Answered step by step

Verified Expert Solution

Question

1 Approved Answer

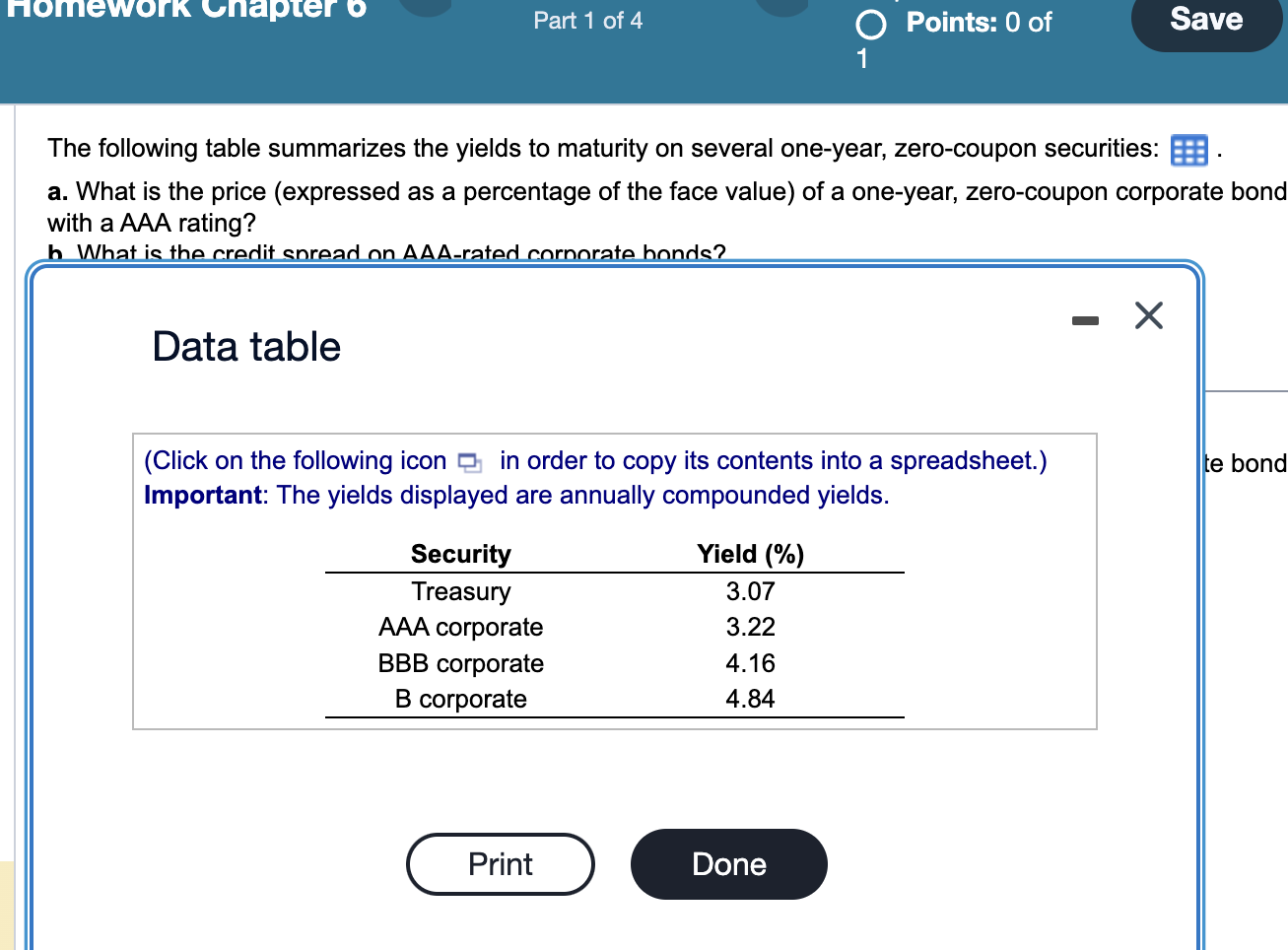

Answer the following (first question should have 4 parts in its answer): The following table summarizes the yields to maturity on several one-year, zero-coupon securities:

Answer the following (first question should have 4 parts in its answer):

