Answered step by step

Verified Expert Solution

Question

1 Approved Answer

30 points Save Answe (30 marks) Jungle Jim Incorporated is looking at buying a company (Alpha Co.), which has the following unlevered net income

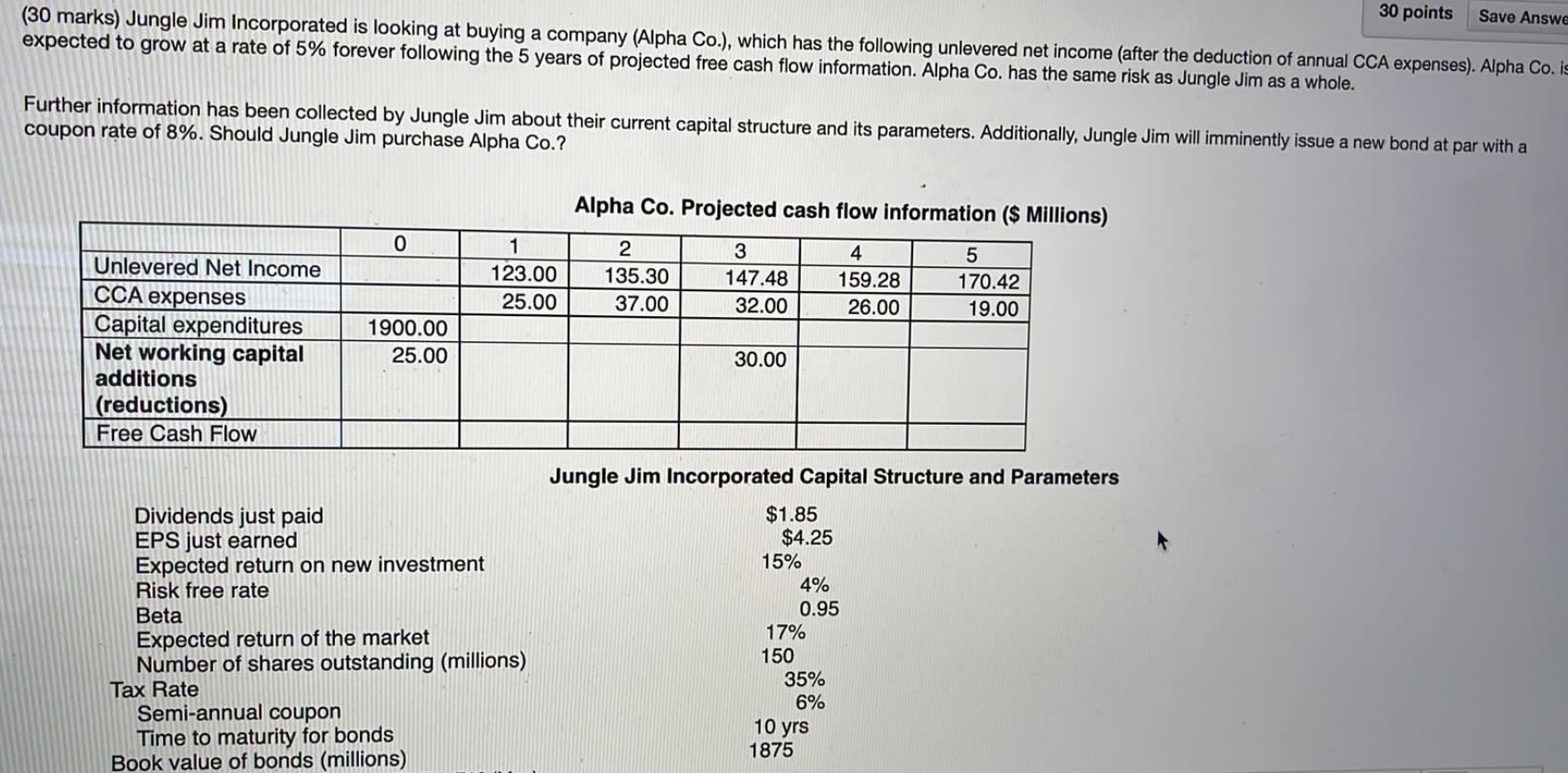

30 points Save Answe (30 marks) Jungle Jim Incorporated is looking at buying a company (Alpha Co.), which has the following unlevered net income (after the deduction of annual CCA expenses). Alpha Co. is expected to grow at a rate of 5% forever following the 5 years of projected free cash flow information. Alpha Co. has the same risk as Jungle Jim as a whole. Further information has been collected by Jungle Jim about their current capital structure and its parameters. Additionally, Jungle Jim will imminently issue a new bond at par with a coupon rate of 8%. Should Jungle Jim purchase Alpha Co.? Unlevered Net Income CCA expenses Capital expenditures Net working capital additions (reductions) Free Cash Flow 0 1900.00 25.00 Dividends just paid EPS just earned Expected return on new investment Risk free rate Beta 1 123.00 25.00 Expected return of the market Number of shares outstanding (millions) Tax Rate Semi-annual coupon Time to maturity for bonds Book value of bonds (millions) Alpha Co. Projected cash flow information ($ Millions) 3 147.48 32.00 4 159.28 26.00 2 135.30 37.00 30.00 Jungle Jim Incorporated Capital Structure and Parameters $1.85 $4.25 15% 4% 0.95 17% 150 35% 6% 5 170.42 19.00 10 yrs 1875

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether Jungle Jim Incorporated should purchase Alpha Co we can perform a discounted ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started