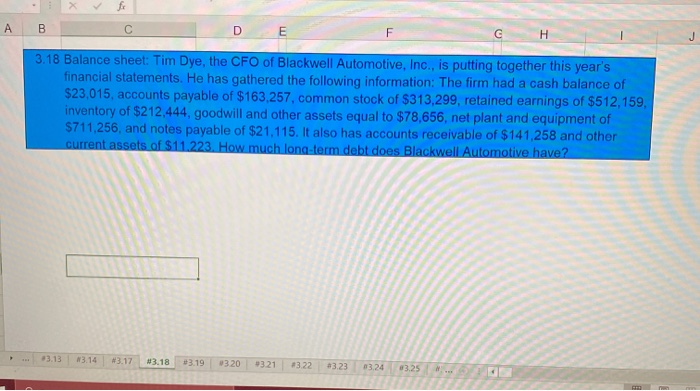

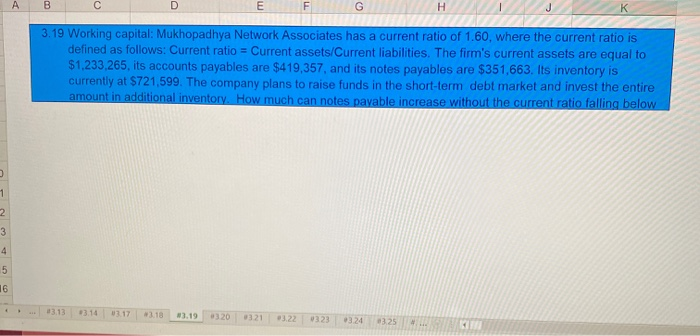

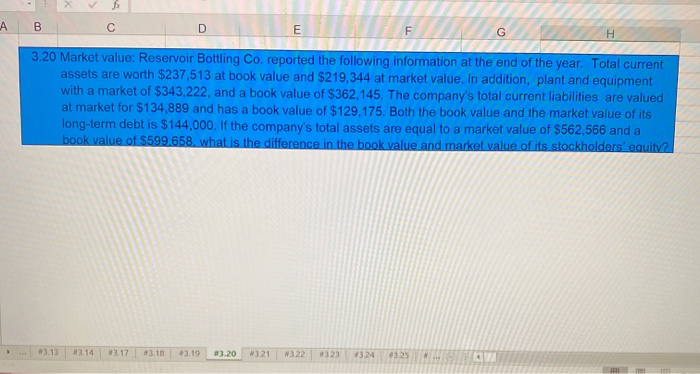

Get Started