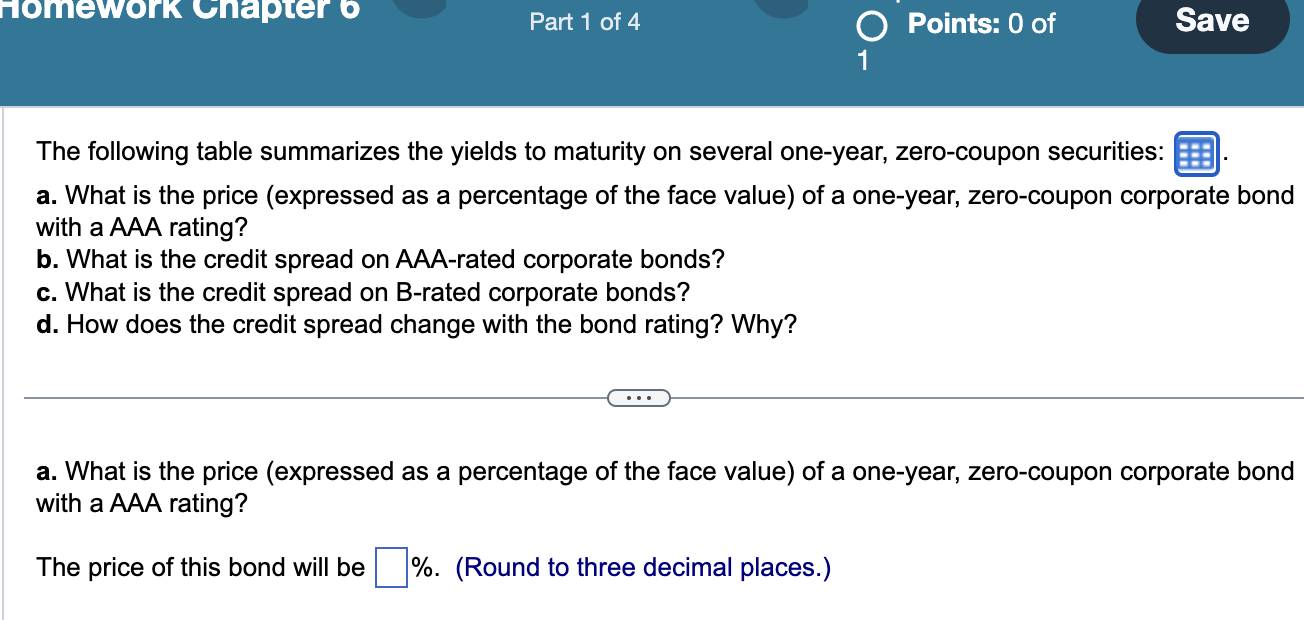

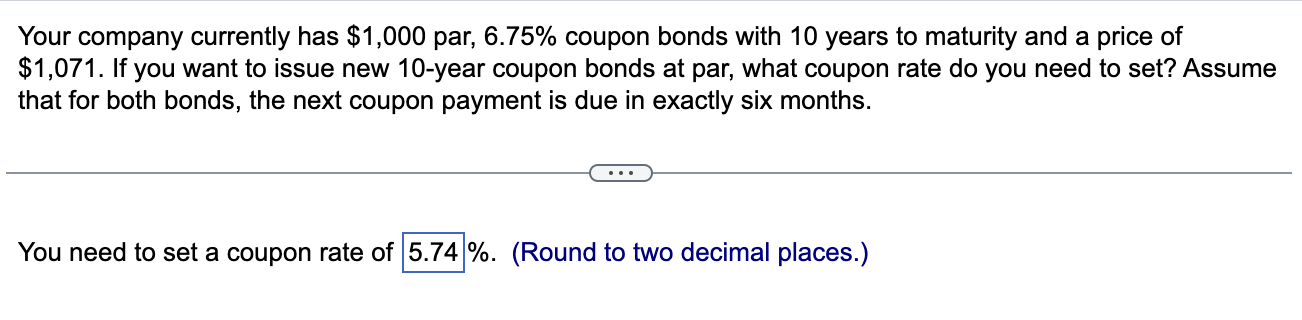

The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? h What is the credit snread on AAA-rated cornorate honds? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) te bond Important: The yields displayed are annually compounded yields. Your company currently has $1,000 par, 6.75% coupon bonds with 10 years to maturity and a price of $1,071. If you want to issue new 10 -year coupon bonds at par, what coupon rate do you need to set? Assume that for both bonds, the next coupon payment is due in exactly six months. You need to set a coupon rate of \%. (Round to two decimal places.) The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? The price of this bond will be \%. (Round to three decimal places.)

The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? h What is the credit snread on AAA-rated cornorate honds? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) te bond Important: The yields displayed are annually compounded yields. Your company currently has $1,000 par, 6.75% coupon bonds with 10 years to maturity and a price of $1,071. If you want to issue new 10 -year coupon bonds at par, what coupon rate do you need to set? Assume that for both bonds, the next coupon payment is due in exactly six months. You need to set a coupon rate of \%. (Round to two decimal places.) The following table summarizes the yields to maturity on several one-year, zero-coupon securities: a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? b. What is the credit spread on AAA-rated corporate bonds? c. What is the credit spread on B-rated corporate bonds? d. How does the credit spread change with the bond rating? Why? a. What is the price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a AAA rating? The price of this bond will be \%. (Round to three decimal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started